- California has tightened the reins on crypto, sparking ripples with Governor Newsom’s recent move.

- Stricter regulations have been introduced, prompting digital asset businesses to prepare for a transformation.

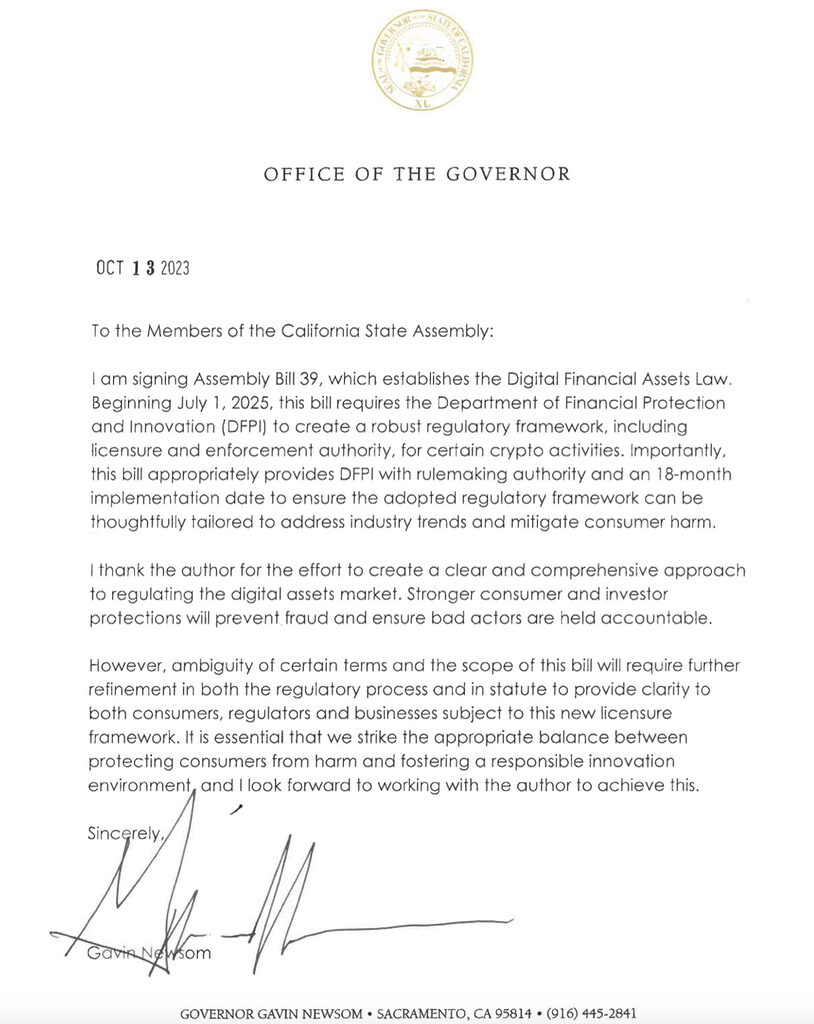

- The elusive signature has played a role in Newsom’s past reservations.

California Governor Gavin Newsom has given the green light to a cryptocurrency bill, ushering in more stringent regulations for businesses engaged in crypto activities, effective July 2025.

New Digital Finance Law Unveiled in California

In an announcement dated October 13, Newsom disclosed that the legislation, known as the Digital Financial Assets Law, mandates both individuals and enterprises to secure a Department of Financial Protection and Innovation (DFPI) license to partake in digital asset-related operations.

The legislative documents reference California’s monetary transmission statutes, which explicitly bar banking and transfer services from functioning without the approval of the DFPI commissioner.

Sponsored

However, the new crypto bill empowers the DFPI to impose rigorous audit criteria on crypto companies and obliges them to maintain meticulous records. The statement underlines the specifics. Furthermore, it elucidates that non-compliance with these regulations will trigger enforcement actions.

Similar 2022 Bill Fails to Win Newsom’s Approval

Around the same period in 2022, Newsom refrained from endorsing a similar bill to establish a framework for licensing and regulation in the digital assets sphere within California.

Even though the bill sailed through the California State Assembly without any opposition, Newsom chose not to affix his signature, citing its inflexibility in keeping pace with the rapidly evolving crypto landscape.

Sponsored

The United States is actively exploring applying the Electronic Fund Transfer Act to cryptocurrencies as a countermeasure against fraudulent transfers. Rohit Chopra, the head of the Consumer Financial Protection Bureau, expressed his commitment to authorizing this move to “mitigate the adverse effects of errors, breaches, and unauthorized transfers” in a recent address.

On the Flipside

- Waiting for federal regulations may result in California missing out on the economic opportunities presented by the rapidly evolving cryptocurrency sector.

- Enforcing licensing requirements for all individuals and firms involved in digital asset business activities might create bureaucratic hurdles that disproportionately affect smaller businesses.

Why This Matters

The approval of California’s Digital Financial Assets Law sets a significant precedent for crypto regulation in the United States, potentially influencing how other states approach digital asset oversight. This move underscores the evolving landscape of cryptocurrency regulation and its growing impact on the wider financial sector.

To learn more about MetaMask’s return to the Apple App Store, read here:

MetaMask Reappears on Apple App Store After Brief Exit

To learn more about Bitcoin’s ongoing struggle at $27,000, despite bullish Grayscale news, read here:

Bitcoin Struggles at $27,000 Despite Bullish Grayscale News