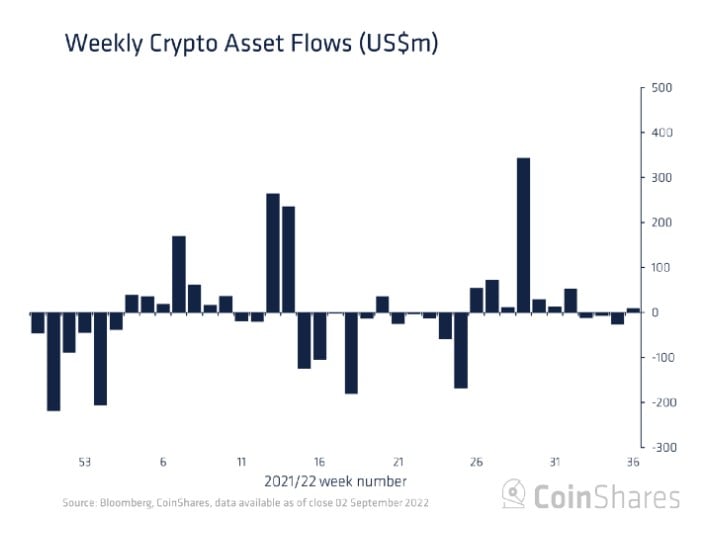

Digital asset investment products are seeing slight inflows after the consequent 3-week pull back, reports crypto market researcher CoinShares.

As per its bi-weekly market report, the combined capital inflows into up to 10 major digital asset funds reached $9.2 million during the past week. The numbers looked different a week ago when $27 million was taken out of crypto investment funds. Since the beginning of August, $52.7 million in total left digital asset funds.

According to CoinShares, the weekly trading volumes sat around $915 million, or $14 million more than a week prior, when they hit the lowest levels since October 2020. CoinShares linked that to the seasonal effect and to the continued apathy that followed the recent price declines in financial markets.

Sponsored

The biggest amounts of capital were poured in Purpose Investment’s digital asset funds ($6.5 million) and CI Investments’ crypto funds ($5.6 million). Meanwhile, the 3iQ crypto fund, which belongs to Canada’s largest digital asset investment fund manager, witnessed the biggest $9.4 million outflows over the past week.

Short Bitcoin Led the Show

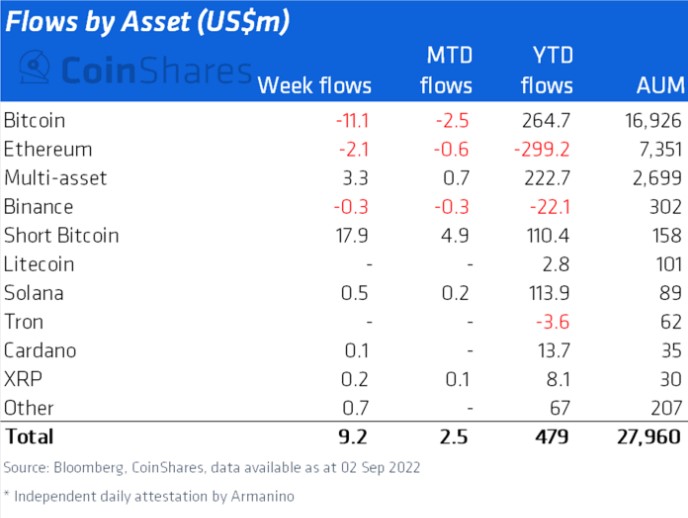

Reportedly, the biggest amounts of capital were moved into Short Bitcoin product, totaling $17.9 million over the set time period. Multi-asset investment products witnessed the second biggest capital inflow, or $3.3 million, more than fives times lower than products offering Bitcoin shorting investments.

Meanwhile, the Bitcoin and Ethereum investment funds registered the most significant weekly losses, with $11.1 million and $2.1 million of investments respectively fleeing out of the funds.

Sponsored

The move represented the 4th consecutive week of withdrawals from BTC investment products, resulting in nearly $70 million of capital decline over time.

Investment products related to other digital assets like Litecoin (LTC), Solana (SOL), Tron (TRX), Cardano (ADA), and Ripple (XRP) have not reported any significant outflows, although the amounts of invested capital remained minor and lingered under $1 million.

Canada Most Active, US Investors Halt

Despite the low trading volumes, the money inflows showed different sentiments across investors of different regions.

As per the report, the biggest amount of capital, or $4.7 million, came from Canada alone, followed by Brazil’s $3.2 million. Investors from Switzerland and Germany were the next in line, pouring in $1.7 million and $1.6 million, respectively.

Meanwhile, United States investors remained most cautious. Their capital inflows totaled $0.8 million, “masked by predominant inflows into short-Bitcoin investment products,” CoinShares said.

Whales Keep Depositing on Exchanges

At the same time, the whale deposit amounts on crypto exchanges keep growing, says another cryptocurrency data research firm CryptoQuant.

According to them, the Exchange Whale Ratio increased right before Bitcoin’s drop today, when the dominant crypto fell below its symbolic $19K level and slipped to lows not seen since June.

Whales are depositing on Exchanges 🐳

— Maartunn (@JA_Maartun) September 6, 2022

Just before the 5% drop of #Bitcoin, Exchange Whale Ratio was increasing. The sharp increase indicate that Whales are active on depositing to exchanges.

The ratio is still high, which is concerning but also a typical bear market behavior🐻 pic.twitter.com/z3maytuPhz

The Exchange Whale Ratio is the relative indicator that shows the size of the 10 biggest Bitcoin transactions compared to the total transactions made. According to CryptoQuant, today it once again surged to the critical 90% zone, which is historically considered a warning sign for specific crypto.

Simply put, the high value of the ratio means that whale transactions make up a large part of the whole BTC deposits. Typically, the increasing inflows to the exchanges can be considered a bearish signal.

On the Flipside

- More than half of Bitcoin’s circulating supply remained dormant throughout the past year. The part of dormant Bitcoins also keeps growing. The move is typically considered a bearish sign.

Why You Should Care

Bitcoin is still the dominant crypto and sets the direction for where the whole cryptocurrency market will be moving in the near term. The bearish BTC typically means that similar sentiments might keep lingering around the altcoins as well, especially in times of extremely uncertain macroeconomic conditions.

Find out more about today’s Bitcoin (BTC) price drop:

Bitcoin (BTC) Falls To Its Lowest Point In Two Months, Dipping Below $19K

Check out tips on how to survive the crypto winter:

How to Get Through Crypto Bear Market