- U.S. GDP growth in Q3 2023 surpassed expectations.

- The Federal Reserve’s reaction is what the crypto market is looking like.

- Inflation is a top concern for the Fed.

The U.S. economy is showing robust growth, with the latest GDP figures exceeding expectations. Traditionally, this would be a cause for celebration across financial markets. However, the news might not be as favorable as it seems for the cryptocurrency sector.

A strong economy could give the Federal Reserve the confidence to tighten monetary policy, which usually involves raising interest rates or reducing the money supply. Such moves could make traditional investments like bonds more attractive, potentially diverting money from riskier assets like cryptocurrencies.

Main Point: The Double-Edged Sword of U.S. Economic Growth

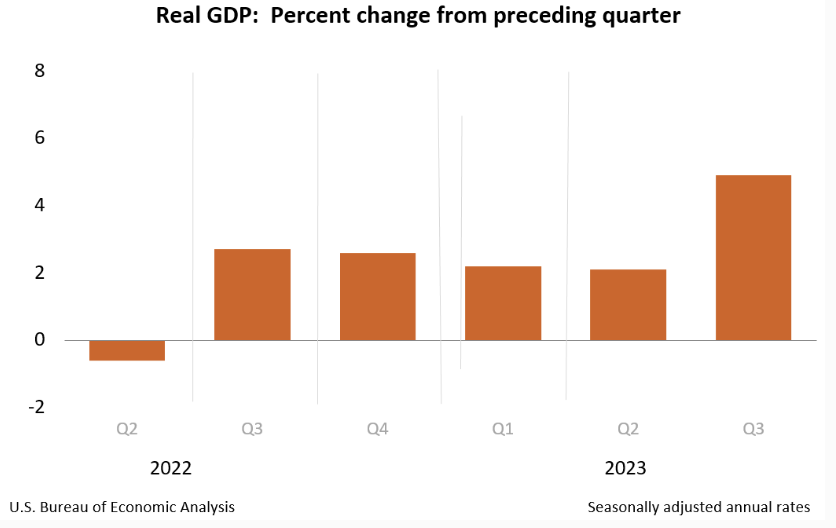

On Thursday, October 26, 2023, the U.S. Commerce Department reported that the economy grew at an annualized pace of 4.9% in the third quarter. This growth surpassed the 4.7% estimate and marked a significant increase from the 2.1% pace in the second quarter.

While these numbers generally indicate a healthy economy, they also present a conundrum for the Federal Reserve. Namely, strong growth often leads to more spending and, in turn, more inflation. A strong economy could, therefore, give the Federal Reserve the confidence to tighten monetary policy.

Sponsored

Such moves usually involve raising interest rates or reducing the money supply, which could make traditional investments like bonds more attractive. This, in turn, will divert money away from riskier assets like cryptocurrencies.

The Fed’s Aggressive Stance on Inflation and Its Impact on Crypto

In 2022, the U.S. Federal Reserve took an aggressive approach to combat inflation, notably impacting various financial assets, including cryptocurrencies. In June 2022, Federal Reserve officials emphasized keeping inflation close to the bank’s long-term 2% goal.

Sponsored

In September 2022, the Fed took an even more aggressive stance as part of its most aggressive fight against inflation since the 1980s. Notably, the U.S. central bank’s aggressive campaign to tamp inflation has already weighed on valuations for risky assets, including crypto, in 2022.

On the Flipside

- Despite the Federal Reserve’s aggressive stance on inflation, crypto markets are currently up considerably. The most likely cause for this momentum is the anticipation of Bitcoin spot ETF approvals.

- Geopolitical factors can also influence the Federal Reserve independently of inflation. For example, geopolitical tensions like the war in Ukraine or the Israel-Gaza conflict could steer the Fed in a different direction.

Why This Matters

Federal Reserve’s past and future actions are important market sentiment and asset valuation indicators. Therefore, keeping an eye on U.S. economic indicators and the Federal Reserve’s policy could be key to successfully navigating the volatile crypto market.

Read more about how inflation can boost crypto:

Inflation-Ridden Turkey Turns to Bitcoin: Will the Rest of the World Follow?

Read more about Chainlink’s partnership with Backed:

Chainlink’s Protocol Secures Backed Real-World Assets