- Bitcoin’s Fear and Greed Index flashed “Greed” for the first time in ten months.

- The indicator might show that traders are becoming more bullish on BTC.

- The last time Bitcoin was in “Greed” territory was when it neared its all-time high.

Bitcoin has had a great start in 2023 after hitting $23,000 in January. A recent signal on market sentiment might mean that BTC could rally in the near future.

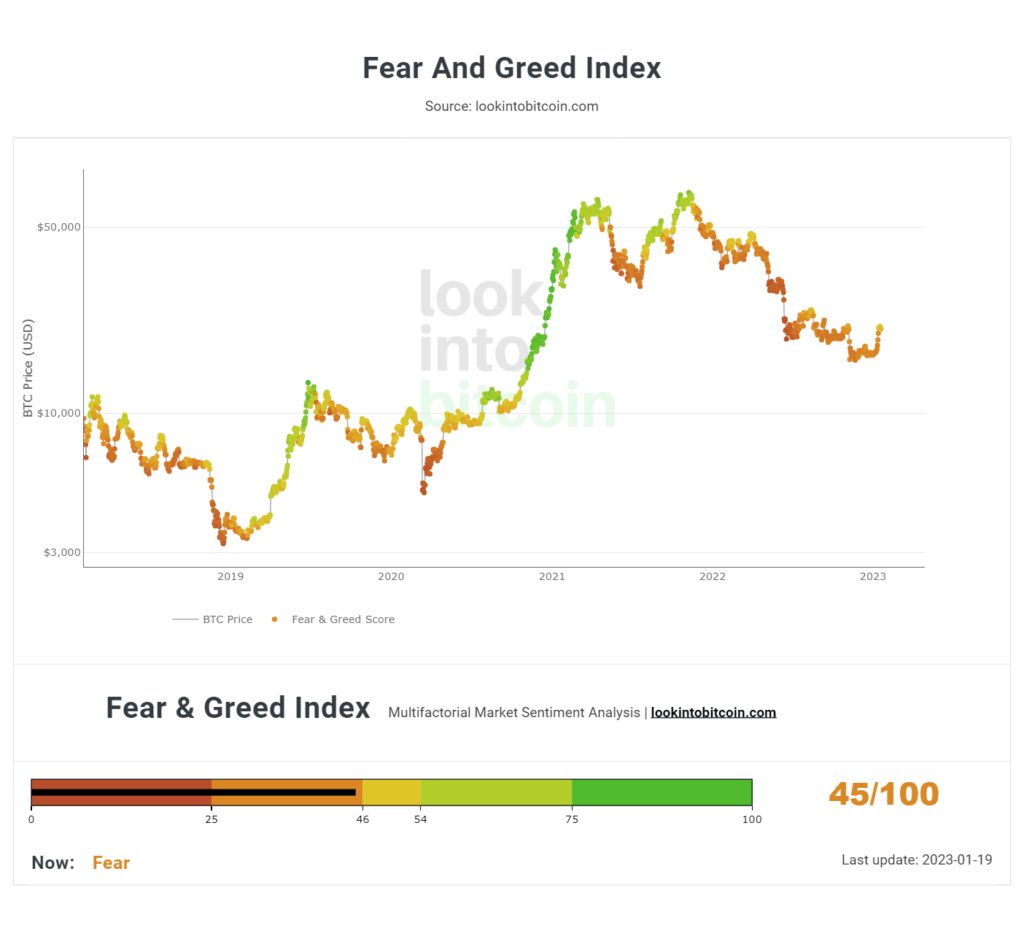

On Friday, Bitcoin’s Fear and Greed Index flashed “Greed” for the first time in ten months. This may be a sign that investors are becoming more bullish on Bitcoin and willing to take bigger risks in the near future.

The indicator, which goes from 0 to 100, is based on numerous variables, including volatility, momentum, and social media sentiment. Values near 0 represent Extreme Fear, while those near 100 represent Extreme Fear. Currently, the index is at 55, putting Bitcoin in the “Greed” zone.

Sponsored

March 2022 was the last time Bitcoin’s sentiment was in the “Greed” zone, trading at $45,500. Since then, there has been a huge reversal, with BTC falling as low as $15,000.

However, Bitcoin has seen a rally in 2023, jumping to $23,000 in January. This may suggest that investors are becoming more hopeful about the future of Bitcoin and are willing to take greater risks.

On the Flipside

- While many investors go with the crowd, savvy investors do the opposite. Some investors use the Fear and Greed Index to time the market.

- For example, if the index enters the “Extreme Greed Zone,” that may be a sign that the asset is overvalued. On the other hand, they buy when sentiment is poor.

- Warren Buffett famously said investors should be “fearful when others are greedy, and greedy when others are fearful.”

Why You Should Care

Market sentiment has a significant influence on the price of an asset. Bitcoin could rally and regain some of its losses if positive sentiment continues.