- Bitcoin Lightning Network has struggled to take off in Africa.

- Stablecoins are more appealing to Africans.

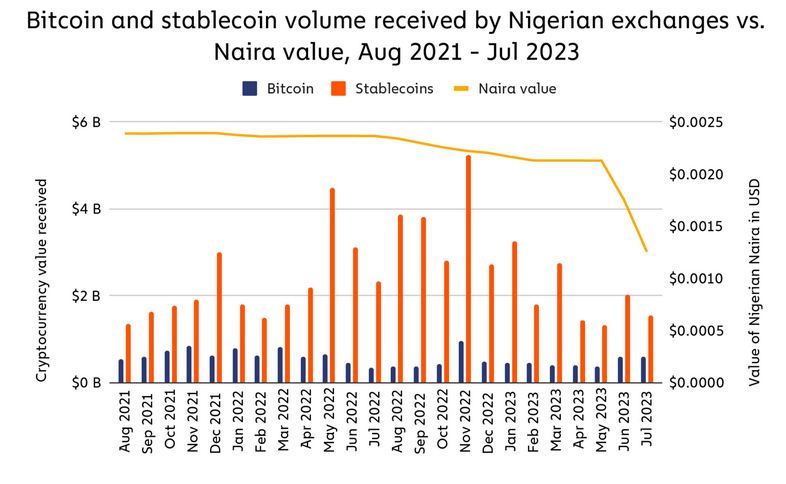

- Bitcoin lags behind stablecoin activity in Nigeria.

The Bitcoin Lightning Network was envisioned as a secondary layer solution that could enable faster and cheaper Bitcoin transactions for everyday payments. Yet former NFL player Russell Okung recently expressed his dismay at the lack of interest from Africans, who prefer using dollar stablecoins.

Africans Don’t Favor Bitcoin Lightning Network

Sharing his experience advocating for Bitcoin Lightning in Africa, Okung stated that he “faced a cold, hard realization” that Africans are more interested in dollar stablecoins, such as USDT.

Okung added that he assumed that “fostering understanding and dialogue” around BTC Lightning would overcome resistance. However, Okung stated that his firsthand experience was the opposite of what he expected, with Africans displaying a “real apathy” toward the leading cryptocurrency.

Sponsored

Curt Taylor echoed Okung’s experience, tweeting that demand for US dollar exposure outweighed Bitcoin’s appeal in Africa, Lebanon, and Argentina, based on his anecdotal experience. Taylor posited that “folks on the breadline” cannot risk price volatility, which is not an issue with dollar stablecoins.

In a recent article published by the Conversation, author John Hawkins, an economics lecturer at the University of Canberra, stated that BTC volatility makes it impractical as a payment method for physical goods or services, which is why prices are rarely expressed in crypto.

Chainalysis data highlighting stablecoin popularity in Nigeria, Africa’s largest crypto market, supports Okung and Taylor’s anecdotal experiences.

Stablecoin Rule Exchange Inflows

The popularity of stablecoins over Bitcoin in Africa is evident by Chainalysis data that showed stablecoins had consistently more inflows into Nigerian exchanges since first charting the data in August 2021.

Sponsored

Notably, BTC and stablecoin exchange inflows fell as the naira tanked against the US dollar in May 2023, going against expectations that cryptocurrency exchange activity would increase during a currency crisis. However, whether this pattern holds in the present is unknown as the data goes to July 2023 only.

On the Flipside

- Lightning Network fees are negligible at around $0.04.

- Users must acquire BTC and become subject to its higher fees before being able to on-ramp into the Lightning Network.

- The popularity of cryptocurrency in Africa reflects the continent‘s underdeveloped banking sector.

Why This Matters

Cryptocurrencies like Bitcoin are predominantly embraced for speculative and investment purposes in economically advanced regions. Users in developing regions, like Africa, rely on digital assets to serve critical banking functions due to an unreliable banking sector. This highlights a stark dichotomy in crypto use cases globally.

Read about the Bitcoin Lightning Network’s security vulnerabilities here:

Bitcoin’s Lightning Network Faces Serious Security Threats

Find out more about the $21 Bitcoin halving challenge here:

Bitcoin Halving: Buy $21 BTC Challenge Gathers Steam