- Bitcoin (BTC) has recently initiated an upward trend, breaking above key resistance levels and moving averages.

- Technical indicators and on-chain metrics suggest that the market is currently bullish. However, there are also indications of potential corrections in the near future.

- On-chain analysis also provides insight into the current market conditions.

Will Bitcoin Recover in 2023?

Bitcoin (BTC) has recently initiated an upward trend, breaking above key resistance levels and moving averages. In November 2022, BTC found support at the $16,000 level, and on January 12th and 13th, it has since surpassed the 100-day and 200-day moving averages at $18,000 and $19,600, respectively.

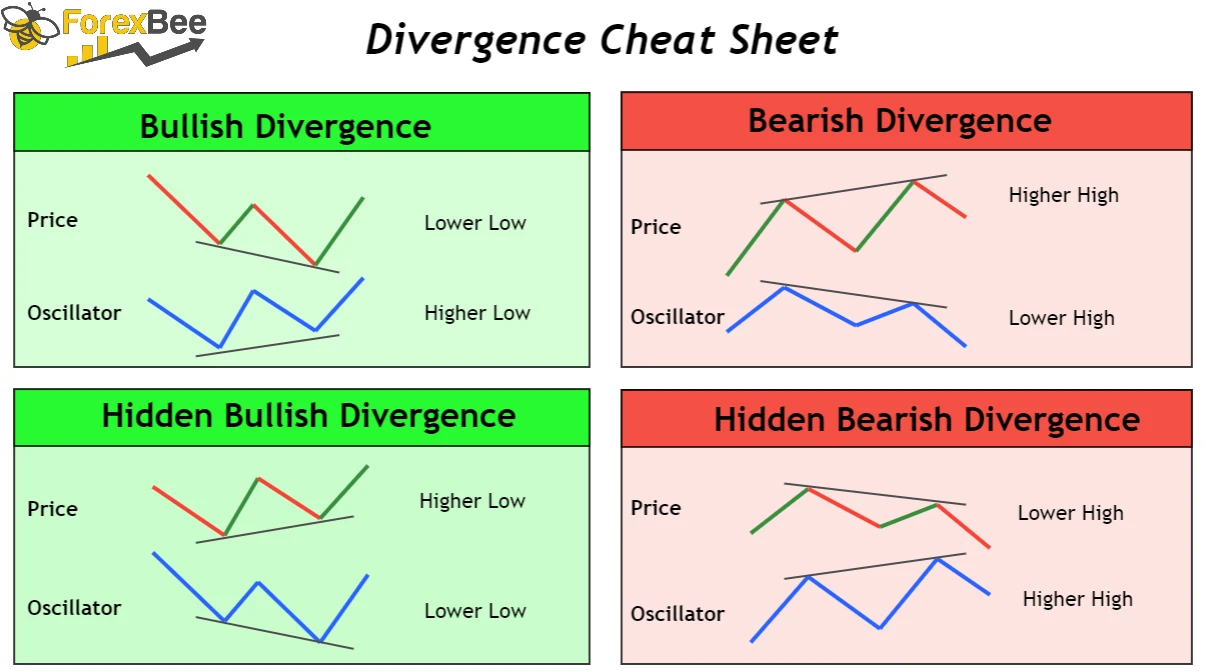

This is a significant bullish sign for the market as it suggests that adequate demand will likely return. However, there is also a bearish divergence between the price and the relative strength index (RSI) on the daily timeframe.

Sponsored

This particular technical pattern suggests that a correction will likely occur soon, which can guide traders in charting their next move. To stay responsive to chart movements, traders often use pivot points to evaluate probabilities and make quick decisions.

The Journey Thus Far

On January 14th and January 20th, the BTC price broke through key pivot points of $19,800 and $21,800, respectively, and as of writing, it is consolidating around the $23,000 level. This has become a temporary level with many smaller supports and resistances.

The next crucial resistance level for BTC is the major pivot at the $25,000 price level, which has also been a static resistance level for the past few months. However, there is also a bearish divergence in the four-hour timeframe, which suggests that the price may enter a short-term consolidation phase between the $23,000 and $21,000 levels before potentially reaching the $25,000 resistance level.

Sponsored

The cryptocurrency market is highly volatile, meaning price movements may deviate significantly from the support and resistance levels. As such, these levels should be only used as guidelines rather than definitive outcomes.

15-Minute price chart for Bitcoin. Source: TradingView

Is Bitcoin in a Bear Market Now?

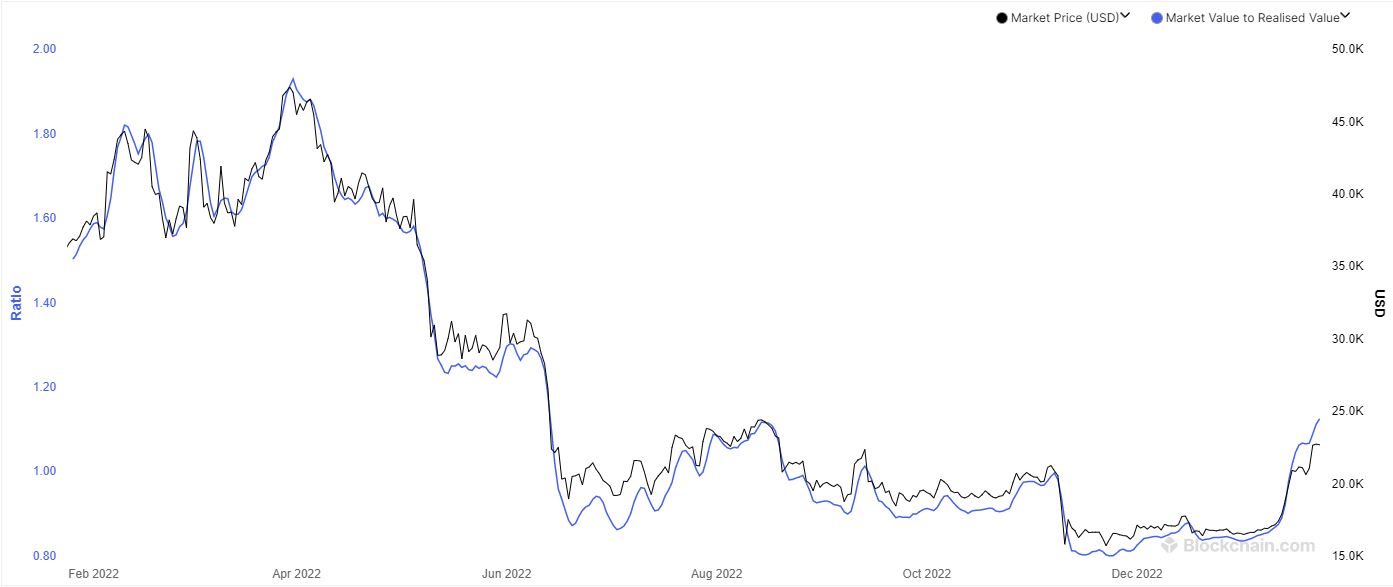

One way to evaluate whether or not we are in a bear market is by looking at the market value to realized value (MVRV) ratio, which compares the market capitalization to the realized capitalization of BTC. This metric, commonly used in on-chain analysis, can provide insight into the state of the current market conditions. Historically, this metric falls in the green zone during bearish market phases, indicating that BTC is trading at an undervalued level and the cycle’s bottom is forming.

When the MVRV metric spikes above one, it suggests that BTC is in a bullish phase and a bull market may be starting. The recent rally of BTC has resulted in a sharp increase in the MVRV metric, which could indicate that the market has entered a bullish mid-term phase with increased volatility.

Market Value to Realized Value. Source Blockchain.com

Short Term

The rising trend channel of BTC suggests a growing optimism among investors, as shown by the lack of resistance in the price chart. This presents the potential for further upward movement in the value of the leading digital asset.

In the event of a negative reaction, BTC has support at approximately $21,400. The relative strength index (RSI) is above 70, which shows that the currency has strong positive momentum in the short term.

It’s worth noting that for large stocks, a high RSI has traditionally meant that the stock is overbought and that there is a chance of a reaction downwards. This could indicate a small movement upwards followed by a bigger retracement.

Four-Hour price chart for Bitcoin. Source: TradingView

Medium Term

BTC has broken above the ceiling of the falling trend, indicating a slower initial falling rate. The currency has support at $21,000 and resistance at $35,000. These levels are significant as they represent previous points at which large trading volume has occurred. As a result, they are likely to play a crucial role in future price movements.

The support level of $21,000 represents a lower point at which the price of BTC is likely to reach before experiencing a rebound. On the other hand, resistance at $35,000 represents a point at which the price of BTC is likely to reach before experiencing a correction. Additionally, if the price of BTC can break through the resistance level of $35,000, it would signal a bullish trend. Conversely, if the price falls below the support level of $21,000, it would signal a bearish trend.

The current volume balance is also positive, which strengthens the currency. The RSI curve further indicates a rising trend, which is considered an early signal of the start of a correlating trend for the asset’s price. Overall, BTC is assessed as technically slightly positive for the medium term.

One-Day price chart for Bitcoin. Source: TradingView

Long Term

Bitcoin is currently in a bullish trend but is facing resistance at the $35,000 level. It is important to note that, in the past, this level has been a strong resistance for BTC, and it may take some time for the price to break above it. The volume balance is also positive, which is a bullish sign. The RSI has also been above 70, indicating strong positive momentum in the long term.

In relation to the short and medium-term analysis, a high RSI can signal overbought conditions, which could lead to a potential correction. Overall, BTC is assessed as technically positive in the long-term, with $35,000 set to be the key level to watch. Here are potential scenarios based on where the asset is as of this writing.

One-Week price chart for Bitcoin. Source: TradingView

Is This the Bear Market Bottom?

Overall, the analysis of Bitcoin’s price action, technical indicators, and on-chain metrics suggests that the market is currently bullish. However, there are also indications of potential corrections soon. To assess the future direction, it is important to closely monitor key resistance levels and indicators, such as the RSI. It’s also important to consider the macroeconomic situation, regulations, and other factors that may impact the price of Bitcoin.

On the Flipside

- The duration of bull and bear runs in the crypto market can vary greatly and depend on various factors, including unpredictable external elements.

- It is hard to predict when a bull or bear run will end. Closely monitoring key indicators and market conditions can aid in making informed decisions, but certainty can never be guaranteed.

- While some experts believe that Bitcoin and other cryptocurrencies have the potential for significant growth, others believe it may not reach mainstream adoption.

Why You Should Care

Bitcoin, the largest and first cryptocurrency, has been making headlines for its price movements and potential to disrupt the financial industry with blockchain technology. Understanding current market conditions and key indicators are crucial for development progress.

Although crypto is a relatively new and uncertain market, staying informed on changes in Bitcoin and the market can significantly impact the future.

FAQ

Has the Bear Market Bottomed?

It’s uncertain, but indicators like key resistance levels and MVRV ratio can suggest it’s approaching a bottom.

What Will Bitcoin Be Like in 10 Years?

It’s hard to predict the future of Bitcoin with certainty due to market volatility and complexity. Experts have differing opinions on potential growth, some predicting significant growth and others less optimistic. The adoption of Bitcoin by governments, institutions, and individuals will play a crucial role in determining its future value. Regulations and laws that limit its use could decrease its value, while wider acceptance and regulation may lead to an increase in value.

How Long do Crypto Bear Runs Last?

The duration of a bear market can vary depending on factors such as market sentiment, economic conditions, and investor behavior. In the case of cryptocurrency, bear runs can last anywhere from a few months to several years. The previous bear market, commonly referred to as the “crypto winter,” lasted from January 2018 to December 2020.

How Long do Crypto Bull Runs Last?

The historical pattern of Bitcoin market movements has shown a three-year bull run followed by a one-year bear market, closely correlated to the 4-year Bitcoin halving cycle. The duration of a bull market in crypto, just as in the case of bear runs, can vary and be influenced by a range of factors. It’s worth noting that bull runs and bear markets can alternate, and one does not necessarily follow the other.

For more about the Bitcoin price action:

Bitcoin (BTC) Continues Strong Start to 2023, Hits $23k, Analysts Divided on Rally

Read about the previous Bitcoin rally below:

Bitcoin Holds Above $21,000 for Three Consecutive Days: Dawn of the Bull Market? – DailyCoin