- Critics slammed Binance’s relief efforts in Morocco as a ploy.

- Cryptocurrency’s usefulness in a disaster situation is called into question.

- Digital assets remain a quick and convenient way to transfer value.

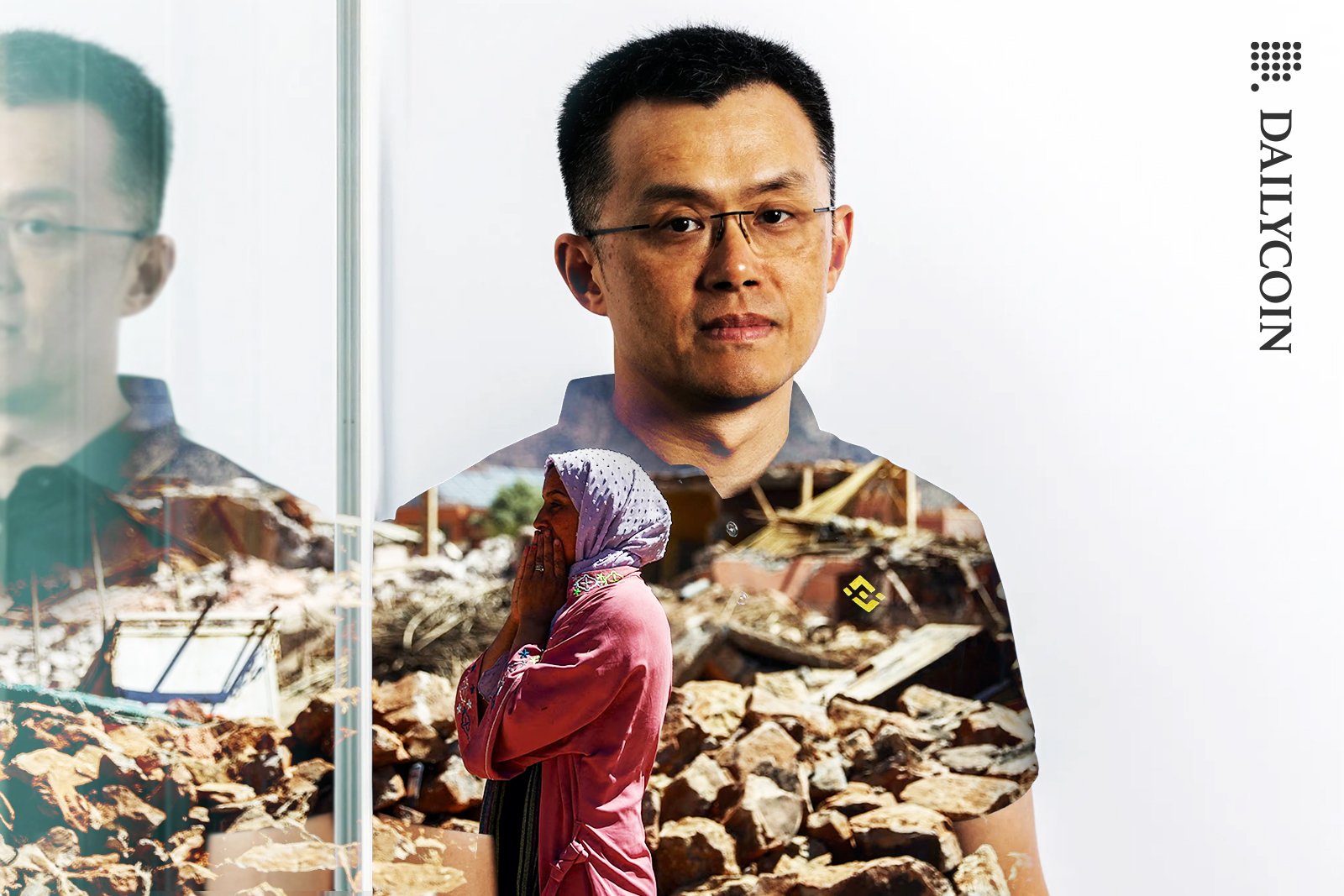

Cryptocurrency exchange Binance has come under fire for donating its native BNB token to Morrocan users following the devastating earthquake near Marrakesh on September 8. The 6.8 magnitude quake is reported to have killed 2,800 people, with as many as 300,000 people displaced and in desperate need of aid.

Binance Charity responded to the incident by airdropping $3 million in BNB to Binance users in the region. However, some aid experts criticized the move by highlighting that cryptocurrency has no immediate use in times of humanitarian crisis, fostering doubts about the real-world utility of digital assets when it really matters.

Moreover, skeptics suggest Binance used this to deflect attention away from its ongoing legal troubles. However, is that a fair determination to make?

Ploy to Deflect?

Concerns about whether cryptocurrency is an appropriate form of aid are at the core of the backlash. In times of crisis, cash, food, water, medical supplies, and blankets are what disaster victims urgently require, not digital tokens, according to the critics.

Sponsored

The fact that converting BNB to local currency requires a degree of technical knowledge drew further fire from critics. Speaking to the Financial Times (FT), executive director of the Action on Armed Violence charity, Iain Overton, slammed Binance for forcing its digital asset adoption agenda onto a disaster situation.

“In post-disaster environments, most people are seeking the familiar. This isn’t a space for digital innovation and new financial tools. What people want is food, shelter, medical aid, and space to grieve. They’re not looking for crypto”, said Overton.

The world’s largest cryptocurrency exchange faced further condemnation for restricting its donations solely to existing users of its platform, which also included recipients who were not directly impacted by the devastation. Aid experts slammed the company’s geo-identifying distribution method as ineffective in reaching those needing help.

Sponsored

Regardless of the intent behind the donation, it appears that Binance may have responded without consideration of more pressing factors, such as the necessity of offerings with immediate utility and relief amid the devastation. The matter is made all the more confusing, considering that cryptocurrencies are banned in Morocco.

Binance Defends Donations

Having anticipated backlash over the selective distribution of donations, at the time of the airdrop, Binance CEO Changpeng Zhao appealed to the humanity of Moroccan BNB recipients unaffected by the earthquake by imploring them to pass the funds along to those in need. Zhao added that the company’s efforts were geared towards providing support amid the devastation.

Addressing wider concerns about the usefulness of BNB, Binance Charity issued a statement to the FT, rejecting criticisms of its relief efforts. The statement clarified that airdropping digital assets is a suitable way of getting funds to earthquake victims quickly and conveniently.

“Crypto transfers can be used to deliver urgent financial aid to disaster victims as they provide fast, low-cost, borderless, and transparent transactions. As needed, they can also be converted to local fiat currencies around the world”, read the statement from Binance Charity.

The charity arm of Binance was set up in 2018 as a way to bring philanthropy and blockchain together. The entity has consistently donated funds to humanitarian crises during its history. Recent examples include donating to Libyan flood victims this week and to victims of the Turkey earthquake in February.

Despite complaints against Binance’s chosen medium for its donation, any contribution in times of need, be they crypto or cash, is a symbolic gesture of support in a harrowing situation for those living in the disaster zone.

Learn more about Binance’s worsening situation here:

Binance.US CEO Makes Shock Exit as Onlookers Fear the Worst

Find out Deutsche Bank’s latest venture in institutional crypto custody here:

Deutsche Bank’s Crypto Foray Taps Institution