- The price of Bitcoin has stalled after reaching record highs, with analysts blaming the Federal Reserve.

- The stablecoin market cap has continued to climb, which suggests strong buying power.

- Bitcoin’s MVRV Z-score has suggested a potential upswing, indicating that the market is not yet overheated.

The recent meteoric rise of Bitcoin (BTC) has hit a snag, with the leading cryptocurrency struggling to maintain gains above $70,000. This comes after reaching a record high of over $73,500 in mid-March. Analysts attribute this slowdown to diminishing expectations of a June Federal Reserve interest rate cut.

Stablecoin Stockpiles Grow

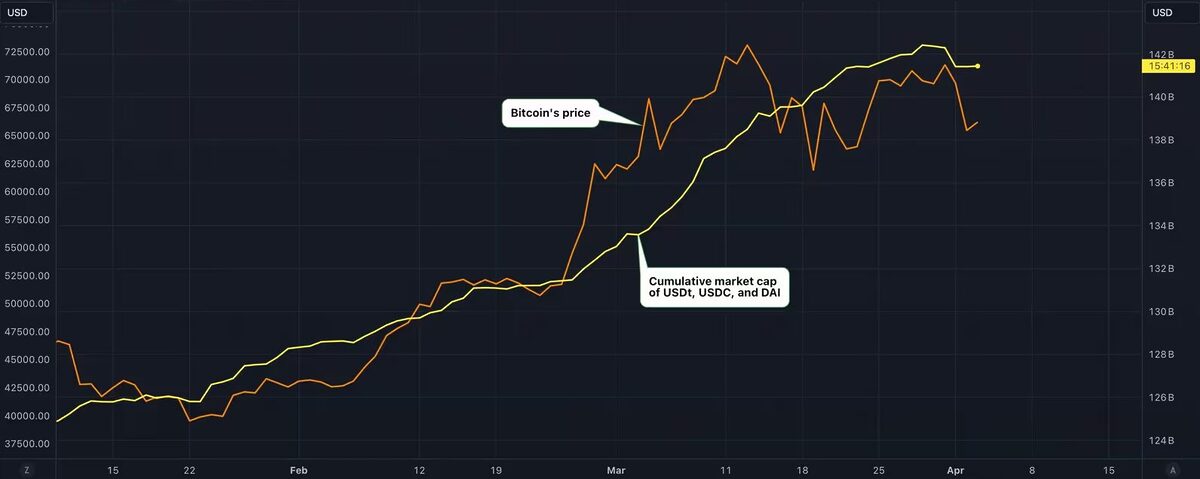

However, a different story is unfolding in the realm of stablecoins: cryptocurrencies pegged to the value of the US dollar. Seen as a potential “war chest” for future token purchases, the total supply of the three dominant stablecoins, Tether (USDT), USD Coin (USDC), and DAI (DAI), has shown continued growth.

According to data from TradingView, their combined market capitalization has surged 2.1% to $141.42 billion, the highest since May 2022. This year alone, the cumulative supply has ballooned by over $20 billion.

Firms like Reflexivity Research interpret this significant rise in stablecoin supply as a positive sign for the overall crypto market. “As this [stablecoin supply] continues to trend upwards, it indicates capital is still flowing into crypto,” the firm stated in a recent newsletter.

Sponsored

In simpler terms, the easy availability of stablecoins suggests strong potential buying power for Bitcoin when the market dips, potentially leading to a resumption of the broader upward trend. Stablecoins have become the preferred method for purchasing cryptocurrencies in the spot market and trading derivatives since late 2021.

Sponsored

They offer a crucial advantage: stable value. Stablecoins provide a linear payoff, unlike traditional, volatile cryptocurrencies used as a margin for futures contracts. The value of the collateral remains steady regardless of market fluctuations, eliminating the need for constant hedging strategies.

Has Bitcoin Reached Its Peak?

Beyond stablecoins, other indicators suggest a potential upswing for Bitcoin. The Z-score of the coin’s market value-to-realized value (MVRV) ratio points towards a bullish outlook. The MVRV Z-score measures the deviation of market value from a perceived “fair value,” estimated by the total cost basis of all Bitcoins in circulation.

Historically, a score below zero has indicated market bottoms, while readings exceeding seven have signaled market tops. Currently, the Z-score sits at a comfortable 2.87, according to Glassnode data, suggesting Bitcoin is neither oversold nor nearing a major market peak.

On the Flipside

- While the rise in stablecoin supply suggests potential buying power, it doesn’t guarantee it will be directed toward Bitcoin.

- The MVRV Z-score is a historical indicator; however, past performance doesn’t guarantee future results.

Why This Matters

While Bitcoin’s price struggles, the surging stablecoin supply indicates crypto investors are accumulating capital, potentially foreshadowing renewed buying power and continuing the overall crypto market’s upward trend. This suggests investors view the current Bitcoin slowdown as a buying opportunity, anticipating future price increases.

To learn more about Tether’s commitment to security and how it passed a recent audit, read here:

Tether Reaffirms Security Compliance with SOC 2 Type 1 Audit

Curious about Tether’s recent Bitcoin purchase and how it’s become a major Bitcoin holder? Read more here:

Tether Buys 8,888 Bitcoin, Pushing Its Reserves to 75,000 BTC