- Binance exits the Netherlands and Cyprus amidst regulatory pressure.

- The crypto exchange is under investigation in France for illegal canvassing and potential money laundering.

- The mounting regulatory scrutiny on Binance raises concerns about its future operations.

In a series of regulatory setbacks, Binance, the world’s largest cryptocurrency exchange, has pulled out of the Netherlands and Cyprus. In addition, the exchange is also under investigation in France.

Troubles in Europe come on the heels of the exchange’s recent troubles in the United States, where it has faced significant regulatory scrutiny.

Binance’s Regulatory Challenges in Europe

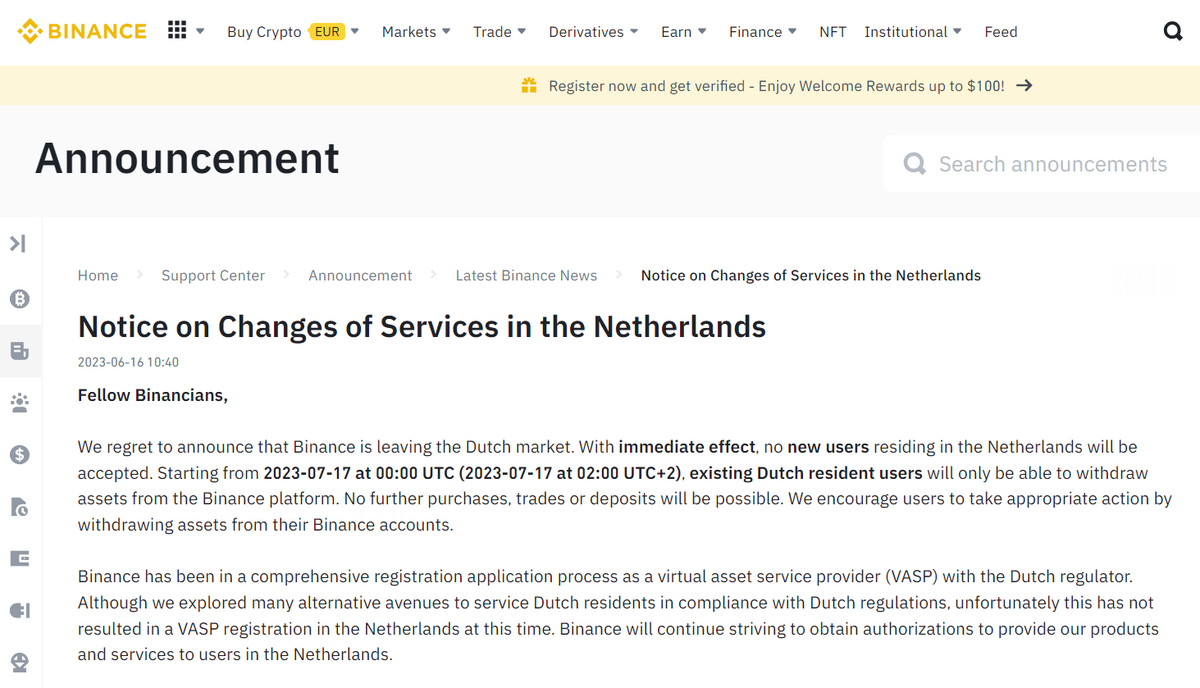

On Friday, June 16, 2023, Binance announced its decision to exit the Netherlands after failing to secure a VASP license from the Dutch regulator. This license is crucial for any entity intending to provide services related to transferring, safekeeping, or offering virtual assets.

Despite its size and resources, Binance’s bid for the license was unsuccessful. The Dutch regulator’s refusal to issue the license forced Binance to cease operations in the country.

Sponsored

This move followed Binance’s decision to deregister its Cyprus unit from the country’s register of crypto asset service providers just two days earlier. Specifically, on Wednesday, June 14, Binance’s Cyprus unit applied to be removed from Cyprus’ register of crypto asset service providers. This move came less than a year after Binance Cyprus Ltd. received approval from the Cyprus Securities and Exchange Commission.

The decision to deregister represents a significant reversal for Binance, which had initially viewed Cyprus as a favorable jurisdiction for its operations. However, Binance’s issues extend farther than the Netherlands and Cyprus.

Binance Under Investigation in France, US

In addition to these exits, Binance is also under preliminary investigation by the Paris prosecutor’s office. Authorities are allegedly investigating Binance for illegal canvassing of clients and “aggravated” money laundering.

Sponsored

“The investigation is about, on one hand, the unauthorized practice of the profession of virtual assets service provider and, on the other, about aggravated money laundering, ” the prosecutor’s office revealed on Friday, June 16.

In fact, Binance confirmed that it received an “on-site visit” from French authorities the same day. In a Twitter post, the exchange said it complied with all its obligations to French authorities. Still, this investigation adds to the growing list of regulatory challenges it faces.

The exchange’s regulatory troubles are not limited to Europe. In the United States, Binance faces lawsuits from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

These regulatory bodies have been investigating Binance for potential violations of US securities laws, adding to the exchange’s global regulatory challenges.

On the Flipside

- Recent issues in Europe are significant setbacks in Binance’s European operations and reflect the mounting regulatory pressure on the crypto giant.

- The French investigation is a potential setback for Binance’s plans to open a regional hub in Paris.

Why This Matters

For crypto traders, Binance’s regulatory challenges underscore the uncertainties and risks associated with the global cryptocurrency market.

Read more about Binance’s lawsuits in the US:

Binance Sued: How SEC Lawsuit Differs from CFTC Case

Read more about how regulatory concerns are causing troubles for crypto markets:

Crypto Trading Volumes Drop to Yearly Low on Regulatory Risk