- A major wallet has aggressively accumulated LINK, fueling speculation about a potential price surge.

- Chainlink’s holder base has steadily increased, suggesting broader community interest.

- LINK has recently broken through $20, but further growth potential remains.

Whispers of a buying spree in the cryptocurrency world have focused on Chainlink (LINK) in recent days, with one particularly active whale wallet raising eyebrows. While excitement bubbles with each new LINK purchase, the question remains: is this a prelude to a price surge, or simply a whale flexing its financial muscle?

Whale Snaps Up $83M in LINK

Data from Lookonchain reveals a dedicated wallet relentlessly accumulating LINK over the past three days, amassing a hefty 4.5 million tokens worth a cool $83.6 million at current prices. This whale’s bullish enthusiasm is hard to ignore, suggesting a belief in LINK’s future potential.

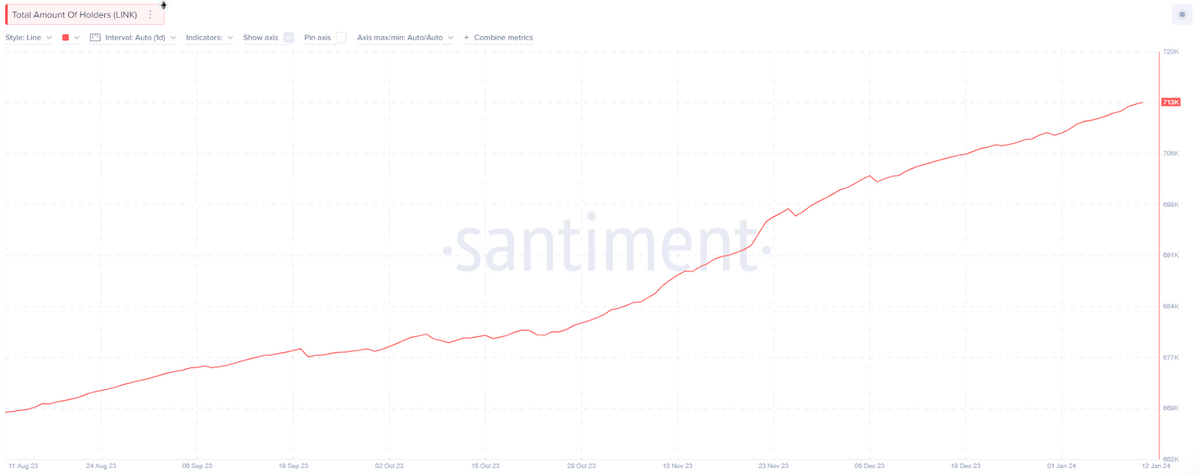

But whales aren’t the only ones showing faith in Chainlink. The number of overall LINK holders has witnessed a steady climb in recent months, according to data from Santiment. The community has grown by nearly 9,000 from January to today, reaching 717,000 dedicated individuals.

Furthermore, analysis reveals a curious trend. LINK is leaving the party at cryptocurrency exchanges. The LINK supply on these platforms has dwindled to approximately 21.5% of the total supply, suggesting holders are moving their tokens into non-exchange wallets.

This HODLing mentality often suggests anticipation of a price upswing.

LINK Soars 13%

The LINK price chart depicts a slightly similar picture. Chainlink’s daily timeframe shows it is clinging to the $18 range since early February, with fluctuations but no decisive breakout until late Saturday evening when it burst through the $19 and $20 marks, climbing 15% to a high of $20.65 before cooling down to its current value of $20.30.

It still seems like there is room to grow as the excitement surrounding the whale’s purchases and increasing holder base has only now started to translate into a clear upward trajectory.

On the Flipside

- Moving tokens off exchanges isn’t unique to LINK and can be attributed to various reasons, including securing holdings in personal wallets or staking for rewards.

- The recent price increase is promising, but past performance does not indicate future results, and a sustained uptrend is not guaranteed.

Why This Matters

A major whale’s LINK accumulation, surging holder numbers, and tokens exiting exchanges paint a bullish picture for Chainlink. While a price surge isn’t guaranteed, this confluence of factors suggests growing anticipation and potential for significant upward momentum.

Sponsored

Curious about the identity of the mysterious Chainlink buyer? Read more here:

Mystery Chainlink (LINK) Buyer Snaps Up $42 Million in Tokens

To learn more about the current state of XRP and its community, read here:

XRP Holders Demand Answers for Depressing Price Performance