The second quarter of 2020 has been generous for the decentralized finance (DeFi) industry as the figures here have reached new all-time highs.

June was the record month of transaction volume of DeFi decentralized applications (dApps), meanwhile, Ethereum doubled its amount of active dApp users in Q2, says the 2020 Q2 Dapp Market Report.

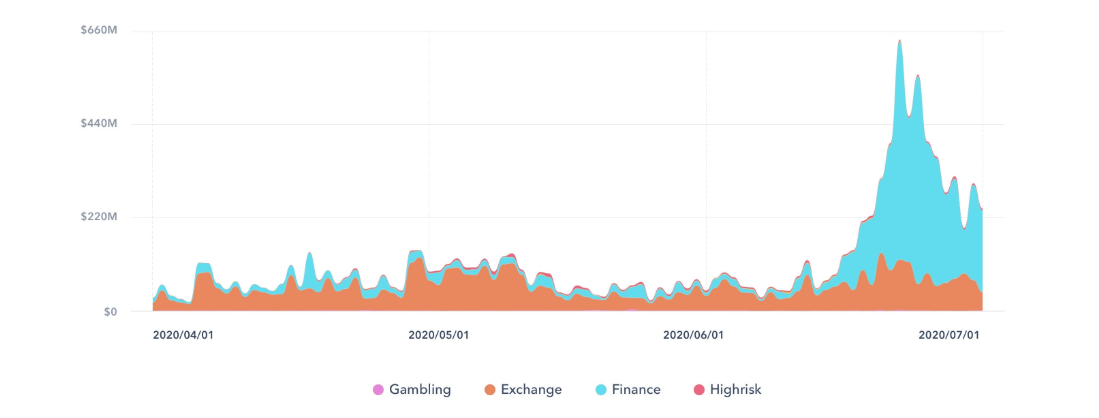

The booming industry, which currently counts nearly 1400 decentralized applications on 12 public blockchains, witnessed a new daily record on June 21, when the transaction volume of DeFi applications spiked to over $608 million and reached the daily all-time high (ATH). On the same day, the newly released COMP, the governance token of DeFi lending platform Compound, also hit its record high of $372.79.

Moreover, a record amount of volume, over $4.9 billion, was transferred through the finance DApps alone in the second quarter of the year. The figure is 67% higher compared to the first quarter, which brings the total volume of DeFi at the current level of $11.5 billion.

Sponsored

Besides, the transaction volume in June reached $6.63 billion, twice more compared to the previous month. Meanwhile, the number of purchases on the Ethereum network alone surpassed $5.7 billion during the same month, which accounts for 97.5% of the whole dApp transaction volume.

According to the report, the June was the best month for DeFi sector so far:

When we call 2020 the year of DeFi, we should call June 2020 "the month of DeFi".

The leading Ethereum

Further statistics reveal the sharp increase in the number of active application users on the Ethereum network during the last month. The number grew by 48% from mid-June reaching the amount of 1.258 million users, which also marks its all-time high, another one for the sector this month.

Sponsored

With the leading volumes on Ethereum dApps, the network accounts nearly 10 times higher sums compared to other leading networks like EOS and TRON, which also grew by 30% and 50% respectively. Ethereum’s closest competitors in the DeFi sector processed volumes of $1.89 billion and $260 million respectively within the second quarter.

However, a deeper look inside reveals that only 10% of active users came from finance applications. The vast majority (65%) of active users processed transactions on the high-risk sector, which includes gambling.

The influence of Compound

In the times when the best performing DeFi sectors are lending platforms and decentralized exchanges (DEX), the launch of COMP token has contributed a lot to the growth of the industry during the last quarter.

COMP, which is the governance token of the Ethereum-based lending platform Compound, was released in mid-June and soon became the largest DeFi token by market capitalization. According to the report, the transaction volume on Ethereum network has soared since June 15, when COMP token was released:

After the distribution of COMP, Compound’s volume has increased from $131 Million in the first half of the month to $3.3 Billion in the second half of the month - 24 times increased. It’s user also increased from 2,629 to 11,879 - 3.5 times increased.

Despite the fact that COMP token brough DeFi sector to the new highs, Basic Attention Token (BAT) was the most used token by DeFi with a transaction volume of $931 million.

The whole decentralized finance (DeFi) sector is currently on the rise. The market capitalization of the industry has exceeded $2 billion within the first days of summer after the rapid double growth in a few months.