- Crypto exchanges face greater scrutiny following several high-profile scandals.

- Nexo launches its Live Status feature to provide a better user experience.

- The crypto industry faces many recurring challenges that hinder public perception.

Several high-profile crypto scandals in recent years have worked to undermine public trust and tarnish the reputation of the digital asset industry. The collapse of FTX in late 2022, with the subsequent revelations of misappropriated customer funds, served as a stark reminder of the need for greater transparency and accountability within the crypto ecosystem.

In the wake of these damaging events, crypto exchanges have sought to regain user confidence through various initiatives, including releasing Proof-of-Reserve (PoR) data to evidence solvency. Nexo’s newly released Status Center feature is the latest initiative in this battle to win over the public.

Nexo Strives For Transparency

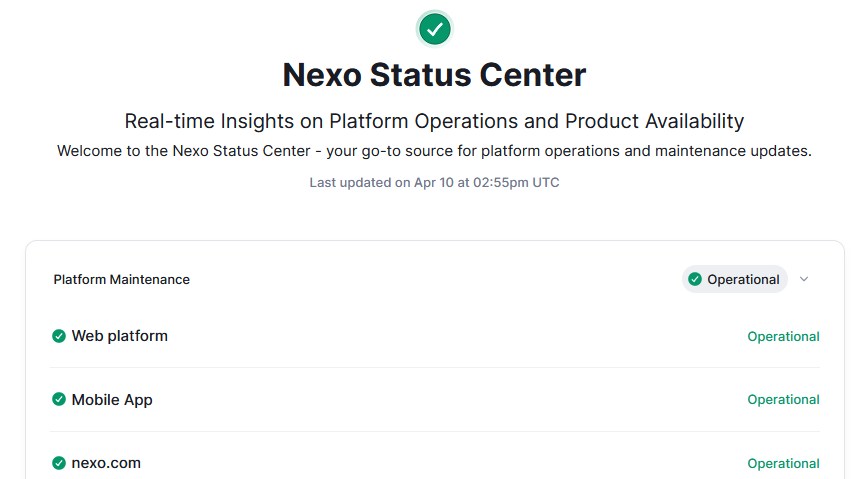

Striving to lift the reputation of crypto exchanges in the eyes of the public, Nexo recently unveiled its Status Center feature, which provides real-time insights into the company’s operations, maintenance updates, and service availability. This feature offers users a comprehensive and transparent view of Nexo’s platform performance and changes to its core services.

According to Nexo, the Status Center is intended to keep users up-to-date on the current state of the exchange’s key functions, such as borrowing, earning, card, and withdrawal functionalities, from a single point of reference.

Sponsored

This initiative comes when public scrutiny of the crypto industry has intensified, particularly following the recent spate of regulatory clampdowns in the US.

Nexo was thrust into the spotlight in January 2023 when the company agreed to pay a $45 million settlement with the Securities Exchange Commission (SEC) while voluntarily bowing out of the US market. The SEC alleged that NEXO had not registered its crypto-lending product with the agency.

Sponsored

Nexo co-founder Kosta Kantchev did not admit or deny the allegations but stated that he was “content” with the outcome. Despite the high-profile nature of the allegations and the associated public scrutiny, Nexo has continued to service other jurisdictions.

Mixed Bag from Crypto Exchanges

With high public scrutiny on crypto exchanges, negative comments become magnified as users seek to avoid potential pitfalls. Crypto.com, in particular, has been on the brunt of complaints from users regarding unresponsive customer support and extensive wait times.

However, CEO Kris Marszalek recently took accountability for the issues, apologizing for the frustrating user experience. Marszalek stated that the company had bolstered its workforce with new hires to tackle the problem, demonstrating a commitment to improving public perception of the company.

Platform outages appear to be a recurring issue among crypto exchanges, especially during high traffic. Over the years, Coinbase has developed a reputation for being among the worst offenders in this regard, with the platform experiencing difficulties in late February.

In response to the outage, X influencer borovik.sol questioned why a company of Coinbase’s size experiences platform outages, fostering discussion among his followers. However, rather than address the issue or communicate a plan to resolve the problem, Coinbase CEO Brian Armstrong responded by informing users that engineers are “working to remediate.”

On the Flipside

- Nexo shuttered its PoR before September 2023, citing the development of an alternative way to verify funds.

- A subset of crypto advocates maintains that handing tokens to any centralized entity, in general, is not worth the risk.

- Nexo is suing Bulgarian authorities for $3 billion over allegations of fraud and tax evasion that were later dropped.

Why This Matters

Amid increased public and regulatory scrutiny surrounding crypto exchanges, Nexo’s transparency-driven approach emerges as a compelling model for the industry. By providing users with real-time service insights and actively addressing operational updates, Nexo showcased its commitment to fostering a more trustworthy industry.

SEC Commissioner Peirce spills the beans on the agency’s opaque rulemaking. Read more here:

Hester Peirce Unmasks SEC’s Secret Garden of Unaccountability

Survey data reveals growing trust in the crypto industry. Read more here:

Crypto Mistrust Fading? Survey Reveals Changing Perceptions