- The crypto industry took a surprising turn after an underwhelming quarter.

- Cardano managed to break through its slump.

- As Cardano gains momentum, market participants are growing increasingly excited; however, a massive sell wall looms ahead.

As the new quarter unfolds, the crypto market has sprung a delightful and somewhat unexpected twist, breaking free from its grueling bearish grip. After months of lackluster performance, Bitcoin has registered new yearly highs, and altcoins, including Ethereum and Cardano, are in hot pursuit, trying to replicate the market leader’s price performance.

As prevailing market sentiment leans predominantly bullish, Cardano is charging ahead with unwavering determination, setting its sights on its highly coveted $0.3 price level. Market participants now find themselves on the edge of their seats, monitoring each candle with bated breath, speculating whether Cardano is on the cusp of shattering its enduring three-month slump.

Cardano Prepares to Overcome $0.3

Following Bitcoin’s dramatic rise, Cardano wasted no time emulating its upward trajectory, clocking an impressive 16% surge over the past week and inching close to the $0.3 price level, missing it by just $0.0022.

Sponsored

At the time of writing, ADA exchanged hands at $0.29 with a daily trading volume exceeding $300 million, providing a compelling show of the Bulls’ prevailing dominance.

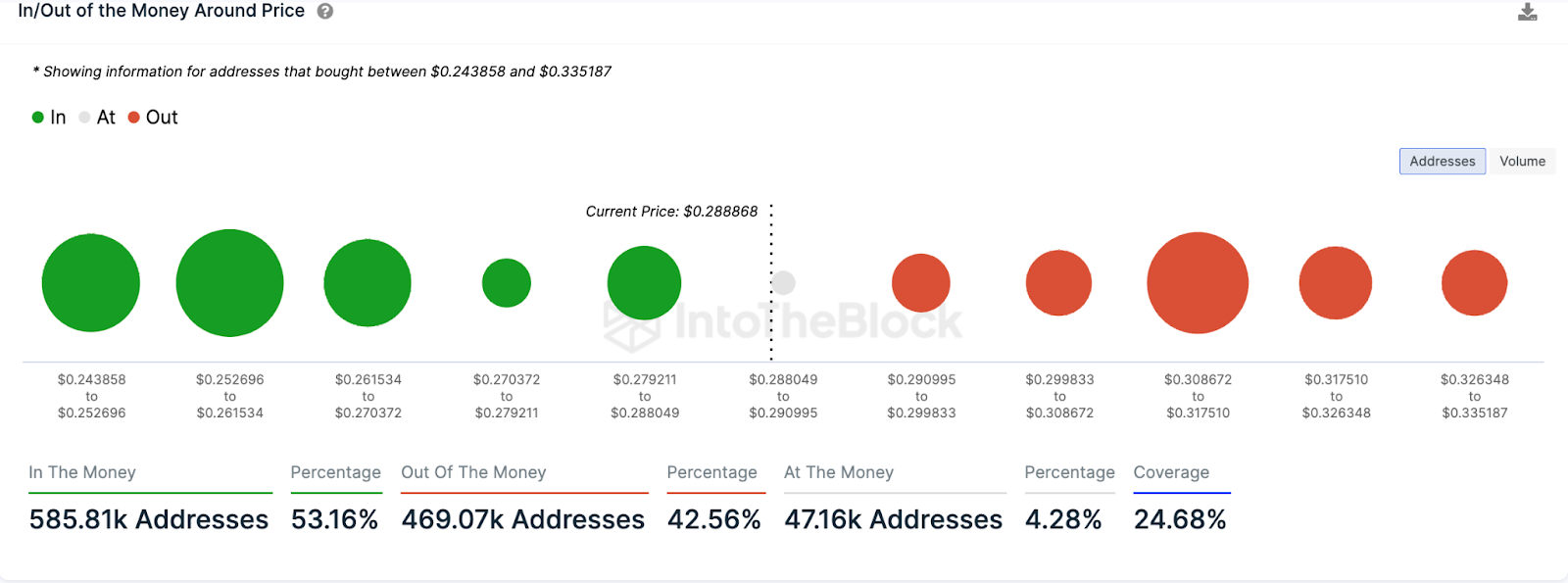

While data from IntotheBlock painted a predominantly bullish picture across DeFi, Exchange, and Derivatives markets, Cardano’s long-to-short ratio still lingered in the red, indicating that a majority of market participants were looking to sell despite the positive news.

A closer inspection of the order books across various exchanges revealed a massive sell wall holding 1.6 billion ADA, equivalent to approximately $460 million, between $0.308 and $0.310 price levels.

Sponsored

As we head into year-end, the question lingers: Can Cardano break through the $0.3 mark?

Drawing insights from on-chain and exchange data, Cardano can potentially spike above $0.3, only to face a massive sell wall hovering above $0.308. However, should ADA defy the odds and charge through $0.310, a clear path toward $0.45 opens up.

On the Flipside

- Cardano recently lost its long-held 7th spot to Solana in total market cap rankings.

- The last time Cardano was above $0.3 was in August.

- Market dynamics can be unpredictable, so it is essential to consider alternative perspectives and opinions when evaluating the potential future performance of ADA.

- IntotheBlock reports only 80% of ADA holders remain in losses.

Why This Matters

The $0.3 price level holds significant psychological importance for Cardano. After a three-month slump and unimpressive price performance, numerous users had contemplated selling their ADA. Nevertheless, its recent recovery might ease concerns and persuade market participants to hold onto their investments.

Read why Coinbase CLO expects Bitcoin ETF to be approved soon:

Coinbase Chief Legal Officer Expects Bitcoin ETF Approvals Soon

Read the last Cardano regular:

Cardano Regular: Charles Hoskinson on the Offensive; Impersonation Scams on the Rise, and Exciting Developments