- 2023 sees $2.25 billion in digital asset inflows.

- Inflows increased 2.7x from 2022.

- Bitcoin garners $1.9 billion, 87% of total inflows.

While markets anticipate the Securities and Exchange (SEC) decision on Spot Bitcoin exchange-traded funds (ETFs), similar products have been gaining ground. ETFs in the US and spot funds in other countries have seen significant growth in 2023.

Sponsored

The industry saw a record influx of investments, totaling $2.25 billion for the year. This surge in inflows was led predominantly by Bitcoin.

Bitcoin ETFs Lead Among $2.25 Billion Inflows

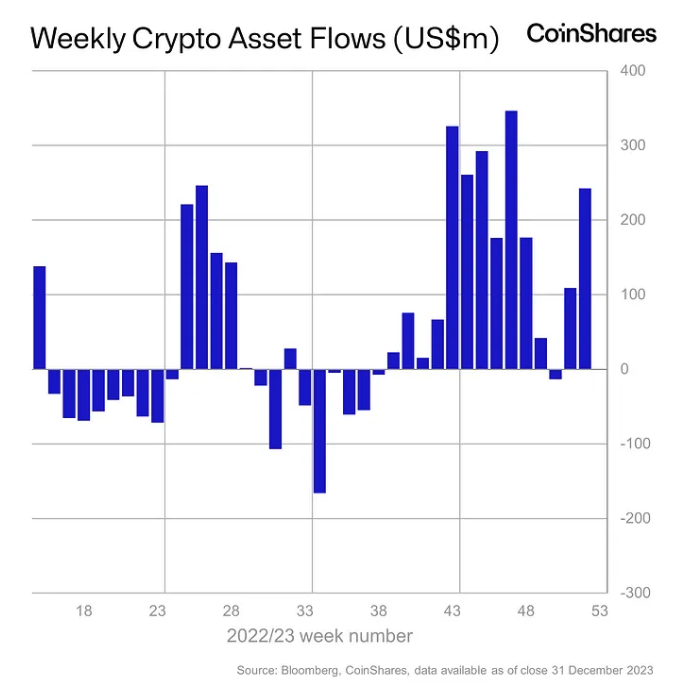

According to a report by CoinShares published on Wednesday, January 3, last year saw a remarkable surge in investment in crypto exchange-traded funds (ETFs). Crypto-related ETFs saw a record influx of investments, totaling $2.25 billion for the year. Notably, inflows were 2.7x that seen in 2022.

Bitcoin, in particular, emerged as the primary benefactor with inflows of $1.9 billion. This represents 87% of the total inflows, showcasing its dominant position in the market. Bitcoin’s current inflow percentage is the highest in its history, surpassing its peak of 80% in 2020.

Ethereum, Solana Trail Bitcoin ETFs

While Bitcoin led the charge, other digital assets like Ethereum and Solana also saw notable inflows, signaling a diversifying interest among investors. For one, Ethereum showed signs of recovery by the end of 2023, with inflows totaling $78 million. Moreover, Solana benefited from diversification and saw inflows totaling $167 million.

Most ETF inflows, specifically $792 million, were from the United States. However, this figure only amounted to 2% of the country’s total Assets under Management (AuM).

Sponsored

On the other hand, Germany emerged as a standout, with digital asset inflows reaching 22% of its total AuM. Canada and Switzerland also recorded significant inflows, with 15% and 13% of their AuM, respectively.

On the Flipside

- While not yet approved in the US, spot Bitcoin ETFs are available in several other jurisdictions.

- US investors have access to other types of Bitcoin ETFs.

Why This Matters

Growing inflows in Bitcoin ETF suggest investor interest in these products. This indicates a potential for higher investments after the SEC’s potential approval of a Spot Bitcoin ETF.

Read more about the spot Bitcoin ETF approval:

Bitcoin ETF Approval Unlikely This Week, Expert Predicts

Read more about Binance Labs’ investment in Memecoin (MEME):

9GAG Memeland Token Surges After Binance Labs Investment