- Doge scorches past the $0.16 mark, putting over 85% of custodians in profit.

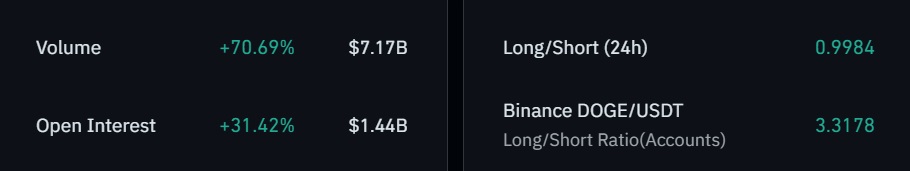

- Derivatives see $7.17B volume, with Binance users most bullish on DOGE.

- Amid a full-scale bull market takeover, DOGE shows mixed on-chain signs.

The top dog memecoin Dogecoin (DOGE) is back on its paws amid an illustrious 97% weekly rally, mostly due to the spiking demand for DOGE in both Spot and Derivatives crypto markets. The Open Interest (OI) hike since last week now has DOGE’s Derivatives trading surging past $7 billion in the last 24-hour timeframe, shifting the scales of the OI ratio to $1.44B, a three-year high.

In the on-chain data provided by blockchain analytics firm CoinGlass, Binance’s traders depict the optimism surrounding DOGE, as the long versus short ratio on Binance Futures is 3.31, meaning that long positions outweigh short placements over three times.

The last time Dogecoin clinched such a milestone was May 10, 2021, when its price lingered around the $0.60 price range. Given the currently high 0.88 correlation with Bitcoin (BTC), a surge to the aforementioned level can still be on the cards, as cryptocurrencies with over 85% of holders in the money tend to face less severe market corrections.

DOGE Price Backtrack on the Horizon?

Dogecoin’s Spring bull run now puts DOGE above $0.16, doubling the market capitalization from $11 billion to $23 billion over the past 30 days. As Dogecoin’s new wallet addresses soared since the beginning of 2024, Dogecoin’s Proof of Work (PoW) network now encompasses over 6 million active crypto wallets.

Sponsored

This has garnered a 177.7% increase in accumulated transaction fees in a 90-day timeframe, according to blockchain data by IntoTheBlock. While these on-chain stats are reasonably deemed bullish, Dogecoin’s large transactions dropped by 13%, signaling that DOGE whales have gone quiet after several huge transfers spotted last week.

Sponsored

As DOGE continues to reach for the moon, veteran crypto analysts share their takes on the potential of a Spring 2024 bull run. The DOGE Coach remarked that the weekly 97% rally serves as a building block for “something great,” highlighting a similar price boost when Elon Musk bought Twitter and the XPayments account creation started a reverberant buzz among the vibrant community of DOGE Army.

At press time, the #10 seated Dogecoin (DOGE) exchanges hands at $0.1612, inking 14.8% gains in the last 24 hours. From a yearly perspective, Dogecoin’s price returned 112.8% profit, most of it coming from last week’s monumental run.

On the Flipside

- Dogecoin’s Relative Strength Index (RSI) points to a severely overbought condition at 98.32, based on the 1-day technical charts.

- While the daily trading volume topped $2.33B on Monday, the combined order book of Spot markets indicated pending sells rising by 16%.

Why This Matters

Dogecoin is a long-term TOP 10 contender by global crypto market capitalization and is one of the most highly-publicized cryptos around the globe.

Discover DailyCoin’s top crypto news: