- The now-defunct FTX exchange investigates the artificial intelligence company AI Safety Group for investments made before its collapse.

- The exchange invested millions of dollars in the company over four months.

- FTX’s debtors are investigating entities with financial ties to the exchange.

Since its collapse, the tumultuous saga surrounding the now-defunct cryptocurrency exchange FTX and its founder, Sam Bankman-Fried (SBF), has witnessed continuous developments. The exchange, under the direction of its new chief executive officer, John Ray III, has embarked on a litigation spree to implement controls and recover assets in hopes of financial restitution.

In this pursuit, FTX, through its debtors, has cast a wide net, probing numerous companies with financial ties to the exchange, with the latest target being the Center for AI Safety (CAIS).

FTX’s Legal Onslaught Targets CAIS

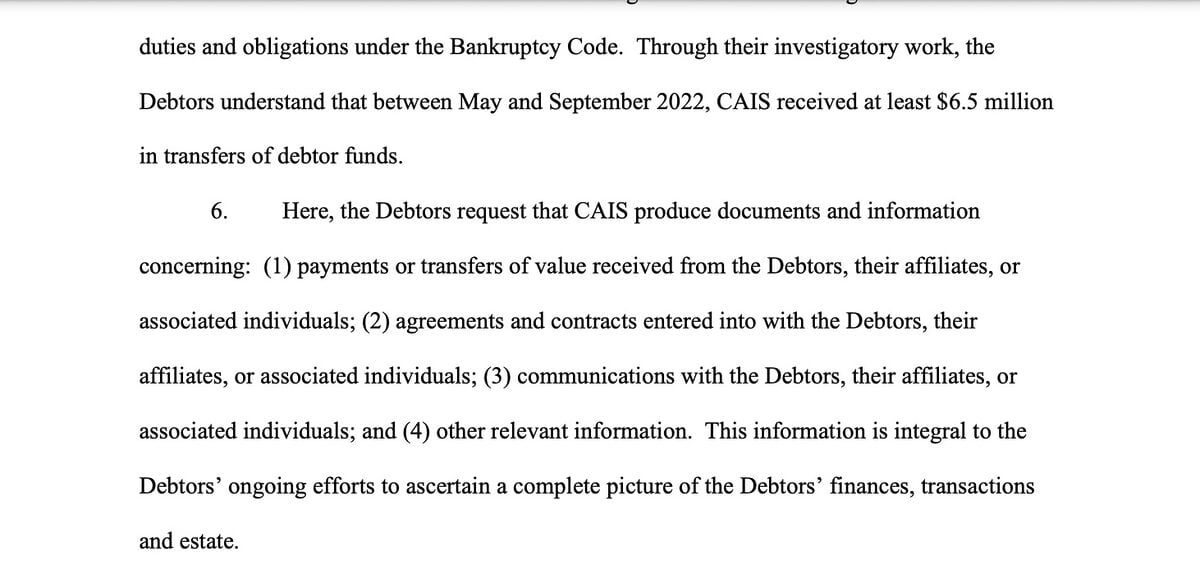

On Wednesday, October 25th, FTX’s debtors initiated legal actions against CIAS, seeking to uncover details about the $6.5 million payments made to the group between May and September 2022.

Sponsored

The motion, filed in the United States Bankruptcy Court for the District of Delaware, demands the AI safety group to produce accounting documents and information on payments or transfers of value received from the FTX and their affiliates, agreements, and contracts with the exchange or associated individuals.

It further requests the communication records between the CIAS and the FTX Group or individuals, including Caroline Ellison, Samuel Bankman-Fried, Nishad Singh, and others, among other pertinent details.

The debtors noted that CAIS had rejected voluntary cooperation when initially contacted in August 2023 and via email exchanges in early October 2023, prompting the exchange to devise legal measures.

Sponsored

The Delaware Bankruptcy Court has swung its weight in favor of FTX’s motion, obliging CAIS to provide the requested information without limitation.

However, the CAIS probe is just one facet of FTX’s ongoing attempts at financial restitution, as several other entities have also come under the exchange’s scrutiny.

Legal Pursuit Beyond CIAS

Over the past months, FTX has targeted various institutions to recover misappropriated assets.

On September 18th, FTX attorneys slammed former CEO Sam Bankman-Fried’s parents with a lawsuit, alleging the exploitation of their legal expertise and influence within FTX to siphon wealth from the exchange and enrich themselves. They added that the longtime Stanford law professors Joseph Bankman and Barbara Fried misappropriated millions of dollars in company funds.

The legal showdown extends further with a lawsuit filed against our former employees of FTX’s Hong Kong-based affiliate, Salameda, requesting $157 million in restitution.

The legal team alleged that the employees and two related companies exploited their connections to withdraw assets from FTX when the exchange’s future became questionable.

On the Flipside

- FTX owes over $3 billion to an extensive list of creditors.

- While the exchange’s legal team has made progress in financially targeting entities linked to the exchange, the ultimate success in recovering sufficient assets to meet the exchange’s obligations under the Bankruptcy Code and settle with creditors remains uncertain.

- Former FTX CEO Sam Bankman-Fried is still involved in an ongoing trial, facing criminal charges related to investor fraud and the misappropriation of customer funds.

Why This Matters

This ongoing legal pursuit holds significant implications for FTX and its extensive list of creditors. The resolution will determine whether FTX can offer relief to creditors waiting for closure since the exchange’s collapse in November 2022.

Disgraced crypto mogul SBF at the center of the drama seeks opportunity to assert good faith as trial nears end. Read more:

SBF to Take a Legal Gamble and Testify in FTX Fraud Trial

BlackRock accused of violating the U.S SEC investment disclosure regulations. Read more:

SEC Slams BlackRock $2.5M Fine for Investment Misconduct