- Ethereum (ETH) has surged nearly 70% in 2024, and analysts predict even more gains by the end of June.

- Technical indicators have suggested a breakout, with analysts predicting a further jump after.

- Big money investors have accumulated ETH, fueling bullish sentiment due to accepted spot Ether ETFs.

Ether (ETH), the native token of the Ethereum blockchain, has surged nearly 67% in 2024 and analysts predict further upside in June fueled by a confluence of technical indicators, on-chain data, and potential regulatory tailwinds.

Technical Breakout Points to $4,255 Ethereum Target

As of June 1, Ether appears to be breaking out of a falling wedge pattern, a bullish reversal signal in technical analysis. This pattern typically resolves with a price increase equal to the height of the wedge. In Ether’s case, this translates to a potential rise to $4,255 by June’s end, a 12.65% increase from current levels.

Sponsored

Interestingly, this breakout could also be part of a larger bull flag pattern, suggesting a potential surge to $6,000 by the end of June or early July.

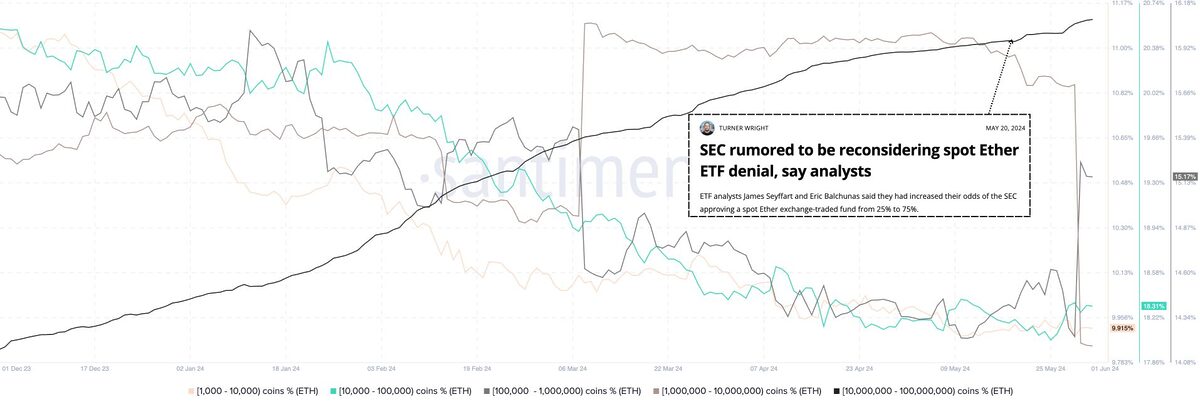

The activity of Ethereum’s largest whales is adding fuel to the bullish fire. According to on-chain data provider Santiment, entities holding between 10 million and 100 million ETH have been accumulating since May 20, coinciding with rumors of the SEC reconsidering its stance on spot Ether ETFs. This accumulation has continued following the official approval of such ETFs on May 23.

Conversely, whales holding between 1 million and 10 million ETH appear to be taking profits, while exchange reserves have also declined significantly. This suggests investors are moving their holdings off exchanges, a sign of long-term bullish sentiment (hodling) that could propel Ether above $4,000 in June.

Spot Ethereum ETFs Could Boost Demand

Analysts see a “legit possibility” of U.S. spot Ether ETFs launching by late June, fueled by BlackRock’s recent update to its iShares Ethereum Trust (ETHA) filing with the SEC. This development is seen as a positive signal for the approval of other similar products.

Sponsored

Spot Bitcoin ETFs, launched in January, have already seen significant inflows, and analysts predict similar success for Ether ETFs. This surge in institutional demand, coupled with the ongoing technical breakout and whale accumulation, could push Ether’s price above $4,000 in the coming month.

On the Flipside

- Technical indicators are not foolproof, and a failed breakout of the wedge pattern could lead to a price drop.

- The success of Bitcoin ETFs does not guarantee the same outcome for Ether ETFs. Institutional adoption of Ether could be slower than anticipated.

Why This Matters

Ether’s potential price surge in June, fueled by technical indicators, whale accumulation, and the possibility of spot Ether ETFs, could signal a broader bull run for the cryptocurrency market. Increased institutional investment via ETFs and long-term investor confidence could lead to a domino effect, boosting the entire crypto space.

Interested in the future of Ethereum? This article discusses the potential impact of Ethereum ETFs on the cryptocurrency market:

Ether ETFs to Oppose Bitcoin Dominance: Is the Flippening Near?

Big news for Ethereum! This article details BlackRock’s recent filing to launch an Ethereum ETF:

BlackRock Files Updated ETH ETF Proposal: Here’s What’s New