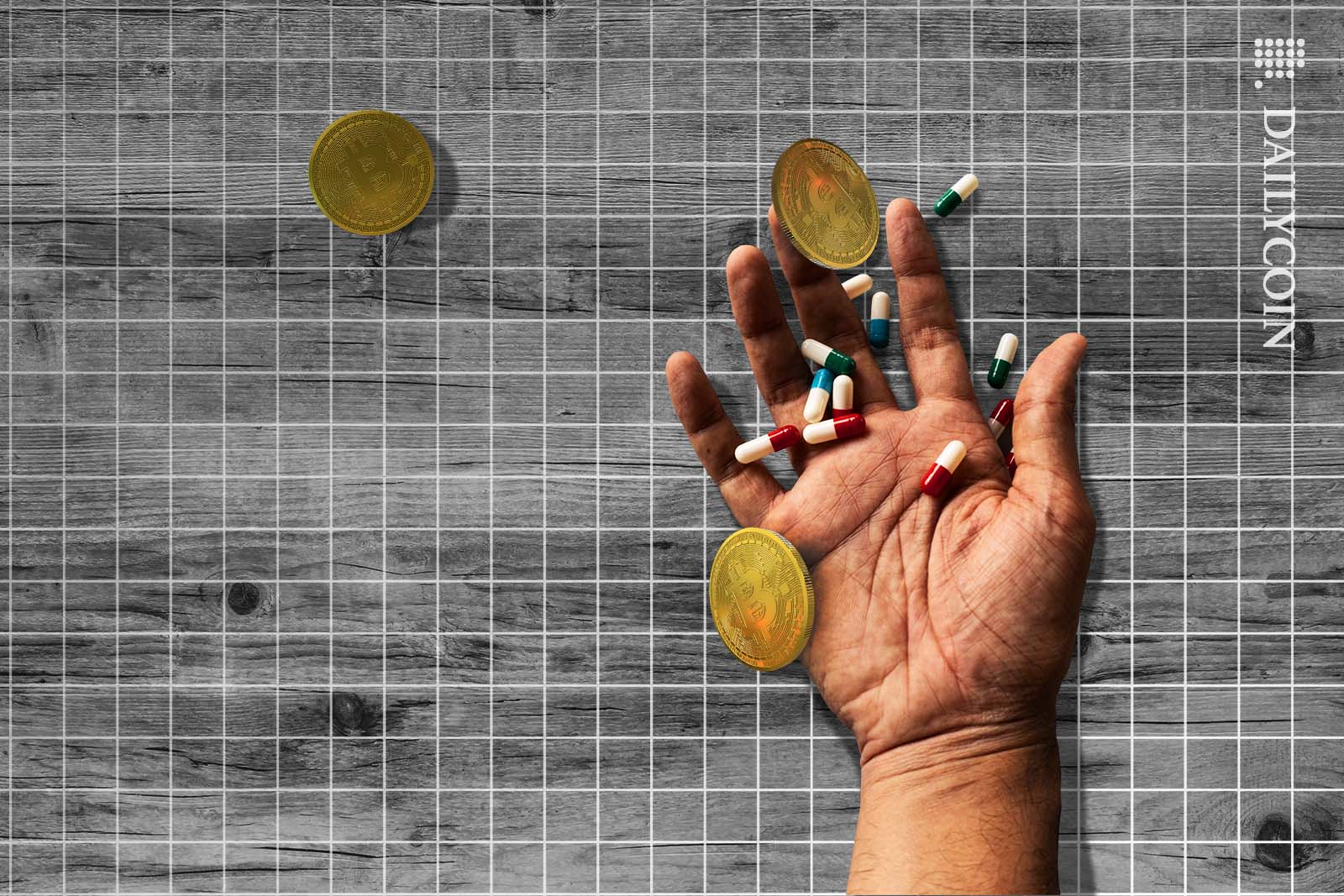

Crypto suicides have devastated the blockchain industry for as long as it has existed.

When the last bull run started in early 2020, the crypto market was the best place to be. The price of Bitcoin (BTC) rose exponentially, and like a rising tide, it took almost every project along with it. The crypto community was innovating on a day-to-day basis, and venture capitalists were spraying funds as if they had endlessly deep pockets.

NFTs and Play-2-Earn projects got simply insane valuations. Everyone wanted to have a piece of the crypto pie, and in a way, many people did. Ordinary people became millionaires. Millionaires become billionaires.

Sponsored

Elon Musk was shilling Dogecoin (DOGE) on social media, and Ethereum (ETH) broke new all-time highs week on week.

But even the euphoric highs couldn’t last forever, and the dizzying rise of crypto couldn’t be sustained. Something had to give.

Table of Contents

The Birth of the Bear

The unprecedented influx of cash into digital currencies ensured that the ecosystem had become joined at the hip with the traditional economies, like the stock market.

Sponsored

In simple terms, DeFi was seeing too much money at the same time as TradFi. Ordinarily, that would be great news. But it also meant that if TradFi got ill, DeFi also got ill.

TradFi got ill. Russia’s invasion of Ukraine spiked energy prices, leading to an economic chain reaction demanding the Federal Reserve raise interest rates. In a short space of time, investors went from being ‘Risk-on’ to ‘Risk-Averse.’ The financial world’s appetite for cryptocurrency floundered, sending the market into fearful territory.

Once these dynamics played out, it was clear that crypto was heading for a bear market. However, people didn’t know that the bear would not just wipe out money; it would also wipe out lives.

The “Too Big to Fail” Fantasy

As investors poured money into the market, they created sustainable businesses built on false promises. They also created some unsustainable behemoths considered ‘too big to fail.’

Those who regarded these businesses as too big to fail forgot one important thing. These businesses can usually rely on government subsidies and bailouts. Crypto was (and still is) actively anti-government bailout, and no government was going to bail out crypto leviathans.

One by one, crypto businesses and ecosystems collapsed. The first to bite the dust was Do Kwon’s Terra Luna network. A vulnerable algorithmic stablecoin backed the blockchain, and its fall erased around $300 billion US dollars from the blockchain industry.

At this point, many people thought that was the worst that could happen to crypto. But things were just starting to unravel. Scores of ‘reputable’ crypto firms had exposure to the Terra ecosystem. The House of Cards was about to implode under the weight of its debt, with cascading liquidations and market-wide sell-offs tanking the market in days.

The next business to fall was 3AC, one of the biggest capital players in the ecosystem. Within days, 3AC assets, worth billions of dollars, were worth mere thousands.

Several companies were also affected, with companies like Voyager, Finblox, Celsius, Genesis, and BlockFi getting hit as well.

That wasn’t the worst to happen. In November 2022, FTX’s balance sheet was leaked, showing large holdings of artificially-valued, low-liquidity assets. Sam Bankman-Fried’s crypto exchange, once considered a champion of blockchain’s future, had stolen over $8B in customer deposits.

All these shocks brought institutional powers in the ecosystem to their knees and had real consequences on people’s lives.

The Déjà Vu of the Bear

For new investors in crypto, this is the most critical time in the ecosystem. The amount of fear, uncertainty, and doubt (FUD) in the market was so palpable that many have decided to give up entirely.

But old players in the ecosystem understand that this has all happened once before. In 2011, the price of Bitcoin fell from an all-time high of $32 to $0.01. This wiped out millions of dollars in value and left thousands of people “holding the bag.”

But within two years, BTC had rallied and resumed its ascent. The same thing happened in 2015 and 2018. Veteran players in the ecosystem are no strangers to extreme bear markets; to them, this is just one of those cycles.

The Death Toll

When an economic mishap happens, people quickly ask exactly how money was lost. American news outlets like Bloomberg report almost exclusively on the economic impact of the misfortune and what it means for Wall Street, the NASDAQ, and stocks like Apple, Amazon, Meta, and Tesla.

The devastating impact on people’s livelihoods and mental health is often swept under the rug and ignored.

The Man In Taiwan

Immediately after the LUNA crash, Taiwanese law enforcement found a man dead on the streets outside his apartment after jumping from his balcony.

The man lived in a luxury apartment building and was presumably well off. In the early hours of May 24, 2022, he stepped out of his window and fell to his death.

The man was 29 years old, and according to the police investigation, he’d not left a suicide note. There was also no sign of struggle in his apartment, and no one had broken in.

After investigating further, the police found a text message where the man complained that he’d lost 99% of the value of his LUNA tokens in just two days. He’d invested about $2 million in the tokens, and only about $1,000 remained.

Telangana Man

An Indian man named Ramalingaswamy was driven to take his own life because of his crypto losses. The man booked a hotel room and consumed poison after locking the door.

After a while, the hotel workers called the police because they couldn’t access his room. The police arrived, found a way to open the door, and found him dead. The police searched the room and found a suicide note left for his wife.

His family said Ramalingaswamy had been investing in online trading via a cryptocurrency app. He initially invested a little money and had gotten good returns. Hence, he invested a lot more.

Unfortunately for Ramalingaswamy, he lost a lot of money and raised the bulk of it through loans. Facing mounting threats from loan sharks and crushing debt, Ramalingaswamy joined the ranks of crypto suicide victims.

Bitcoin Trader

Stephen Reale committed suicide after sending a distraught voice note to his friend. He told his friend to donate his organs if possible and told his ex-girlfriend that he had “lost everything.”

Before Stephen’s unfortunate death, he was a Bitcoin Trader. While not too much is known about the exact cause of his suicide, his messages suggest that he’d lost a great deal of money to crypto.

This loss plunged him into a deep depression and drove him to take his own life. In the end, his lifeless body was found by passersby in a wooded area of London.

A Family Affair

Three family members were found dead in South Korea around the same period as the Luna crash. A car belonging to the family was retrieved from the waters off the island of Wando.

Inside the vehicle were three dead bodies. The bodies were that of a 10-year-old, her 36-year-old father, and her 35-year-old mother. The family had presumably gone on a vacation, but after a while, the 10-year-old’s school alerted the police to the absence of the family.

After investigations, the police found the family’s car and retrieved the bodies from it. Further investigations revealed that the family was in dire financial trouble and had googled Luna, sleeping pills, and a way to “make an extreme choice” – common terminology for suicide in Korea.

All these made it quite likely that the family had committed suicide because they had lost all their money on the Luna network.

Murder-Suicide

Before the bull run of 2020, Bitcoin suffered a massive loss of value that made a Chinese man lose a huge chunk of his savings. This loss was devastating because most of the money belonged to his parents and his wife’s parents.

Zheng, the man in question, told his wife about his plans to commit suicide because of the losses. However, she convinced him that they had to die together if he had to die. The couple then decided that they wouldn’t just commit suicide and kill their daughter.

Zheng first killed his daughter and threw her into the sea. After that, he took his wife’s hand, and they also jumped into the sea. However, Zheng survived the jump, while his wife didn’t.

After he was rescued, he confessed his crimes to the police and was made to face the law. Ironically, by the time Zheng was in court, the price of Bitcoin had almost doubled. If he’d just waited a little longer, he might have never had the cause to take such drastic measures.

Blood on Crypto’s Hands?

All these deaths reveal that more and more people are taking their own lives due to their involvement in cryptocurrencies. It’s a difficult problem, and it’s one that even the biggest stakeholders in crypto are unwilling to acknowledge.

However, the solution to this problem isn’t to hide from the uncomfortable facts. The solution is to own up to them and understand that the ecosystem, as a whole, needs to become more transparent and safe.

But is crypto itself really to blame? Human greed takes many forms, and normal gambling likely has a far greater reach victim toll than crypto. Of course, crypto news sensationalizing market movements certainly doesn’t help.

Better access to financial education and risk management strategies would help people make more informed decisions. This would hopefully mean that their mental health would be less affected by swings in market sentiment.

On the Flipside

- One might argue that even TradFi has the same problem with suicides during periods of economic downturn.

- Irresponsible investing habits cause many crypto-related suicides due to faults in human nature, not crypto.

Why This Matters

If you’re feeling overwhelmed by crypto market conditions and think your mental health is suffering, please contact a local suicide prevention hotline or service. Don’t become another statistic.

FAQs

There are thousands of dead cryptocurrencies living on the blockchain. Most are abandoned or rugged projects with no future.

No, there is plenty to look forward to in crypto’s future, with many innovative new projects hitting the market every day.

Unfortunately, there are plenty of documented cases of crypto-related suicides.