- Nearly 70% of total losses in 2023 are from the ten largest hacks.

- These attacks, primarily private key thefts, were the most damaging.

- 2023 saw a 50% reduction in the total stolen amount.

Hacks have been plaguing crypto since its inception. Still, there has been notable progress in security measures, reflected in the data. Overall, crypto hack losses fell by 50% compared to last year.

Despite a noticeable decline in the overall volume of crypto hacks, a small number of high-profile incidents have disproportionately contributed to the year’s total losses.

Top Ten Hacks Contributed to 70% of Losses

In 2023, the cryptocurrency world witnessed a significant shift in the pattern of cyber attacks. According to TRM Labs, the total volume of losses due to hacks fell by over 50% compared to 2022.

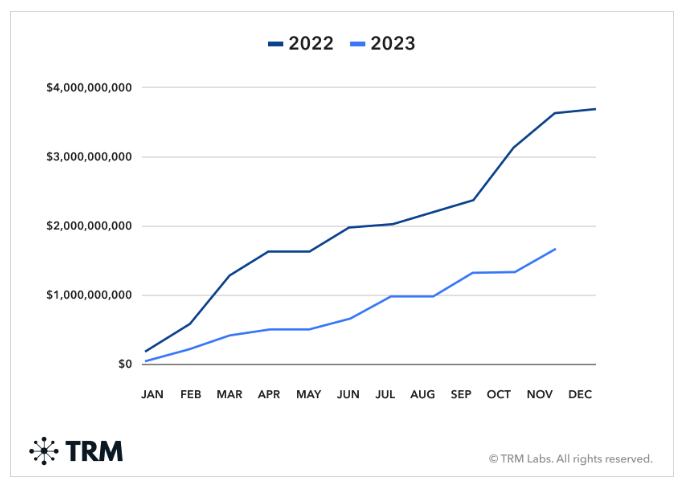

The year recorded around 160 attacks, similar to the previous year, but the total amount stolen reduced dramatically to USD 1.7 billion from nearly USD 4 billion in 2022. This decline is indicative of improved security measures within the industry.

A closer examination reveals an alarming trend: the top ten hacks of the year were responsible for nearly 70% of all stolen funds. This statistic highlights the disproportionate impact of major breaches.

Among these, several exceeded USD 100 million, targeting prominent platforms such as Euler Finance, Multichain, Mixin Network, and Poloniex. The incidents predominantly involved infrastructure attacks, particularly private key theft or seed phrase compromise.

The average financial impact of these infrastructure attacks neared USD 30 million per incident. While usually gaining less coverage, these losses overshadow those from protocol attacks and code exploits.

Crypto Hacks Fall Due to Enhanced Security and Law Enforcement

The decline in cryptocurrency hacks in 2023 can be attributed to improved security measures and enhanced law enforcement efforts. The cryptocurrency industry has significantly upgraded its security protocols over the past year, implementing real-time transaction monitoring and anomaly detection systems.

Sponsored

Law enforcement agencies worldwide have also intensified their focus on cybercrime involving digital currencies. The increased collaboration between these agencies has led to quicker responses to hacking incidents.

Moreover, the cryptocurrency sector has witnessed greater industry coordination. Exchanges, wallet providers, and blockchain networks have ramped up information sharing about vulnerabilities, threats, and breaches.

On the Flipside

- Despite the encouraging trends, the cybersecurity landscape in the cryptocurrency sector is far from static. The emergence of new, sophisticated threats could quickly reverse the decline in hack volumes.

- The targeted hacks suggest that while the frequency of attacks may decrease, their potential impact remains significant.

Why This Matters

The reduction in cryptocurrency hacks has broad implications for the industry and its stakeholders. For investors and users, it instills confidence in the security of digital assets, potentially leading to greater adoption and investment in cryptocurrency.

Read more about crypto scams you should be aware of:

Types of Crypto Scams: Common Cryptocurrency Scams You Need to Watch Out for

Read more about the most bullish development for 2024:

SEC Set to Approve First Bitcoin Spot ETF in January 2024