“History doesn’t repeat itself, but it often rhymes” ~ Mark Twain

This Twain quote implies that what’s happened before is likely to happen again, although it may appear differently. What appears to be happening now is an orchestrated manipulation of the cryptocurrency market and Bitcoin in particular.

Sponsored

We’ve all heralded the billions in fiat currency that have flooded into cryptocurrency during the past 24 months from institutional investors also known as “smart money.”

These large players entering the crypto game have added liquidity to the space, validated the asset class, and spurred mainstream adoption of digital assets. However, this recent crypto collapse is a stark reminder that it’s a game that institutional investors are playing to win.

While Bitcoin was invented to level the playing field for the average individual against the manipulative financial barons and captains of finance, it appears that Bitcoin has been played by these latest entrants to the game. Who can blame them for wanting to play? The underlying technological innovation of blockchain-based currencies, trillions in potential upside coupled with the weakening economic stability of inflationary fiat currencies posed too great an opportunity for the barons and captains to ignore.

Sponsored

The manipulation of financial markets has been happening for centuries and it appears to have hit cryptocurrencies in a big way. While this can’t be proven conclusively, there is strong evidence to support the premise that Bitcoin has been masterfully gamed – and as the largest crypto asset – it’s taken down most of the crypto-sphere as well.

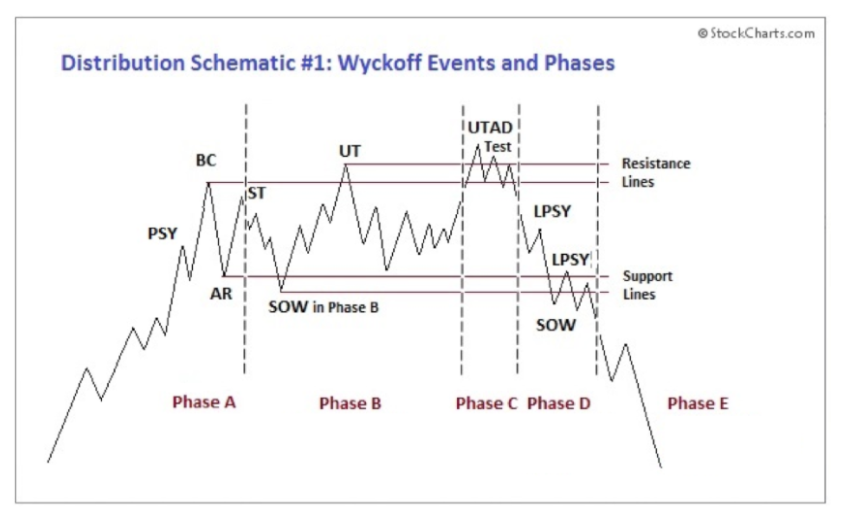

Market manipulation occurs and it shouldn’t surprise us, in fact fabled financial instructor, expert investor, and technical analyst from the 1920s – Richard D. Wyckoff – created a chart that explains exactly what market manipulation looks like.

If you visit the “school” section of StockChart.com, you can get definitions of all the alphabet-soup notations on the above chart (i.e. PSY = Preliminary Supply; BC = Buying Climax; UT = Upthrust…etc.) as well as an easy-to-understand explanation of Wyckoff’s market manipulation theory.

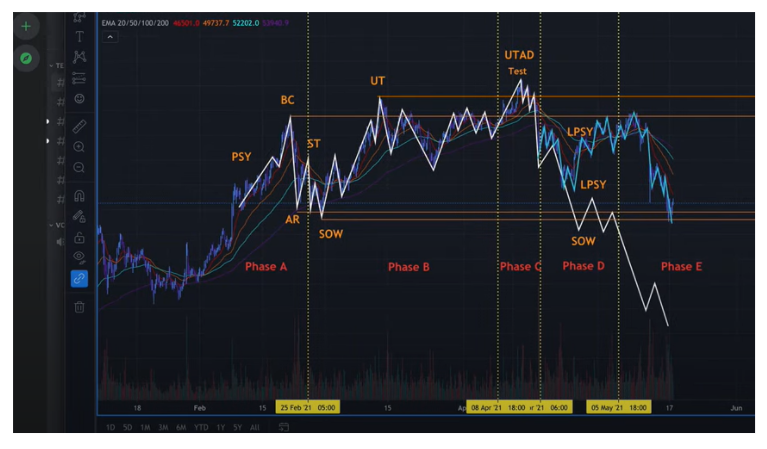

What’s truly fascinating about Wyckoff’s chart is that when it’s overlaid on Bitcoin’s recent price activity – which was expertly done by the cryptocurrency investor who runs the Uncomplication channel over on YouTube – you see that they map almost perfectly together.

The white line is Wyckoff’s manipulation chart from nearly 100 years ago, and the blue line is Bitcoin’s price up until yesterday, May 18th.

Screenshot: chart analysis by Uncomplication

While this doesn’t conclusively prove manipulation occurred, the mirror charts separated by a century of time are compelling and individual investors need to understand the strong likelihood that the “smart money” is taking advantage of dumb investors through its jobbing of digital assets.

Wyckoff was compelled to develop this chart and his market manipulation theory because he was a Wall Street insider who was tired of seeing individual investors screwed over by colluding institutional investors, whom he collectively referred to as “The Composite Man.”

…all the fluctuations in the market and in all the various stocks should be studied as if they were the result of one man’s operations. Let us call him the Composite Man, who, in theory, sits behind the scenes and manipulates the stocks to your disadvantage if you do not understand the game as he plays it; and to your great profit if you do understand it.” (The Richard D. Wyckoff Course in Stock Market Science and Technique, section 9, p. 1-2)

Make no mistake, “The Composite Man” is alive and well – and he’s resetting the cryptocurrency game. Individual investors need to learn the rules of “his” game so that when history repeats itself, we’re not reckt when it tries to rhyme with this most recent orchestrated downturn.

On the Flipside

Based on years of first-hand observation and research, Wyckoff taught his students that if you understand the market behavior of The Composite Man (aka institutional investors), one could identify many trading and investment opportunities early enough to profit and not get reckt.

The Composite Man invests with the end in mind as he executes, concludes his campaigns, and then seeks to repeat the cycle with other assets. Could ETH be the next target?

According to Wyckoff, The Composite Man attracts the public to buy a stock in which he has already accumulated a sizeable line of shares by making many transactions involving a large number of shares, in effect advertising his stock by creating the appearance of a “broad market.” Hmmm, sounds like the Dogefather.

Regardless, do your own research with the purpose of judging the behavior of the respective asset or coin, always keeping an eye on the motives of key influencers in the space.