- Ethereum investors are increasingly choosing to self-custody their ETH.

- Exchange ETH holdings have low numbers not seen since genesis.

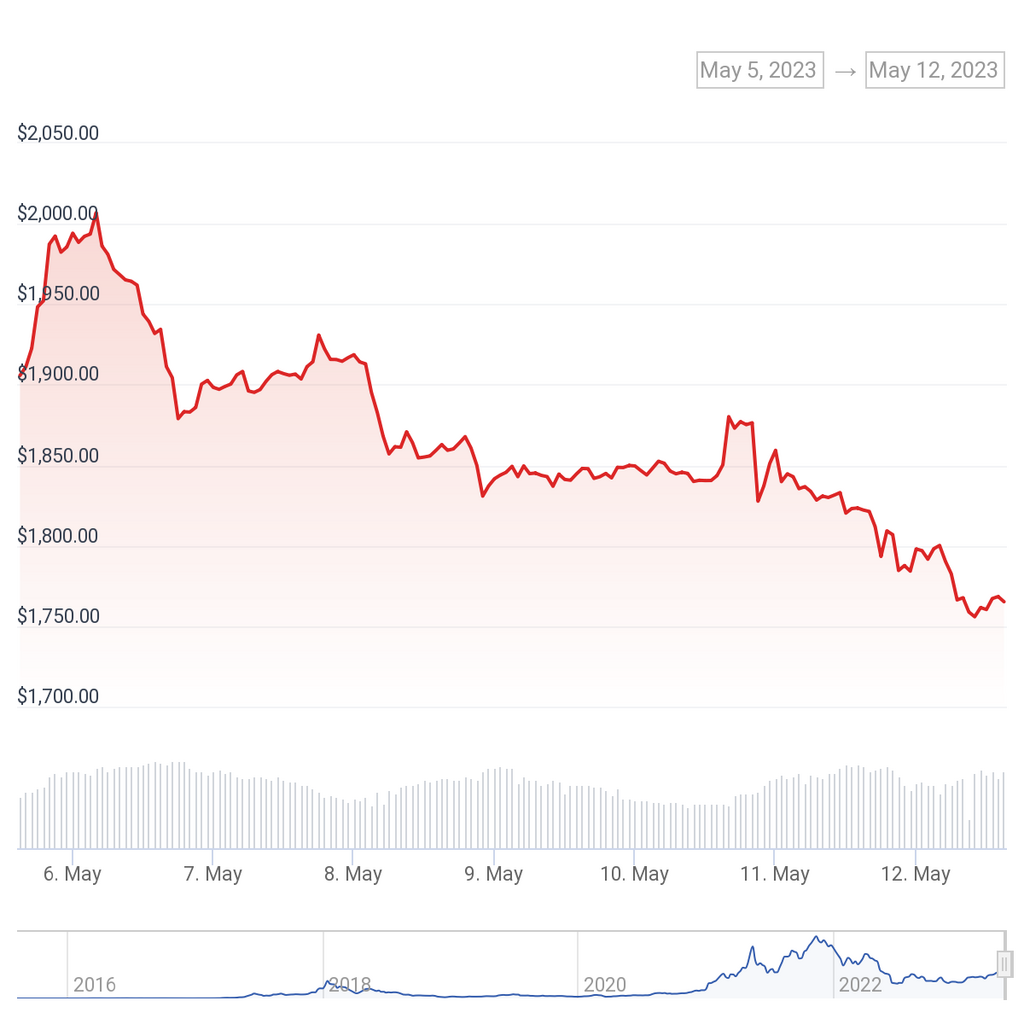

- ETH is down 7.2% in the past week.

Centralized crypto exchanges are one of the most popular places to trade and hold digital assets. However, the FTX blowup last year spurred an exodus from centralized exchanges to self-custody.

The migration to self-custody has been so strong that ETH held on exchanges has reached low levels that haven’t been since genesis.

ETH Holdings on Exchanges Hit All-Time Low

ETH is one of the most popular crypto assets in the industry. The second largest cryptocurrency has a $214 billion market cap and has recently entered a deflationary period.

Sponsored

ETH is also an asset that investors value and choose to self-custody instead of holding it on centralized exchanges. In fact, according to data from Santiment, ETH held on centralized exchanges has just hit an all-time low.

Currently, only 10.1% of all ETH in circulation is being held on centralized exchanges. This means that the remaining 89.9% of ETH is held by investors in self-custody wallets.

What’s more interesting is that 10.1% of ETH held on exchanges is the lowest since public trading of ETH began in 2015. That’s despite the fact that ETH has been experiencing a slump in the past week.

ETH Goes Down

ETH has been one of the best-performing assets since the start of the year. However, in the past week or so, the native currency of the Ethereum blockchain has gone down significantly.

Sponsored

According to data from CoinGecko, ETH is down 3.1% on the day and 7.2% in the past week. ETH is currently trading at $1,766.

ETH is trading below the levels before the Shapella upgrade was activated on mainnet on April 12. Shapella is the upgrade that enabled staked ETH withdrawals for the first time since 2020.

Many saw Shappela as bearish for the price of ETH. However, ETH skyrocketed more than $200 on the successful upgrade and even broke the $2,100 mark.

Since then ETH was trading sideways until the last few days. ETH, together with the whole crypto market, has gone down significantly. The total market cap of all cryptocurrencies now is $1.15 trillion, according to CoinGecko.

On the Flipside

- ETH has been deflationary ever since The Merge last August. However, in the past week or so, amid the memecoin mania, ETH has been super deflationary. For example, in the past seven days, over 66,000 ETH has been burned.

Why You Should Care

ETH is one of the most used cryptocurrency assets. The drama surrounding centralized exchanges has shown the importance of self-custody at all times.

Read more about Polygon being pushed out of the top 10 cryptocurrencies:

Polygon (MATIC) Pushed Out of Top 10 Cryptocurrencies by Solana (SOL)

Read more about Ethereum OFAC-compliant blocks:

Ethereum’s OFAC-Compliant Blocks Drop to 27%: What Does It Mean?