2022 has been historic for the crypto space. Coins fell from record highs, whipping out hundreds of billions, and leading projects collapsed and went bankrupt. At the same time, the year was marked by innovation and building.

“Bear market is for building,” says Mayur Kamat, the Head of Product at Binance. DailyCoin asked him about the company’s plans and priorities for 2023.

Continues Investments in Proof-of-Reserves

Mayur Kamat joined the Binance team before the crypto market made its significant turndown last March. After spending years at companies like Google and Microsoft, he now leads the product and design teams at the world’s biggest crypto exchange.

Sponsored

According to him, user trust and transparency are the core of the company’s product development. When asked about Binance’s product development roadmap for 2023, Kamat named investments into features related to proof-of-reserves among the company’s priorities.

“In 2022, we built new features like proof-of-reserves to show users their funds are safely held at Binance. In 2023, we will continue investing in this area. One product I am excited about is the Zk-SNARK- based proof-of-solvency, which we are exploring with Vitalik,” he said.

Proof-of-solvency (PoS) became the hottest question in the crypto space after the collapse of FTX in November 2022. To prove they are solvent, crypto industry players, especially crypto exchanges, were expected to disclose their reserves and liabilities.

The inspection, typically conducted by an independent audit firm, requires the auditor to look into the account balance of any crypto exchange user. This raised a question on the privacy risks, as even encrypted auditing data could potentially be hacked and real user identities revealed.

Sponsored

Ethereum founder Vitalik Buterin offered the idea of Zk-SNARK, a way to simplify the company’s proof-of-solvency process without compromising the privacy of its clients.

Changpeng Zhao (CZ), the CEO of Binance, confirmed that Vitalik Buterin is willing to use Binance as a “Guinea pig” for the testing and supported the fact.

And we're live!

— Binance (@binance) November 14, 2022

Tune-in to our Twitter space as @cz_binance will be answering all of your questions 👇https://t.co/4t8fJqQR1e

At the end of December 2022, Binance stepped into the spotlight of global attention after disclosing its proof-of-reserves. The exchange communicated them as overcollateralized; however, the audit lacked proof of its liabilities.

Mazars, the audit firm hired by Binance, removed the audit documents from the public eye after backlash from critics. The firm also suspended services for all of its crypto clients.

Plans Focusing on CeDeFi

Investments in developments for proof-of-reserves will not be the only line on Binance’s priority list. According to Mayur Kamat, CeDeFi will be “another area of interest.”

The term, introduced by CZ himself in 2020, refers to centralized-decentralized finance, the hybrid of both financial systems.

On the one hand, CeDeFi contains the features of centralized finance, like transparency and regulatory compliance, but it also leans towards centralization. This means it remains governed by a sole entity or a group.

At the same time, CeDeFi enables features and services native to DeFi: faster and cheaper transactions, liquidity mining, lending and borrowing, decentralized exchanges, stablecoins, and more.

According to Mayur Kamat, many regular users still see DeFi as a challenge.

“It is still very hard for regular users to use DeFi. Onboarding a new wallet, seed phrases, storing keys securely, connecting to Dapps, especially cross-chain, is very painful. Binance DeFi Wallet and Trust Wallet have made some great progress here, and we will be working on making it more accessible this year,” he stated.

The exchange’s non-custodial DeFi Wallet is available to all 120+ million users of the world’s biggest crypto exchange. This means the exposure to the user base is four times higher than MetaMask’s. One of the most popular DeFi wallets accounted for 30 million users ten months ago.

DeFi dominated the headlines last year after becoming the leading target of hackers. 95% of hacks during 2022 have happened on DeFi, resulting in more than $3.2 billion in total losses by the year’s end.

Compliance Products the Biggest Success

Kamat named investments in further compliance product development as the third high priority for 2023. According to him, they were Binance’s most successful product last year.

“I’d say our biggest success in 2022 was our compliance products. We were able to onboard tens of millions of users through our strict KYC process, get licenses in 14 jurisdictions and work with regulators across the world because of our work on compliance,” he stated.

Kamat also noted that centralized exchanges are a gateway to Web3 and play a big role in bringing new users to crypto.

According to him, Binance has made “huge investments” in improving its Know-Your-Customer (KYC) product and applied industry-leading systems like Anti-Money Laundering (AML) and transaction monitoring to meet compliance requirements.

“We will continue to invest in compliance and regulation throughout our products in 2023,” he resumed.

Simplifies Platform for New Web3 Developers

When asked about Binance’s plans to launch its own metaverse, the Head of Product did not provide a direct answer. The exchange sees itself as a “platform provider,” he revealed instead.

“Binance already provides some of the core infrastructure to enable metaverse scenarios. Binance Labs has also made few investments in this area. We see ourselves as the platform provider here,” Kamat said.

Nearly a year ago, Binance NFT, the centralized gaming platform, reported the partnerships with more than 30 gaming and venture capital funds, as well as with Binance Labs and BNB Chain fund “as part of our commitment to building the Gaming Metaverse.”

According to Kamat, the main goal of the exchange is to provide a platform for Web3 developers and let them “build the magic.”

“BNB Chain, Binance Identity, SBTs, Oracle – the key pieces to build great games already exist. We will make it a bit simpler this year for developers to get started on this,” he noted.

The Head of Product has not specified which technical features will be updated. He, however, confirmed that Binance would keep working on products and platforms to enable Web3 developers to build metaverse applications in 2023.

Binance NFT gaming platform enabled an NFT minting option for its verified users at the end of last summer.

According to an official blog post, 100k newly minted NFTs (approximately 25k NFTs per month) have been created since then, generating an average of 10 million USDT in trading volume each month.

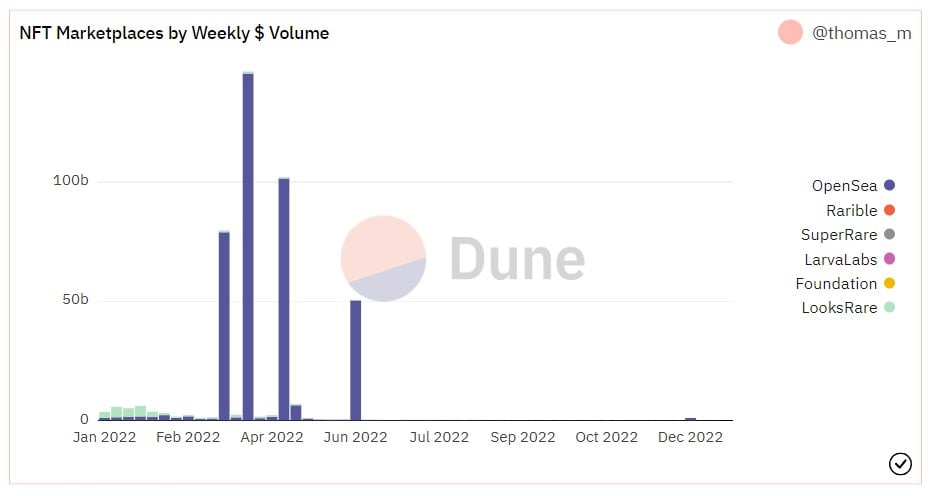

The broader NFT market witnessed a significant drop in trading volume during 2022, reflecting the general negative sentiment of broader financial markets.

OpenSea, the popular NFT marketplace, suffered the most, losing over 99% of its volume, which dropped from $145.4B in March to $1.06B in December of 2022, according to the data published of blockchain analysis platform Dune Analytics.

Source: Dune.com

Sees Potential for Crypto Real World Use Cases

Kamat declined to speculate on what areas of Web3 could emerge as new trends throughout 2023 and whether the NFT market will regain its former glory this year.

Despite that, he acknowledged that real-world use cases of crypto could be a potential option:

“I think we will be pleasantly surprised with the progress of crypto for real-world use cases this year.”

According to him, the industry is already practicing real-world use cases like ticketing through NFTs and enabling Soulbound Tokens (SBTs), digital identity tokens, to represent a person’s or entity’s identity on the blockchain.

Kamat also mentioned GameFi as one potential real-world use area. However, for it to work out, the world “needs strong games with crypto, instead of crypto games with poor gameplay.”

From his point of view, Kamat disclosed that he is excited about stablecoins and their role in payments, remittances, and B2B settlements.

“I usually avoid making predictions. They aren’t that useful. What’s more interesting is where we see great products being built. Bear market is for building, and strong developers are building some really great stuff,” concluded Binance’s Head of Product.