- Bitcoin has achieved a remarkable 17-week high, reminiscent of a notable milestone in June.

- ETF rumors have taken center stage, sparking market frenzy and speculation regarding SEC decisions.

- Expert predictions and price potential have provided a glimpse into lofty forecasts.

The past week witnessed a thrilling spectacle as the top digital contender, Bitcoin (BTC), made repeated advances toward the elusive $30,000 threshold. The catalyst behind this momentum was the buzzing rumor mill about potential approval for Bitcoin Exchange-Traded Funds (ETFs).

This recent surge in BTC’s price marks the most robust weekly return in the past 17 weeks, with the last similar performance in June during the 25th week of the year.

October Mirrors June as Bitcoin ETF Applications Build Up

Coincidentally, this week coincides with the commencement of applications for spot Bitcoin ETFs by several asset management firms, including industry titan BlackRock, with the U.S. Securities and Exchange Commission (SEC).

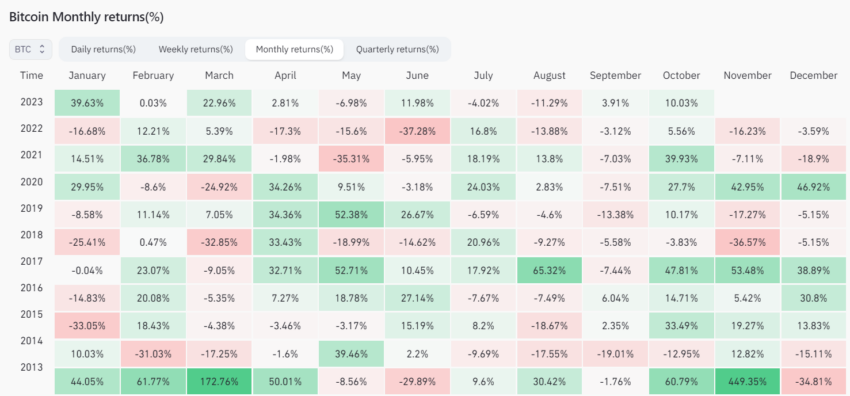

Additionally, a parallel emerges when examining the monthly returns for October and June, as highlighted by Coinglass data. In September, BTC secured a modest gain of nearly 4%, marking a significant recovery from the August downturn of over 11%, with October’s returns already hitting an impressive 10%, closely trailing June’s almost 12% gains.

Could BTC Skyrocket to $50,000 Post ETF Approval?

These price movements can be attributed to the mounting speculation surrounding the SEC’s imminent decision on a spot BTC ETF. An earlier surge in BTC’s price above $30,000, triggered by inaccurate reports of SEC approval for BlackRock’s iShares spot Bitcoin ETF, is compelling evidence of the market’s fervent demand for such an investment vehicle.

Furthermore, these developments align with predictions from K33 Research, suggesting that BTC could potentially soar past $42,000 within the first 100 days following spot BTC ETF approval. Other analytics firms like CryptoQuant offer even more bullish forecasts, setting their sights on values exceeding $50,000.

On the Flipside

- The recent BTC price surge might rely heavily on ETF approval rumors, creating a volatile environment if these speculations do not materialize.

- While the market responded positively to the initial false reports of SEC approval for a spot BTC ETF, it also exposed the vulnerability to price manipulation through misinformation.

- It’s crucial to remember that the price targets of $42,000 and $50,000 are predictions, not programmed outcomes.

Why This Matters

As Bitcoin flirts with ETF acceptances and its $30,000 resistance level, the impending SEC decision on Bitcoin ETFs holds the power to reshape the cryptocurrency sphere. This critical juncture not only influences Bitcoin’s price trajectory but also marks a significant step toward the integration of cryptocurrency into traditional finance

Sponsored

To learn more about the massive short liquidations triggered by Bitcoin’s recent price surge, read here:

Bitcoin’s Price Surge Triggers Massive Short Liquidations

For insights into Matrixport’s Bitcoin price prediction of $42,000 in the event of ETF approval, check out this article:

Matrixport Sees Bitcoin at $42,000 if ETF Gets Green Light