Crypto wallets aren’t just recommended; they are necessary tools for crypto users to buy, sell, and trade their personal crypto assets safely and securely. Wallets have always been tied to cryptocurrency, but in recent years, their benefits and drawbacks have become much more noticeable due to the competitive market for them.

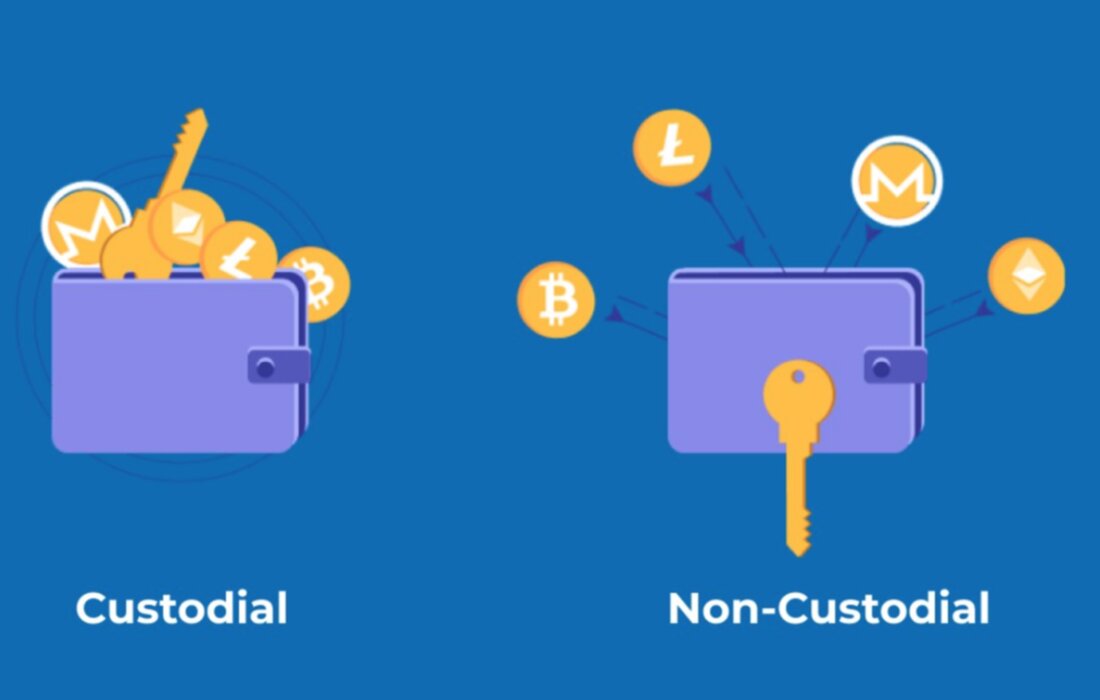

There are two types of crypto wallets, custodial and non-custodial, that function quite differently. Though they serve the same purpose, they also contain unique aspects and systems that make them ideal for different types of investors.

Sponsored

Before comparing the two side-by-side, though, it’s important to answer some of the most important questions about the nature of crypto wallets and how exactly they work.

Table of Contents

How Do Cryptocurrency Wallets Work?

As their name implies, crypto wallets are designed to safely store your cryptocurrency, but they can be a little more complicated than this. First, the wallets themselves can be devices, programs, browser-based extensions, or mobile applications. Most crypto wallets contain a public key for setting up transactions and a private key to authorize these payments.

Despite being commonly referred to as digital wallets, they don’t exactly work like the real thing. For custodial wallets, digital assets are stored on larger blockchain networks, which can only be accessed via the private key.

Who has access to the private key depends on the type of wallet, but these are important to keep safe since they are used to verify that the person accessing the funds is the person to whom they rightfully belong.

Sponsored

Possessing a crypto wallet also adds an extra layer of security to the users’ funds, which can only ever be a good thing. Whether for short-term ventures or a long-term campaign, acquiring a crypto wallet can make your experience with handling cryptocurrency much easier.

Types of Crypto Wallets

Rather than choosing a wallet at random, it’s important to research each one to ensure you know where your funds are being stored and how much control you will have over them. Let’s take a closer look at how the custodial and non-custodial wallets operate and what types of users they each appeal to more.

What Is a Custodial Wallet?

When a person applies for a custodial wallet, they are placing their funds and private key in the safe hands (or sometimes not so safe) of a third party which is usually a crypto exchange.

These external parties abide by proper regulatory regimes, which are in place to keep the funds secure and verify that the person trying to spend them is authorized to do so.

Of course, even though the private key is handed over to someone else, the original owner will still be able to spend or trade their assets in any way they would like. As we will discuss later, though, not everyone is a fan of sharing their precious private key, especially when the wallet is part of a large online custodial database.

What Is a Non-Custodial Crypto Wallet?

Rather than handing over the keys to a crypto exchange, non-custodial wallets provide an alternative option that removes the middleman entirely. This gives users full control and responsibility over their private keys and, in turn, their digital assets.

While many benefits come from picking up a non-custodial wallet, the person using it needs to be extra careful since there won’t be any other parties or helplines to help out if the private key or seed phrase goes missing. There’s also a time-consuming transaction fee that must be paid for moving crypto into a wallet, which can prove costly since it can cause people to miss out on fast trades.

Hardware Wallets

Hardware wallets are physical, non-custodial wallets that often take the form of a USB drive. They can usually work offline, meaning that everything from the blockchain to the ledger is installed within a single device. This protects them from hackers and makes them convenient for those who may not always have reliable internet access.

Custodial vs Non-Custodial Wallets: Key Differences

The existence of a third party is the core difference separating custodial and non-custodial wallets.

This one factor means that the two are vastly different in what they offer users, their accessibility, their speed, and most importantly, how much security they provide. When deciding which to go with, these are the major points that need to be considered.

Ownership

The most obvious difference between the two wallets is how much ownership the user has over their assets. With custodial wallets, the service provider, such as Coinbase or Kraken, will have custody of the private key and will bear most of the responsibilities.

This allows owners to rest easy since they don’t need to worry about losing the key or passcodes at the cost of having a smaller portion of complete control.

Non-custodial wallets are designed for people who don’t like the idea of a stranger handling their tokens and who feel confident enough to monitor their funds without the help of a third party.

Non-custodial essentially makes the user their own bank. This is very attractive for those long-term investors trying to accumulate tokens over time who don’t want to keep all of this in the possession of an external provider like Gemini or BitGo, just to name a few.

Security

Security could be considered the valuable ace in the hole of non-custodial wallets and is a big reason why they have been so popular lately.

Because custodial wallet providers will store the users’ keys and funds in a larger database, there is always a chance hackers can break into the infrastructure and steal personal information. This has happened before such as with the 2020 KuCoin hack where over 150 million dollars worth of tokens were lost to a group of hackers, affecting thousands of users.

Non-custodial wallets don’t carry this same risk since most users will store their private keys off-chain, meaning they aren’t connected to a wider infrastructure. It also helps that many non-custodial wallets can approve transactions automatically, even while offline, making it more or less impossible for outsiders to uncover the private key for their own uses.

Ease of Use

Crypto newcomers will have a much easier time navigating the user interface of a custodial crypto wallet. Most crypto exchanges acknowledge that most of their visitors will be beginners, making the process as user-friendly as possible.

It should also be mentioned that signing up for a custodial wallet can require some personal documentation, making the process a bit longer.

Those with experience managing online funds and assets won’t have much difficulty navigating a non-custodial wallet. Still, the number of integrated systems and features can overwhelm novices. That being said, though, non-custodial wallets don’t require users to go through security measures like KYC, for example, so they can be set up much quicker.

Transaction Speed

Transactions taking place through custodial wallets must be approved by the central exchange, which can take a few minutes to several hours. Transactions also cost more because intermediaries are involved in trading or selling tokens.

When making any kind of transaction with a non-custodial wallet, the only person who needs to authenticate is the user themselves, making the whole process much faster. However, you would still need to pay a network fee, so it’s not always entirely free.

Recovery Options

Having full control over all your digital assets and currency is a nice prospect, but it also places an enormous amount of responsibility on the user. If someone were to lose their private key and forget the 12 to 24-character seed recovery phrase, they would lock themselves out of their own funds completely.

This isn’t the case with custodial wallets, where the providers and external parties can help the user. Because they possess custodial rights, they can easily restore the key after receiving a few bits of personal information from the user.

Custodial Wallet Pros & Cons

Pros

- Backup Options: The exchange providers will always be able to guide the user safely back to their funds if they lose their private key.

- Beginner Friendly: The simplistic interface and external assistance make custodial wallets ideal for crypto newcomers.

- Extra Resources: Many exchange providers offer additional learning resources to help users manage their digital assets safely and securely.

- Responsive To Fluctuations: Funds can be exchanged fast enough to keep up with fluctuating prices within a short period.

Cons

- Risk of Cyberattacks: Placing private keys and funds onto a larger database means there’s always a risk of cyberattacks and hackers stealing private information.

- Limited Currencies: Custodial providers often only have a small pool of currencies, limiting their overall flexibility within the wider crypto infrastructure.

- Speed: The amount of intermediaries involved with custodial wallets means that transactions can take much longer or be delayed outright.

- Risk of Provider Instability: If an exchange provider crashes unexpectedly, it can lock people out of their funds since the providers still possess the private key. This happened in 2022 with the Celsius exchange provider, for example.

- Signing Up: Lots of personal identification is required to meet the KYC regulations needed to create a custodial wallet, which can be a time-consuming process.

Non-Custodial Wallet Pros & Cons

Pros

- Safety From Hackers: Non-custodial users have full ownership over their private keys and funds, and since they are not logged onto a collective database, it’s much harder for hackers to retrieve any sensitive information. This is especially the case with non-custodial wallets, which can also function offline and are also known as cold wallets.

- Full Ownership: Having complete control over all assets means that nothing can be lost due to the fault of a third party crashing or misusing the funds.

- Cheaper: Only the user needs to verify transactions, so no providers must be paid to carry out the process.

- Faster: Personal user authentication allows transactions to happen instantly rather than going through multiple different parties. Applying for a non-custodial wallet is much quicker since users can skip past the KYC security regulations.

- Flexibility: Non-custodial wallets tend to support more types of currency, making them more flexible and perfect for those involved in multiple markets than just one.

Cons

- Limited Backup Options: Outside of the private key and seed recovery phrase, there’s no way to restore the funds stored in a non-custodial wallet. Users therefore need to be extremely careful they don’t lose this information since there are no backup options.

- Heightened Responsibility: No third party helping out means the responsibility of managing and storing crypto is entirely down to the user. This also includes protecting the private key, as there will be nobody else who can recover it once it’s gone.

- Difficult Interface: Non-custodial wallets are primarily designed for those already experienced in buying and trading crypto. The interfaces can, therefore, contain many deeper tools, systems, and technical jargon that might put newcomers off.

Final Verdict

All in all, custodial wallets might be easy to set up and perfect for beginners due to their user-friendly interfaces, but they are much more prone to cyberattacks. They also cost more in the long run due to their transaction fees, and transactions can take a while to be fully processed.

Non-custodial accounts are much safer, faster, and cheaper, but they also come with virtually no backup options, meaning the owner is responsible for keeping their funds safe.

Choosing one should depend on what you value most in a wallet, whether that be ease-of-use and accessibility, as in the case of custodial, or security and cheaper fees, which would make non-custodial the better option of the two.

On the Flipside

- Both types of cryptocurrency wallets have unique pros and drawbacks that must always be carefully considered. Conducting extensive research beforehand and deciding on what features you see as the most valuable is important when choosing one over the other.

FAQs

Technically, a non-custodial user can still be tracked since their transactions will appear on the blockchain in real time. However, because there is no KYC regulation, gathering info on the person themselves isn’t an option.

There can be a common misconception that Bitcoin is a self-custodial wallet, but in reality, it’s simply a form of crypto that can be bought and traded, just like any other.

MetaMask is a self-custodial wallet that interacts with the Ethereum blockchain. It can be downloaded as a web browser or mobile app.