- The U.S. crypto regulatory landscape is shrouded in uncertainty.

- Coinbase took the SEC to court in April, hoping to clear the fog.

- While the SEC has bought itself some time, Coinbase has scored a potentially significant win.

In the United States, crypto businesses have been at odds with the Securities and Exchange Commission over whether the crypto industry needs separate rules.

Coinbase, the largest crypto exchange in the U.S., took the SEC to court in April with hopes of forcing an answer on whether the agency plans to engage in rule-making for the industry.

Sponsored

While the agency has been able to stall giving a constructive response for another four months, Coinbase has scored a win by convincing the court to retain jurisdiction over the matter.

SEC to Submit Reports to the Court

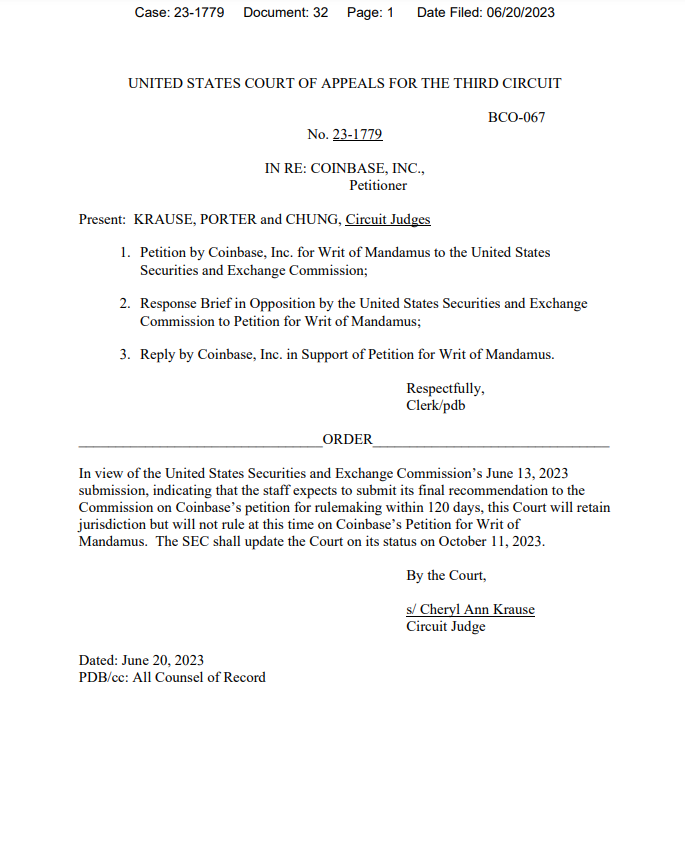

In a court order dated Tuesday, June 20, the Third Circuit of the U.S. Court of Appeals ruled that it would retain jurisdiction over “Coinbase’s Petition for Writ of Mandamus.”

The order is important as it would require the SEC to provide regular updates on its progress toward arriving at a response to Coinbase’s petition for rulemaking.

In a June 13 filing, the markets regulator pushed against the court retaining jurisdiction over the matter, arguing that its process though slower than Coinbase might like, is reasonable.

Sponsored

Responding to the recent order, Coinbase Chief Legal Officer Paul Grewal thanked the court for its decision.

"We are grateful that the Court will continue to shine a bright light on an SEC process that until now has operated entirely in darkness," Grewal noted.

Coinbase filed its initial rulemaking petition to the SEC in July 2022. The commission has committed to providing a progress report by October 11, 2023.

On the Flipside

- The SEC is suing Coinbase for allegedly operating an unregistered securities exchange.

- The SEC may choose to deny Coinbase‘s request for rulemaking.

Why This Matters

Per the court order, the SEC must show that it is working towards responding to Coinbase’s petition.

Read this to learn more about the SEC‘s previous arguments in the rulemaking case:

SEC Rebukes Coinbase ‘Meritless’ Request for Regulatory Clarity

Learn why the recent influx of institutional players in the crypto markets is raising eyebrows:

Binance’s CZ Echoes Community Concerns Over Timing of Institutional Influx