- Binance has seen the largest net outflow of stablecoins in its history.

- A Glassnode report has confirmed a significant decrease in Binance’s USD value and stablecoin balances.

- CFTC’s legal action against Binance has sent shockwaves through the crypto market.

With the Commodity Futures Trading Commission’s (CFTC) lawsuit and the ongoing stablecoin outflows, the cryptocurrency exchange Binance has recently been thrust into the limelight. Such developments have ignited questions regarding the security and stability of Binance, leading to speculations about the potential impact on the broader cryptocurrency landscape.

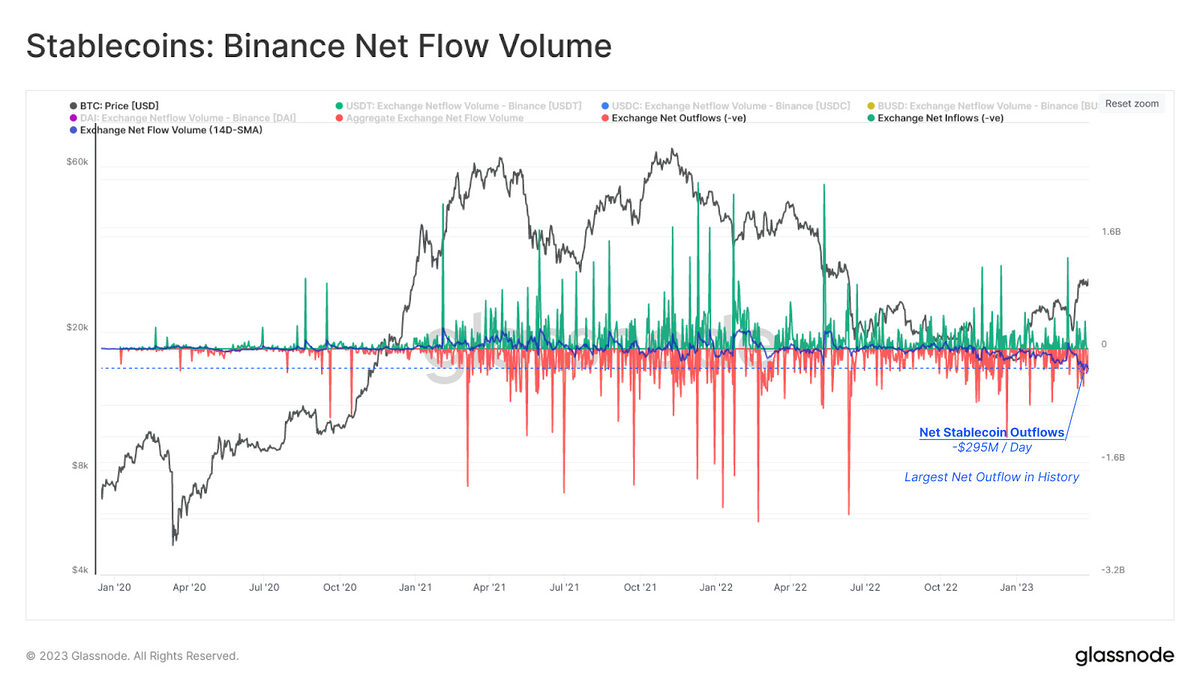

Interestingly, it appears that the outflows have primarily impacted stablecoins and not other forms of cryptocurrencies. According to a recent report by Glassnode, the net flow volume of stablecoins from Binance has surged to a staggering $295 million per day.

Glassnode Uncovers Unprecedented Stablecoin Outflow from Binance

Glassnode’s net flow volume is a crucial metric that estimates the number of crypto assets leaving or entering an exchange. The value of this metric is usually positive when a large number of assets are transferred to the exchange.

Source: Glassnode

Sponsored

Conversely, a negative value indicates an increased withdrawal of assets by the buyers. Unfortunately, the above chart has been showing regular negative spikes, indicating a rise in stablecoin outflows on Binance.

Sponsored

The data suggests that investors are pulling out $295 million worth of stablecoins from Binance every day. This level of net stablecoin outflow is unprecedented on the network. Taking note of this significant outflow, Glassnode stated,

“Whilst Binance has been in the crosshairs of the CFTC this week, overall, there is little evidence of investors fleeing from the exchange. The primary observation is a structural shift in stablecoins hosted on Binance as BUSD enters redeem-only mode and USDC sees global dominance declining.”

Bitcoin & Ethereum Remain Steady Amidst Stablecoin Outflows on Binance

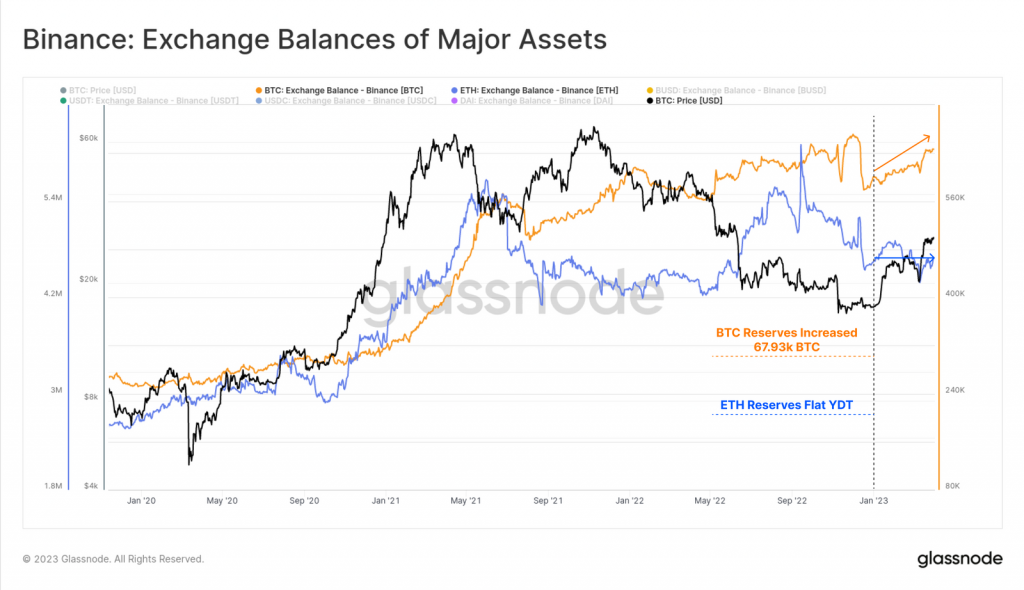

According to the available data, it seems that the CFTC lawsuit primarily affected those who hold stablecoins rather than other cryptocurrencies. Interestingly, there were no significant outflows recorded for Bitcoin (BTC) and Ethereum (ETH).

Source: Glassnode

Recent figures from Glassnode indicate that the exchange has seen an increase in positive inflows of Bitcoin. The report reveals that the BTC balance on the platform has grown substantially, with a surge of 67.93K BTC year-to-date.

On the other hand, the Ethereum reserve has remained steady and has not seen any significant rise or fall. This observation suggests that the community still maintains a high level of trust in Binance.

On the Flipside

- Despite the recent outflows and the CFTC lawsuit, Binance remains one of the largest and most popular cryptocurrency exchanges in the world.

- While the current focus is on Binance, it is worth noting that other cryptocurrency exchanges and platforms have also faced regulatory scrutiny and outflows in the past.

- Binance has a track record of successfully navigating regulatory challenges, and it is likely that it will emerge from the current situation relatively unscathed.

Why You Should Care

Binance is a major player in the cryptocurrency market, and any developments related to the exchange can have significant implications for the industry as a whole. The surge in stablecoin outflows from Binance is also worth paying attention to, as it could signal a shift in investor sentiment towards more stable and less volatile digital assets.

To learn more about the CFTC’s position on ETH and stablecoins as commodities, check out this article:

CFTC Opposes SEC’s Crypto Position: Calls ETH and Stablecoins Commodities

To learn more about the recent rumors of an Interpol Red Notice for Binance CEO Changpeng Zhao, read here:

Here’s Why CZ Was Rumored to Be on Red Notice