- The amount of Bitcoin held on exchanges has fallen significantly.

- This trend has coincided with a period of inflows for U.S. spot BTC ETFs.

- Exchanges still hold a sizeable percentage of the circulating supply.

Bitcoin has been hovering around the $69,000 mark for the past two weeks, trading within a range of $66,400 to $72,000 to induce mixed market sentiment. Bulls point to the relative stability near Bitcoin’s all-time high price as a positive sign, while bearish investors grow impatient over the lack of an upward trajectory.

Sponsored

Meanwhile, during this ranging period, the Bitcoin exchange balance has tanked to record lows, according to on-chain data. The continuous outflow of coins from centralized exchanges (CEXs) suggests a looming supply shock could be on the cards.

Bitcoin Exchange Balance at Record Lows

The Bitcoin balance held on exchanges has tanked recently, with Bitgrow Lab founder Vivek Sen stating that the metric “just hit [an] all-time low” and that a supply shock is brewing behind the scenes.

A positive supply shock refers to an increase in Bitcoin’s availability while demand stays the same or increases, leading to a price decrease. Conversely, a negative supply shock is the opposite situation, resulting in upward price pressure.

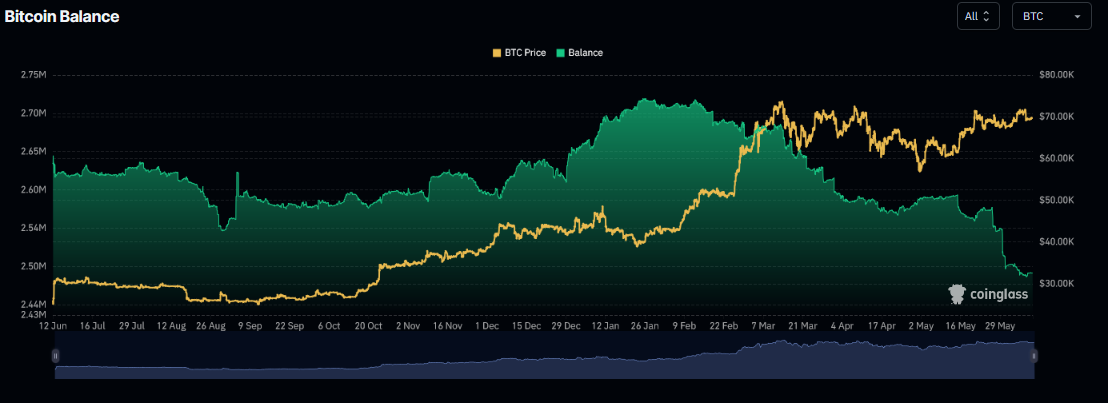

The amount of Bitcoin on exchanges has been trending lower since mid-February when the balance stood at 2.72 million coins. The downtrend plateaued by mid-April, but a sharp decline took hold by May 25, with the balance held on exchanges falling from 2.57 million to 2.49 million by June 7, according to data from CoinGlass.

Over the last 30 days, 99,164 BTC, valued at around $6.9 billion, left exchanges. Kraken, Coinbase, and Gemini were the biggest losers, with outflows of 55,176, 24,494, and 8,055 BTC, respectively.

Sponsored

Although exchange outflows are normally associated with investors moving their coins into storage over expectations of higher prices in the future, there are several other possible factors in play, including a growing awareness of self-custody, and the spot Bitcoin ETF effect.

The Spot ETF Effect

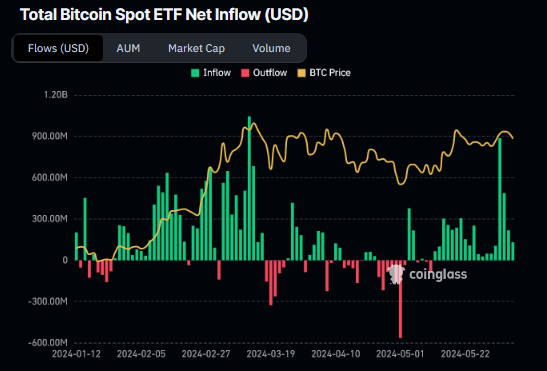

The downtrend in Bitcoin’s exchange balance has coincided with a sustained inflow period for spot Bitcoin ETFs. Since May 13, the U.S. spot Bitcoin ETFs have experienced continuous daily inflows, culminating in the second biggest single-day inflow when $886.4 million poured in on June 4, per CoinGlass data.

Jan3 CEO Samson Mow believes the combination of the recent halving, in which the issuance of BTC was cut to 450 coins, and the growing demand for Bitcoin from spot ETFs will build a supply shock that could trigger an “Omega candle.”

Mow stated, “Even before the halving, daily demand was 5-10 times that of supply, so Omega Candles seem inevitable.”

An Omega candle refers to a hypothetical scenario where Bitcoin’s price surges by $100,000 within 24 hours.

On the Flipside

- A low BTC balance on exchanges means a less liquid market.

- The BTC price is more susceptible to price volatility under less liquid conditions.

Why This Matters

Despite the downtrend in BTC held on exchanges, CEXs still hold just under 2.5 million BTC, or around 13% of the circulating supply.

The popularity of spot Bitcoin ETFs linked to Coinbase exodus:

Coinbase Suffers $500M Bitcoin Exodus as ETFs Gain Traction

Nexo compromises over recent fee hike on fiat transactions:

Nexo Offers Free Fiat Withdrawals to Appease Fee Outrage