- May 22 is Bitcoin Pizza Day, following Laszlo Hanyecz’s famed 10,000 BTC pizza purchase.

- 10,000 BTC is worth several hundreds of millions today.

- The mind boggles with what 10,000 BTC in 2024 can buy.

On May 22 each year, Bitcoiners celebrate the first real-world use of Bitcoin. On this day in 2010, Laszlo Hanyecz, a programmer in Florida, sent 10,000 Bitcoin (worth around $700 million today) to an online forum user who then ordered pizza on his behalf.

Sponsored

At the time, Bitcoin was valued at fractions of a penny per coin, and few saw Hanyecz’s offer as worthwhile. But one user took up Hanyecz’s offer, changing crypto history forever.

Craving Pizza

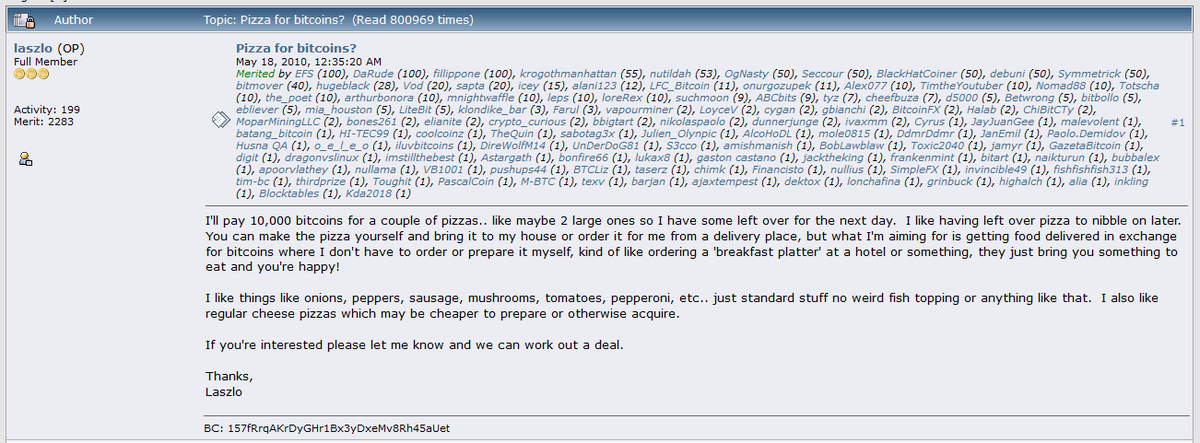

Hanyecz etched his name into crypto history 14 years ago after a craving for pizza led to him making an offer on the Bitcoin Talk forum. The programmer wanted to trade 10,000 BTC with anyone willing to deliver him a couple of pies. Hanyecz wasn’t picky about whether the pizzas were homemade or from a restaurant, just as long as he didn’t have to prepare them himself.

Being a discerning gentleman, Hanyecz specified his preferred toppings as onions, peppers, sausage, mushrooms, tomatoes, pepperoni, “just standard stuff,” with his hatred of “weird fish” toppings being understandable.

In a 60 Minutes interview, Hanyecz recounted how he transferred the 10,000 Bitcoin, worth around $40 at the time, to the other party, who then fulfilled his end of the deal by placing a credit card order to Papa John’s for two pizzas deliverable to Hanyecz’s home address.

This landmark moment paved the way for more sophisticated crypto-payment solutions. But more importantly, Hanyecz’s willingness to experiment with BTC for payment set the stage for becoming a mainstream financial asset worth over a trillion dollars today.

What Does 10,000 Bitcoin Get Today?

Even in the aftermath of the historic Bitcoin pizza purchase, commenters were already ribbing Hayecz over the seemingly lopsided deal as BTC’s value began ticking up. “Greetings from November 2010! What is it, pay $2,600 for a pizza?” one user quipped.

This pattern has only accelerated with Bitcoin’s skyrocketing value, far exceeding what anyone could have imagined in 2010.

Pizza Pies

Had Hayecz held onto the Bitcoin, the $700 million equivalent could buy 35 million Papa John’s pies loaded with all his favorite toppings today.

Land on the Moon

Alternatively, Hayecz could buy himself 2.3 million 100-acre lots of land on the moon to escape the out-of-control Florida rents.

Shiba Inus

What’s better than a Shiba Inu shopping spree? 10,000 BTC today could adopt 175,000 loveable canines, which is more than enough to assemble a real SHIBArmy.

Lambos

With automakers phasing out gas guzzlers, Hanyecz’s windfall would enable him to singlehandedly buy 5,833 Lamborghini Gallardos before they’re consigned to automotive history.

Bailing Out SBF

Even though Sam Bankman-Fried’s (SBF) effective altruism shtick has proven hollow, Hanyecz, if feeling compassionate, may choose to cover SBF’s $250 million bail three times over had he kept the 10,000 BTC.

On the Flipside

- Bitcoin is up over 17,000,000% since Hanyecz paid 10,000 BTC for pizza

- Shrinkflation means 2024 pizzas contain fewer toppings and cheaper ingredients.

Why This Matters

Bitcoin is a mainstream financial instrument today thanks to pioneers like Hanyecz, who advanced the BTC narrative when few saw its value.

UK regulator green lights crypto ETPs for the London Stock Exchange.

FCA Clears WisdomTree’s Bitcoin and Ether ETPs for Listing

Spot Ethereum ETF applicants backtrack on staking to appease the SEC.

Ethereum ETF Hopefuls Axe Staking Plans in Amended Filings