- Retail investors propel CME to a new high in Bitcoin futures market share.

- CME’s notional open interest is closing in on Binance.

- Analysts debate the role of retail investment in CME’s rapid ascent.

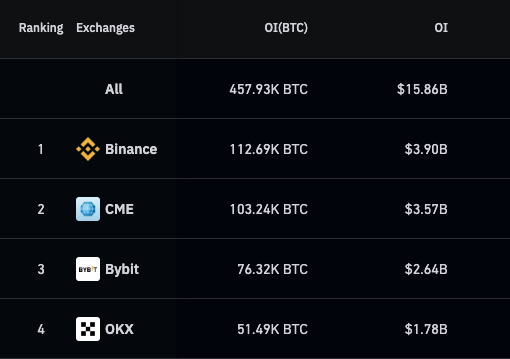

As the crypto market anticipates the anticipated approval of spot Bitcoin ETFs, a seismic shift is already underway. The Chicago Mercantile Exchange (CME) is suddenly giving Binance a run for its money in the Bitcoin futures market.

Sponsored

But what’s behind this unexpected rise? Intriguingly, retail investors are emerging as a significant factor. This raises the question of what this shift means for the future of Bitcoin trading.

CME About to Overtake Binance in Bitcoin Futures

On Monday, October 30, the Chicago Mercantile Exchange (CME) reported a notional open interest of $3.54 billion in Bitcoin futures, according to data from Coinglass. This marks a significant leap from its position just weeks ago when it was the fourth-largest Bitcoin futures exchange.

What is remarkable is that the data suggests that retail investors are playing a more significant role in this rally.

Are Retail Investors the Driving Force Behind CME’s Surge?

For the week ending October 27, 2023, the ProShares Bitcoin futures ETF, primarily invested in CME’s Bitcoin futures, saw a staggering 420% increase in its rolling five-day volume, reaching $340 million. This ETF has become a popular vehicle for retail investors to gain exposure to Bitcoin futures, and its dramatic increase in volume correlates strongly with CME’s rise in notional open interest to $3.54 billion as of October 30, 2023.

So, what’s driving retail investors towards CME’s Bitcoin futures? One possibility is anticipating regulatory changes, specifically the potential approval of spot Bitcoin ETFs.

Sponsored

While the data points to a significant role for retail investors in CME’s recent surge, it’s crucial to acknowledge that they are not the only players in the game. Institutional investors also have a stake in this shift in market dynamics.

According to some analysts, CME’s rise could indicate increased institutional buying. The standard Bitcoin futures contracts offered by CME, equivalent to 5 BTC, are often more appealing to institutional investors looking to make larger investments. Additionally, the regulated nature of CME as an exchange adds an extra layer of credibility that is attractive to institutional players.

While it’s challenging to attribute CME’s surge solely to retail investors, they are undoubtedly a significant force impacting the market dynamics.

On the Flipside

- The looming possibility of spot Bitcoin ETF approval is more than just a regulatory milestone; it could catalyze an influx of investment into the cryptocurrency market.

- If spot Bitcoin ETFs receive the green light, they would offer a more direct exposure to Bitcoin than futures-based ETFs. This could attract both retail and institutional investors who have been sitting on the sidelines, waiting for a regulated way to invest in Bitcoin.

Why This Matters

For crypto traders, the rise of CME as a dominant player in Bitcoin futures could signal a shift in market dynamics. The increasing involvement of retail investors may also pave the way for more user-friendly investment products in the future.

Read more about the anticipated spot ETF approval:

Bitcoin ETF Expected Within Months, Says Former SEC Insider

Read more about GDP growth and its implications for crypto:

Why Strong U.S. GDP Numbers Might Not Be Good for Crypto