With 1.7 million bitcoins left to be created, the mining race is on. Some fall, while others rise, gaining ever greater power.

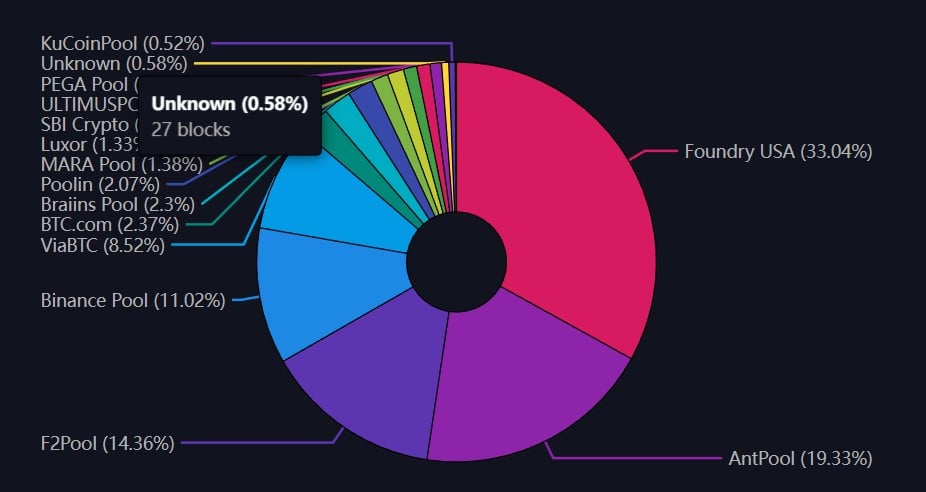

Today, five mining pools control over 85% of the total bitcoin mining power. Who are they? Why did this happen? And what are the risks of the concentration of bitcoin mining power?

Two Mining Pools Control Half of Bitcoin’s Hash Rate

The landscape of the bitcoin mining industry is different from where it was just two years ago. Having undergone major geopolitical changes and mining pool liquidity crises, the bitcoin mining sector has changed.

It is no longer about independent miners. Now it is centralized mining pools, which play the most significant role in the bitcoin mining industry.

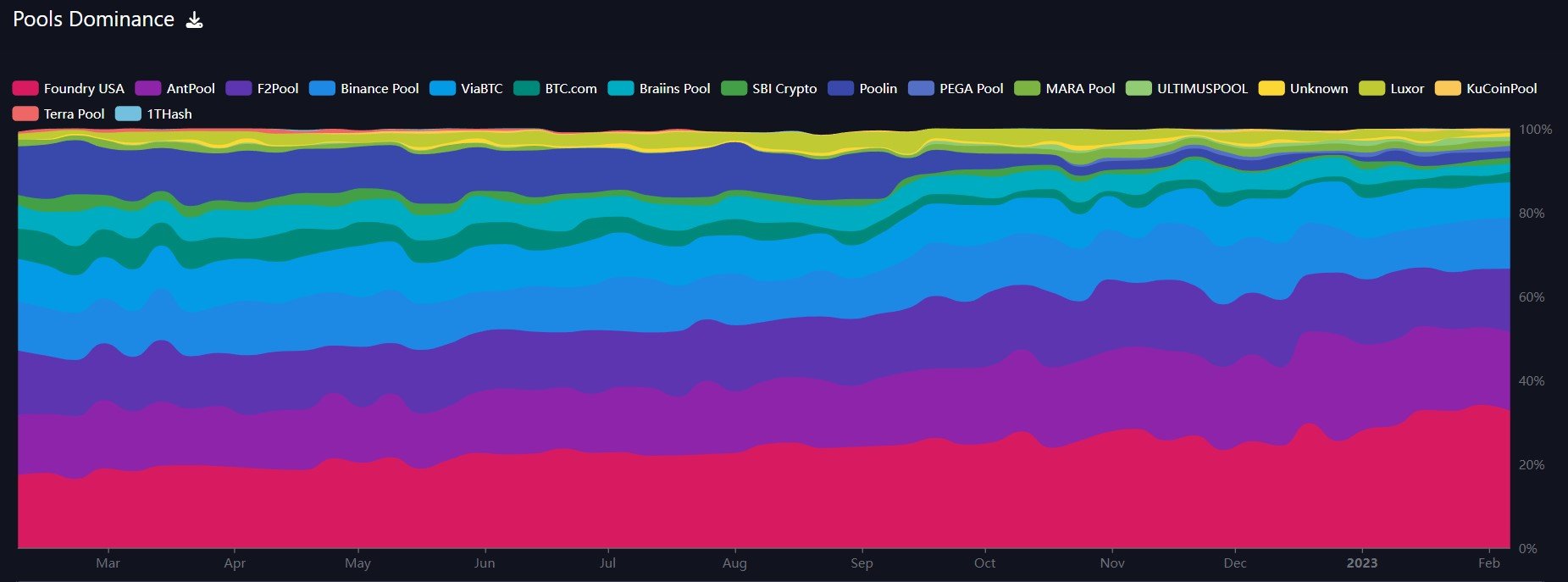

In the first month of 2023, five bitcoin mining pools produced over 86% of the global bitcoin hash rate, a measure of computing power on the Bitcoin network. This is nearly 20% more than a year ago, when five leaders contributed to 67% of the total BTC mining power.

Source: Mempool.space

Two leading pools, Foundry USA and AntPool, controlled 52.3% of Bitcoin’s hash rate over January 2023. Both created 2,432 bitcoin blocks over the first month, 1534 and 898, respectively.

Institutional grade mining pool Foundry USA, a Digital Currency Group (DCG) subsidiary and the world’s largest BTC mining pool, contributed 33.04% of the total BTC hash rate. This is 87% more than the New York-based company’s contribution a year ago.

Foundry has created 12,733 bitcoin blocks over the past year or an average of 34.8 blocks per day. Since miners are rewarded 6.25 BTC per block until the next bitcoin halving, Foundry USA pool miners, on average, shared 217.5 bitcoins worth nearly $5 million at a current price of $22.8K each day.

The second largest mining pool AntPool contributed to a 19.3% network share over the past month. The mining division of Chinese crypto mining manufacturer Bitmain increased its BTC mining power share by 23.3% compared to the same time a year ago.

AntPool mined 8963 bitcoin blocks within the past 12 months. On average, it’s 24.5 blocks or 153 bitcoins or $3.5 million in earnings daily.

Source: Mempool.space

Foundry USA and AntPool grew at the expense of their smaller competitors, whose mining capacity has gradually decreased or changed slightly over the year.

What Led to Mining Pool Market Centralization?

Market conditions have been difficult for bitcoin miners during the massive cryptocurrency market downturn of 2022. First of all, the value of bitcoin dropped by more than 70% from its all-time high price of $68K.

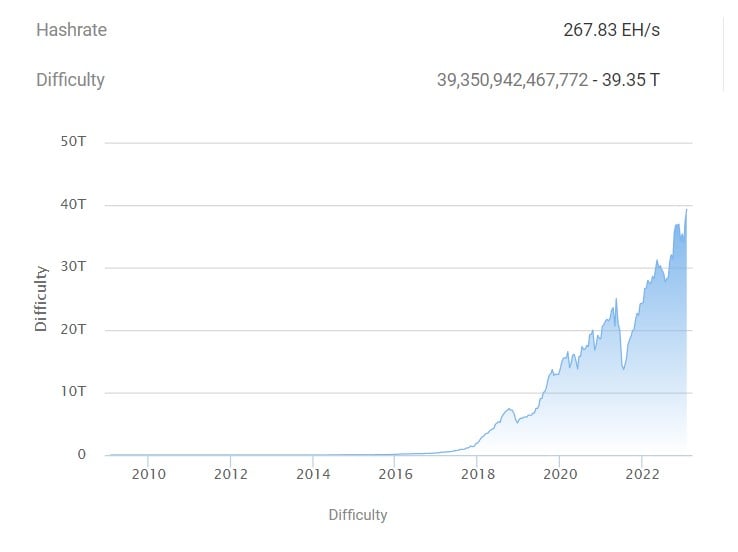

The bitcoin hash rate then kept steadily growing and reached an all-time high of 39.3T on January 29, 2023. The increasing hash rate means more difficult bitcoin mining in which miners must work harder to remain profitable unless the price changes significantly.

Source: Btc.com

Finally, the factor of energy consumption and electricity prices must be considered. Fueled by Russia’s war in Ukraine, energy prices skyrocketed automatically, leading to higher expenses and lower profits for bitcoin miners.

With the cost of production increasing while the bitcoin price decreased, bitcoin miners, including the three largest US-based mining firms, Core Scientific, Marathon Digital Holdings, and Riot Blockchain, faced huge losses and were reported to sell more bitcoin than they mined.

Numerous miners spent 135% of their newly mined coins daily in mid-November 2022, Glassnode reported.

To punctuate this point, #Bitcoin miners are currently spending at a rate of 135% of the daily issued coins.

— glassnode (@glassnode) November 18, 2022

This implies that in aggregate, miners are distributing all ~900 freshly minted $BTC, as well as an additional 315 $BTC from their treasuries each day. pic.twitter.com/RV4QqXDWmF

Poolin, the fifth biggest bitcoin ming pool at the start of 2022, acknowledged liquidity issues and froze withdrawals back in September 2022. Its computational power declined by 86% through the year, from 11.57% in January 2022 to 1.57% in January 2023.

Smaller mining pools, like Btc.com or Braiins Pool, gradually decreased operations. Meanwhile, mining giant Foundry significantly strengthened its positions, which it gained after China’s crypto ban in 2021 when local BTC miners massively transferred their devices and operations into the United States.

US Leads Bitcoin Hash Rate Market

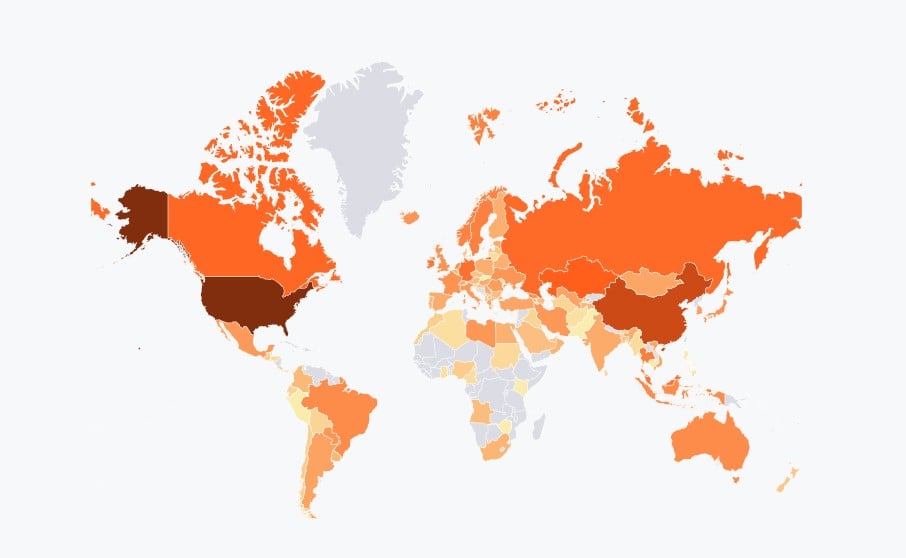

For years China acted as the home base for most BTC mining operations. But since the country’s mining crackdown, the United States quickly established itself as the world’s biggest bitcoin mining hub.

According to the Cambridge Center for Alternative Finance data, US miners contributed 37.84% to the average monthly BTC hash rate at the beginning of 2022. China’s nearest competitor accounted for a lower hash rate share of 21.11%.

Source: Ccaf.io

The United States currently hosts the biggest mining pool. It also hosts major institutional-grade mining companies like Marathon Digital Holdings (which, on average, mined 15.3 bitcoins per day in December 2022), Riot Blockchain, and Hut 8 Mining.

Possible Risks of Bitcoin Mining Power Concentration

As bitcoin was invented as an alternative to centralized money, any centralization is often considered a risk to the network’s core principles and security. One hotly debated issue is Bitcoin’s vulnerability to a “51% attack.”

According to centralization critics, anyone controlling the majority (more than 50%) of the BTC hash rate can manipulate the network. They can censor the confirmation of new transactions, halt them, and even alter the blockchain.

51% of attacks are usually expensive and difficult to maintain, but they may cause huge reputational damage to Bitcoin. Since its early days more than a decade ago, Bitcoin has never suffered a security breach or attack of the majority.

On the other hand, the Bitcoin community questions the potential threat of power concentration among a few mining pools that are nothing more than clusters of separate miners. Miners combine their computational power to increase the chances of winning a block and then share the reward.

However, the growing competition among mining pools leads to them decreasing their fees, eventually reaching similar levels. Theoretically, this leaves mining pools open to miner migration from one pool to another.

According to crypto miners, switching between pools helps to “ensure adequate decentralization and hedge against pool-derived 51% attack.”

Closing Thoughts

When Bitcoin and its white paper first appeared in 2008, it was built on the concept of a decentralized network and accessibility to anyone.

More than a decade later, statistics show it may have become centralized. This means it is dominated by large players, not only large mining pools but also by large bitcoin holders amd crypto exchanges.

Theoretically, the concentration of power could make Bitcoin susceptible to risks such as a 51% attack. It can also imply that most gains from further adoption could fall disproportionately to fewer participants.

Find out more about how long it takes to mine one bitcoin:

How Long Does It Take to Mine 1 Bitcoin?

Check out if green bitcoin mining is possible:

Is Green Bitcoin (BTC) Mining Possible?