With Bitcoin wavering above the $42K mark, Tether (USDT) is giving promising signals that big moves for crypto may be coming, says Santiment, a cryptocurrency market analysis firm.

The firm noticed two major spikes in USDT wallet activity in the past week. The spikes, as 83K and 74K daily active addresses were recorded, mark the highest levels since last December, Santiment stated.

🤑 As #Bitcoin wavers around $41k, #Tether is indicating big moves may be coming for #crypto. Thursday (83k) and Saturday (74k) had the two largest days of 2022, in terms of addresses interacting on the network. Keep an eye on this diminishing stagnancy. https://t.co/KMhY6MyE6e pic.twitter.com/CB8JXeMgMe

— Santiment (@santimentfeed) March 21, 2022

The growth of USDT holder activity perfectly coincides with Bitcoin price’s changes, which rose from a $37.8K bottom one day prior to the first USDT spike. The flagship crypto is trades at above $42.5K as of today’s course.

Sponsored

The increase of assets held on exchanges indicates that market participants are more willing to sell than hold. As stablecoins are typically considered a base currency to hold before allocating funds to more risky digital currencies, the growth of their inflows may be a reflection buyers’ plans to use stablecoins to buy more cryptocurrencies.

Santiment claims that this has historically been perceived as a bullish sign, and encourages crypto traders to keep an eye on the diminishing stagnancy.

Balances on Exchanges Grow

The balance of the dollar-pegged USDT on crypto exchanges reached over $4.3 billion today, according to data from another crypto market analytics firm, Glassnode. This is still one of the highest numbers since March 1st, when record highs of over $5 billion USDT were seen.

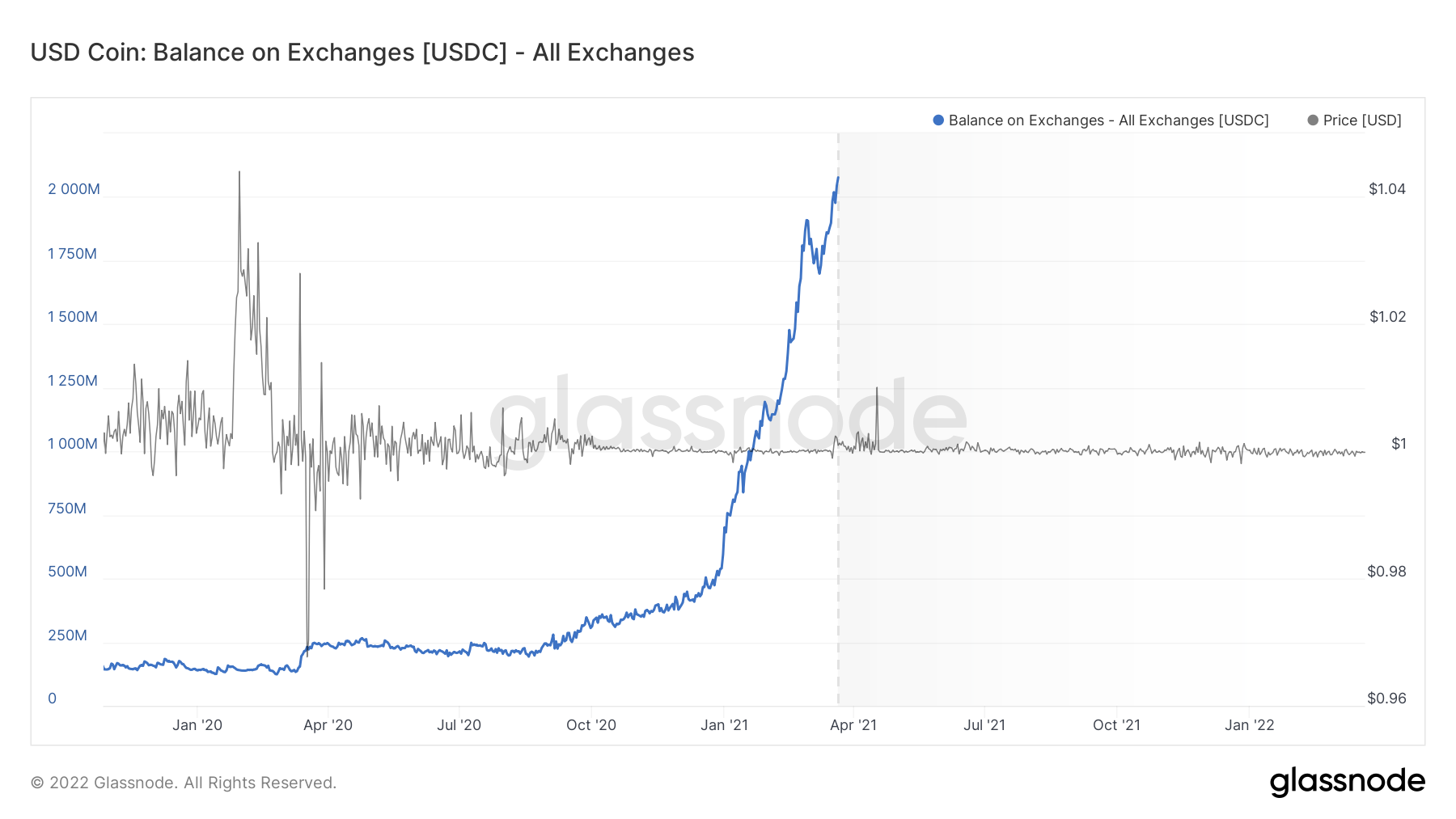

In addition to increased USDT inflows for trading platforms, USD Coin (USDC) balances are also hitting all-time milestones, with more than $2 billion USDC being currently held on crypto exchange addresses, which is more than 20% of the total USDC supply.

Bitcoin’s Price Stabilizes

In the midst of these signals, Bitcoin briefly crossed the $43K level today, climbing by nearly 6% in the past 24 hours. BTC went on to slightly correct, dropping to its current price of $42.5K at the time of writing. However, such levels have not been seen since the early days of March.

Positive sentiment towards BTC’s price growth may be related to expectations for the United States Securities and Exchange Commission (SEC) to approve the first Bitcoin spot ETF.