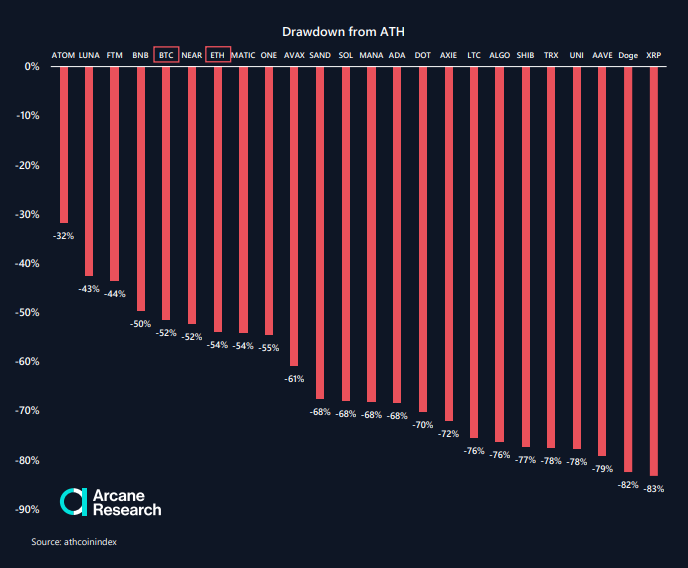

It’s no surprise to any crypto investors that the digital asset market is down overall, but it’s been especially challenging for two previous highfliers – Dogecoin and Shiba Inu respectively. Last Tuesday, cryptocurrency analytics firm – Arcane Research – released its most recent report exploring the state of the industry, which bears those facts out.

This graphic from Arcane Research, shows that crypto stalwarts – Bitcoin (BTC) and Ethereum (ETH) – are down -52% and -54% respectively from their all time highs; while the meme coins Shiba Inu (SHIB) and Dogecoin (DOGE) have fallen even further from their peaks. SHIB is down -77% while DOGE has cratered -82%.

Earlier this month, chief commodity strategist at Bloomberg, Mike McGlone, predicted this decline for these two meme projects in his latest research report titled — Crypto Outlook: Don’t Fight the Fed — which examined the potential impact of pending government interest rate hikes on cryptocurrencies. While McGlone’s outlook is not good for thousands of the no-name crypto projects out there, he foresaw that DOGE and SHIB would be hit especially hard.

Sponsored

"Crypto tops the speculative excesses and may be an early indicator that the broader market tide is due to recede. Peaks in meme coins Dogecoin and Shiba Inu have coincided with similar market highs, emphasizing the leading indications from crypto," stated McGlone in his report. “SHIB in the second half of 2021 and DOGE in the first half of 2021 are examples of coins that are speculative hype and fun for gamers on an unprecedented global scale, 24/7."

What he meant by those published comments was that what shoots up fast tends to drop just as far and fast, which is what has happened with Dogecoin and Shiba Inu – well in advance of an actual rate hike from the Federal Reserve this year. The thesis of his report was that interest rate increases tend to drive investors from risky assets, as they seek higher yields in safer investment options. McGlone expects Bitcoin and Ethereum to eventually regain all-time highs, but expressed concern that investors have already begun the exodus from the dog-themed meme assets.

Since their peaks, both DOGE and SHIB have since dropped out of the top 10 coins by market capitalization, and McGlone suggests those speculative assets could have further to fall in the face of rising interest rates.

Sponsored

"The endless battle for the top cryptocurrencies, often fueled by hype and speculation, makes us realize that most things that add up quickly are scary,” said McGlone.