DeFi promises only unicorns and rainbows as it liberates the financial market from centralization. With centralization comes exorbitant fees for any new listing; it impedes new projects to generate funding and mass exposure to the blockchain community. With the release of Uniswap v3 on May 5th and a steep decrease in Ethereum fees, Uniswap surprises the blockchain space as it continues to be a reference DEX from the 2020 Defi boom.

Uniswap data highlights its market dominance as it surpasses major centralized exchanges in terms of weekly and 24 hours trading volume. Uniswap recorded over 10-billion in cumulative transactions during a week, which amounts to half a trillion per year, according to Hayden James. With a 24-hour trading volume of roughly $2.3 billion, Uniswap ranks higher than the likes of Kraken, Bittrex, being surpassed only by Binance or Coinbase, according to data from CoinMarketCap.

Is Uniswap A Real Technological Unicorn?

Uniswap and DEX benefit from centralized exchanges for market growth. Instances, where decentralization is not truly the case, occurred in the past, when Bancor Network, a decentralized liquidity protocol, was hacked by $23.5 million owners, froze assets to prevent further financial damages. Still, this brings into question the decentralization notion.

Sponsored

Uniswap was subjected to high transaction fees once Ethereum started gaining momentum. Fees on the network would surpass $100, create opportunities for additional exchanges to gain a market share. As such PancakeSwap and, most recently, QuickSwap position themselves as credible competitors in the market as they are built on Binance Smart Chance (BSC), respectively Polygon (MATIC) blockchain.

Ethereum has undergone a network update, increasing the block size from 12.5M to 15M. Network activity increasing, as it incentivized Uniswap users to increase the transaction load. Still, Uniswap holds the first-mover advantage despite previous concerns of high fees. Investing and providing liquidity on Uniswap required higher transaction fees, enabling only better-quality projects to succeed.

Uniswap and other decentralized exchanges possess more than a means to transact crypto without the need for a middleman. Their expansion into a market for blockchain enthusiasts creates a new avenue for discovery. To that end, DEX’s are paramount for cryptocurrency investors as it makes a level of transparency and accountability between investors.

Sponsored

Uniswap is the DeFi norm in 2021. After entering the Top 10 coins by market cap, Uniswap entered a recognition phase as it became more known to higher capital investors. With high fees being a concern, Starkware aims to develop a bridge between DeFi platforms and Ethereum’s layer 1 for users to transact gas-free, thus increasing the transaction power on the exchange.

Still, DeFi is an alluring aspect of blockchain technology. Uniswap has been included in Bitwise Investments, an investment fund, which will open more avenues for institutional investors to become acclimated with the DeFi space. As Bank of America highlighted, “DeFi is more disruptive than Bitcoin.” it positions Uniswap as the main contender to take over most of the DeFi market. UniSwap’s price movement reflects its intrinsic value, and as more investors being using the platform, with transaction fees lowering, UniSwap can be in for a yielding result.

On the Flipside

- The ease of utilizing Uniswap opened new avenues for scams to arise in the blockchain space

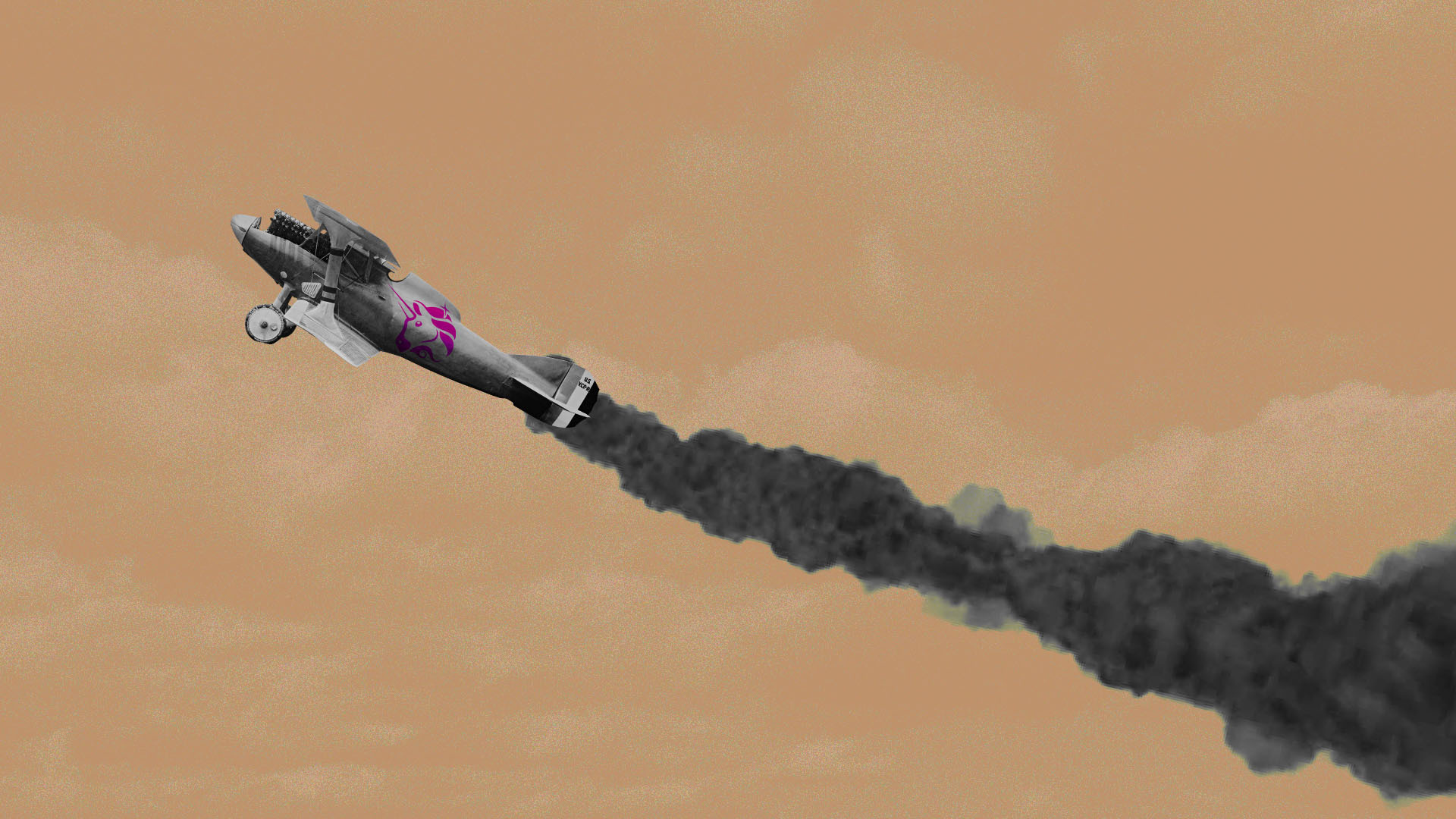

- Overhype of DeFi tokens could lead to a crash and burn similar to ICO’s in 2017

- Uniswap’s success is reliant on Ethereum’s ability to account for the growing network demand.

- PancakeSwap and QuickSwap offer more affordable transaction fees and could dethrone UniSwap if investors find projects less risky.

DeFi After The 2020 Boom

DeFi and DEX’s have been a talking point in the blockchain space for over half a decade after the popularization of smart contracts through Ethereum. Expansion of Chainlink oracle as a standard facilitator for blockchains brought DeFi closer to reality. According to a Forbes article, DeFi’s utility and accessibility into a larger market saved Bitcoin’s price at the end of 2020 and the start of 2021.

The concept of DeFi was nonexistent 3 years ago. Now DeFi, farm yielding, and decentralized exchanges are synonymous with blockchain technology. Data from DeFiPulse shows that on July 26th, the Total Value Locked in exchanges surpassed 1 billion, while on September 28th, 2017, it accounted for only 1.33 million. Now, TVL on DEX’s is over $21 billion, with Uniswap dominating 27.58% of the market.

The current financial model is outdated, broken, and does not account for the development of digital technologies. Thus, the financial needs of many are not met fully. The DeFi summer created a new asset class, where yielding and farming became a source of revenue. It offered the opportunity to convert USD to any coin, generate higher interest than in any central bank, and convert the asset back into USD.