- Bitcoin’s correlation with stocks sinks to new lows.

- 2023 has seen a weakening of the correlation between Bitcoin and tech stocks.

- Some observers believe the historically strong correlation will lead to Bitcoin falling soon.

Bitcoin is generally considered a risk-on asset due to its historically close correlation with US stocks. However, Bitcoin’s recent show of strength amid ongoing economic and geopolitical uncertainty suggests the two are diverging. This has stoked excitement among crypto advocates who have long argued that Bitcoin is a “lifeboat” in the sinking fiat-based economy.

According to correlation data with the Invesco QQQ ETF, which gives investors exposure to 100 Nasdaq-listed companies, including Apple, Microsoft, and Amazon, Bitcoin appears to be decoupling from tech stocks, reimagining itself as a safe haven asset in the process.

Decoupling from Tech Stocks

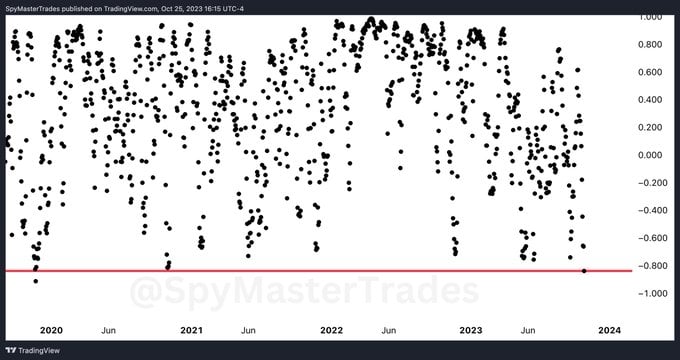

Data on the Bitcoin-Invesco QQQ ETF relationship compiled by the Twitter account “SPY Master” showed recent market movements have led to the lowest correlation between the two in four years, at -0.82.

Sponsored

The last time the Bitcoin-QQQ correlation was this low was during the tail end of 2019, when the correlation score sunk to -0.84. Correlation scores denote 1 for strong positive correlation, 0 for neutral, and -1 for strong negative correlation.

SPY Master’s chart confirms the historically strong positive correlation between Bitcoin and tech stocks, depicting most data points above 0, with dense clustering above 0.7 around May 2022, during the Terra LUNA collapse.

Sponsored

In 2023, the correlation points spread more evenly along the correlation scale than in previous years, indicating a trend of positive correlation weakening, particularly around April.

Commenting on the trend, the Twitter account Bitcoin Archive confidently announced that the decoupling is here. However, not everyone is convinced that this trend will continue.

Bitcoin Cautiousness

Although Bitcoin’s strong recent performance has reinvigorated bullishness across crypto markets, leading to talk of a decoupling in action, some have expressed doubt that Bitcoin can sustain rallying momentum.

Tony Edward, the founder of the Thinking Crypto podcast, mentioned that the Bitcoin-tech stock correlation has historical precedence and should not be discounted so easily. Edward anticipates that the stock downturn will eventually catch up to Bitcoin, leading the BTC price to move lower.

Likewise, Joe Carlasare agreed with Edward’s assessment of the situation, saying that the close correlation between Bitcoin and stocks “will bring BTC back to earth.”

On the Flipside

- There is no historical data for Bitcoin price performance in a recession, making predictive calls more arbitrary than usual.

- Regulation and energy consumption concerns weigh heavily on Bitcoin’s viability as a widely accepted asset class.

Why This Matters

Decoupling challenges the prevailing narrative that Bitcoin is a risk-on asset. As Bitcoin climbs while tech stocks plummet, the leading cryptocurrency may soon be mentioned in the same breath as gold as a trusted store of value.

Learn more about the factors driving the recent Bitcoin rally here:

Unpacking the Bitcoin Rally: What’s Driving the Surge?

Larry Fink likens Bitcoin to “human freedom,” read more here:

BlackRock CEO Calls Bitcoin Priceless, Like Freedom