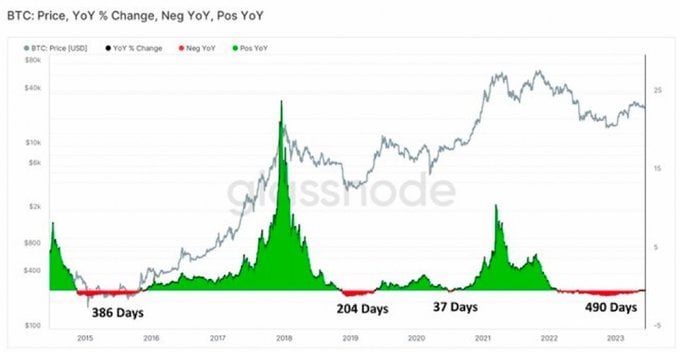

- The current bear market has lasted 490 days and counting.

- Investor sentiment remains risk-averse due to macroeconomic uncertainty.

- Bitcoin fundamentals continue to mature.

Since November 2021’s peak, the total crypto market cap has seen a peak-to-trough fall of 74%, wiping out trillions in valuations consequently resulting in pain and anguish for investors worldwide. Although prices have somewhat recovered from the lows of the post-FTX crash, the ongoing bear market has become the longest in Bitcoin history. As Michaël van de Poppe highlighted, the intense period is testing the faith of even the most die-hard crypto enthusiasts.

The Longest Bitcoin Bear Market in History

Macroeconomic uncertainty continues to cast a bear-shaped shadow over the crypto markets. Despite intermittent periods of rallying prices during the downtrend, investor sentiment remains overwhelmingly risk-averse as the Fed’s rate hike policy shows no signs of pivoting soon, and stubborn inflation works to dampen investor appetite.

Commenting on this situation, CEO and founder of MN Trading, Michaël van de Poppe, underlined that Bitcoin’s price is down significantly from November 2021’s $69,000 all-time high and has been embroiled in a bear market spanning 490 days ever since, marking the most prolonged bear period in its history.

Sponsored

Informing van de Poppe’s commentary is Glassnode data on Bitcoin’s year-on-year (YoY) percentage price change. The chart illustrates YoY growth since late 2014, highlighting the previous negative bear periods. As shown, the bear market of 2015 lasted for 386 days, 2019’s traders had to endure for 204 days, and the slump seen in mid-2020 was broken after just 37 days.

As far as persistent negative price growth is concerned, indicators suggest that the current period is a time for consolidation and reassessment of the risks and rewards of cryptocurrency investing.

Crypto’s Cyclical Nature

In a bid to soothe investor hurt, van de Poppe touched on the pain of depressed prices and the feelings that accompany them, acknowledging that it is in such times that one’s faith in crypto is truly tested.

Sponsored

“It might feel like a ghost town in crypto. It might feel like there’s not even going to be a bull cycle anymore, and I understand why these thoughts are there.” Said van de Poppe.

Van de Poppe highlighted that markets are cyclical, and a period of renewed expansion has historically followed the bad times. Moreover, during the current bear period, Bitcoin’s fundamentals have leveled up, with van de Poppe citing the flurry of recent spot ETF applications, institutional investment in mining companies, and the Hong Kong government’s pro-crypto stance as supportive indicators.

On the Flipside

- BlackRock is a major shareholder in four out of the five biggest Bitcoin mining companies.

- Hong Kong regulators recently granted the first retail crypto exchange licenses in the region to HashKey and OSL.

Why This Matters

There is no guarantee that the bull market will return, but governments and institutions are demonstrating confidence in the long-term potential of digital assets.

Learn more about the past bear cycles here:

When Will This Bear Market End?

Discover Dropbox’s response to abuses of its unlimited storage service here:

Unlimited Storage No More: Dropbox’s Response to Crypto Cloud Mining