Decentralized Finance (DeFi) seems to be on a record-breaking runway these days. However, one of the other peaking projects seems to be far beyond others. Even including Bitcoin.

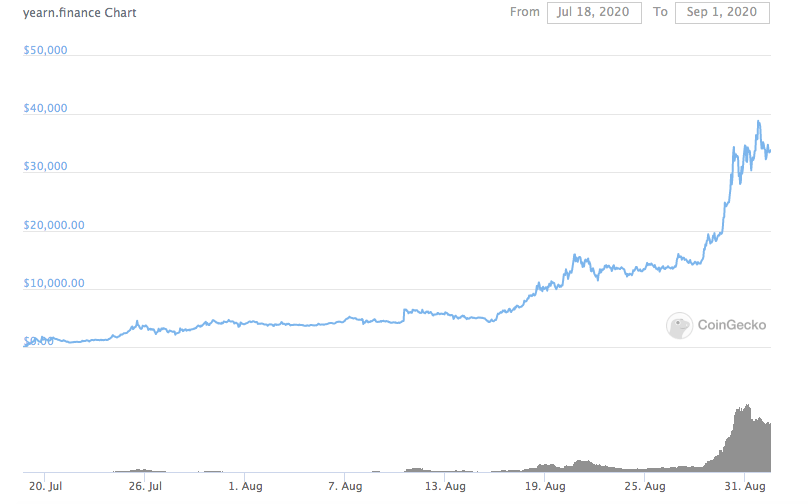

YFI the native token of the decentralized Yearn.Finance protocol came into the limelight this weekend. The asset rocketed to the stratosphere as its price reached the $38.869 on Monday, leaving the world’s biggest crypto Bitcoin far beyond with more than three times lower price.

After such a massive bull run YFI became the most expensive digital asset in history with over a $1 billion market capitalization on August 31, according to CoinGecko. The YFI’s price increased 9 times since the last day of July when it cost lingered around $4.000, making YFI one of the hottest digital assets in the cryptocurrency industry.

YFI is a native governance token of Yearn.Finance, the DeFi yield (interests earned on lending) aggregator for DeFi lending platforms that rebalances for the highest yield.

Launched in July, Built on the Ethereum network, the protocol is also the first that gives YFI token holders the full governance rights. Despite the fact, governance tokens are commonly used as trading assets, some of them like YFI became especially favorable among traders, bringing the digital asset to massive price growth.

There are, however, some explainable reasons behind such a price spurt. One of them is a limited supply. The total supply of YFI tokens is 30.000, very small compared to Bitcoin 21 million. Meanwhile, the lower supply can mean higher demand, and thus the increasing prices. However, in terms of market capitalization, YFI is still far away from Bitcoin, whose market cap sits over $216 billion.

Another factor why YFI became the most expensive digital currency is the upcoming launch of Yinsure.Finance, a new service provided by Yearn.Finance that offers insurance for DeFi users and their portfolios. With the guarantees to protect the investments, the protocol expects to attract new investors in the DeFi sector.

Sponsored

The third reason for the impressive YFI’s bull rally could be the token’s listing on Aave, the biggest protocol of the DeFi sector with $1.61 billion of total value locked and over 17% DeFi market dominance, according to DeFiPulse. Despite the fact of being one of the biggest DeFi protocols, listing on major crypto lending platforms could have even boosted Yearn.Finance’s way to the moon.