- The SEC has finally approved Bitcoin ETFs.

- The ETFs will commence trading on NASDAQ, NYSE, and Cboe on January 11.

- Traditional exchanges are racing to embrace the surging demand for ETFs.

Bitcoin ETFs have triumphantly secured approval following months of intense regulatory scrutiny and delays at the hands of the SEC. Market participants are buzzing with excitement, and traditional exchanges in the country, including NASDAQ, NYSE, and Cboe, are racing to open their gates to the newly approved asset class without further delay.

NASDAQ, NYSE, Cboe Ready to List Bitcoin ETFs

On Wednesday, January 10, the SEC officially approved eleven Bitcoin Spot ETF proposals, ushering in a wave of optimism and joy in the market after months of delays. The issuers approved include Ark 21Shares, Blackrock, Fidelity, VanEck, and more.

Traditional exchanges and issuers in the country are now flurrying as they swiftly file all the important documents, aiming to begin trading as soon as possible, opening their gates to millions of investors in the country.

Sponsored

Starting Thursday, January 11, the ETFs are poised to begin trading on leading exchanges in the country, including NASDAQ, NYSE, and Cboe.

Here’s a quick rundown of where each ETF will be listed based on their respective S-1 documentation:

- BlackRock and Valkyrie have confirmed NASDAQ as the platform for launching their respective ETFs.

- Bitwise, Grayscale, and Hashdex are slated to list their ETFs on the NYSE.

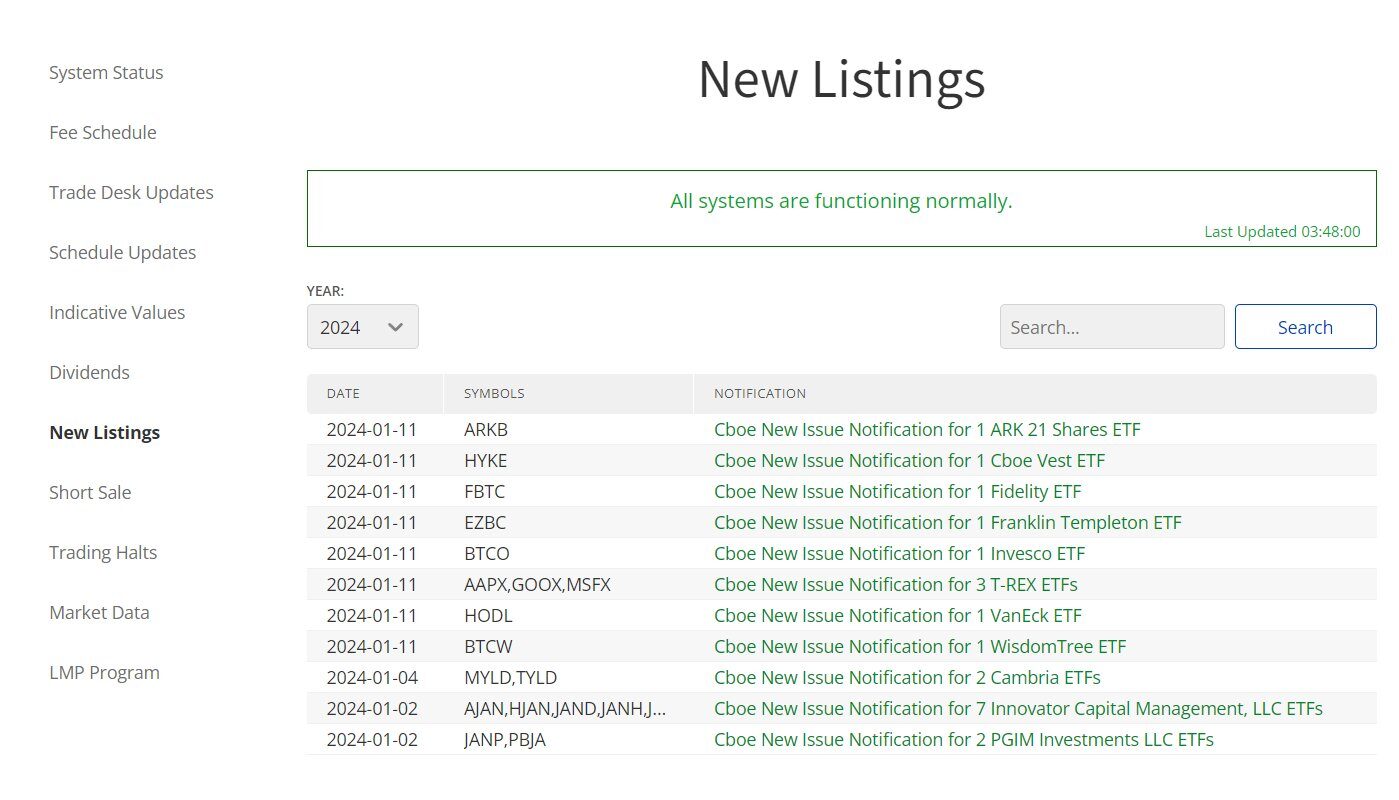

- Ark 21 Shares, WisdomTree, Invesco, Fidelity, VanEck, and Franklin plan to list their ETFs on Cboe BZX.

While BlackRock has already confirmed that trading for its iShares Bitcoin ETF will commence tomorrow, other issuers are yet to provide official confirmation. At the time of writing, 21 Shares and VanEck still displayed a ‘TBD’ notice on their websites, possibly linked to Cboe’s earlier misstep in jumping the gun.

CBOE Struggles to Contain Excitement for Bitcoin ETFs

While traditional exchanges in the US meticulously prepared to meet the surging demand, Cboe got a little too excited about the ETFs, prematurely announcing to have listed six spot Bitcoin ETFs on its exchange on Thursday, even before the SEC officially approved the issuers’ 19b-4 and S1 filings.

However, it wasn’t long before Cboe retracted all of its certifications and announcements, citing that it was still awaiting approval from the SEC. A brief period of FUD among market participants followed, leading to a Bitcoin drop from $47,000 to $45,000 before the commission formalized matters.

Now that the SEC has officially given the green light to the ETFs, the uncertainty has cleared up, and market participants are set to trade the newly approved Bitcoin ETFs on Cboe tomorrow when the markets open.

On the Flipside

- On Tuesday, January 9, the official SEC X account was recently compromised, leading to an unauthorized announcement declaring the official approval of the ETFs.

- Despite the Bitcoin ETF approval, a significant segment of the financial world remains skeptical about Bitcoin and cryptocurrencies.

Why This Matters

The approval of Bitcoin ETFs marks a significant and highly anticipated milestone in the financial industry. Market participants worldwide have been eagerly awaiting this development. With the official green light, exchanges in the country are poised for a transformative shift with the introduction of this new asset class.

Read more about the SEC’s warning against FOMO:

SEC Warns Against Crypto FOMO Amid Surging Bitcoin ETF Hype

What’s next for Bitcoin?

What’s Next for Bitcoin Now that ETFs Have Been Approved?