- Ethereum-killer, Solana, leads by investment in cryptocurrency funds and products brought over the last week.

- In the last week, Solana has brought in $7.1 million, the largest sum among all digital assets over the period.

- The high-speed blockchain network has received increased attention in its blockchain and ecosystem.

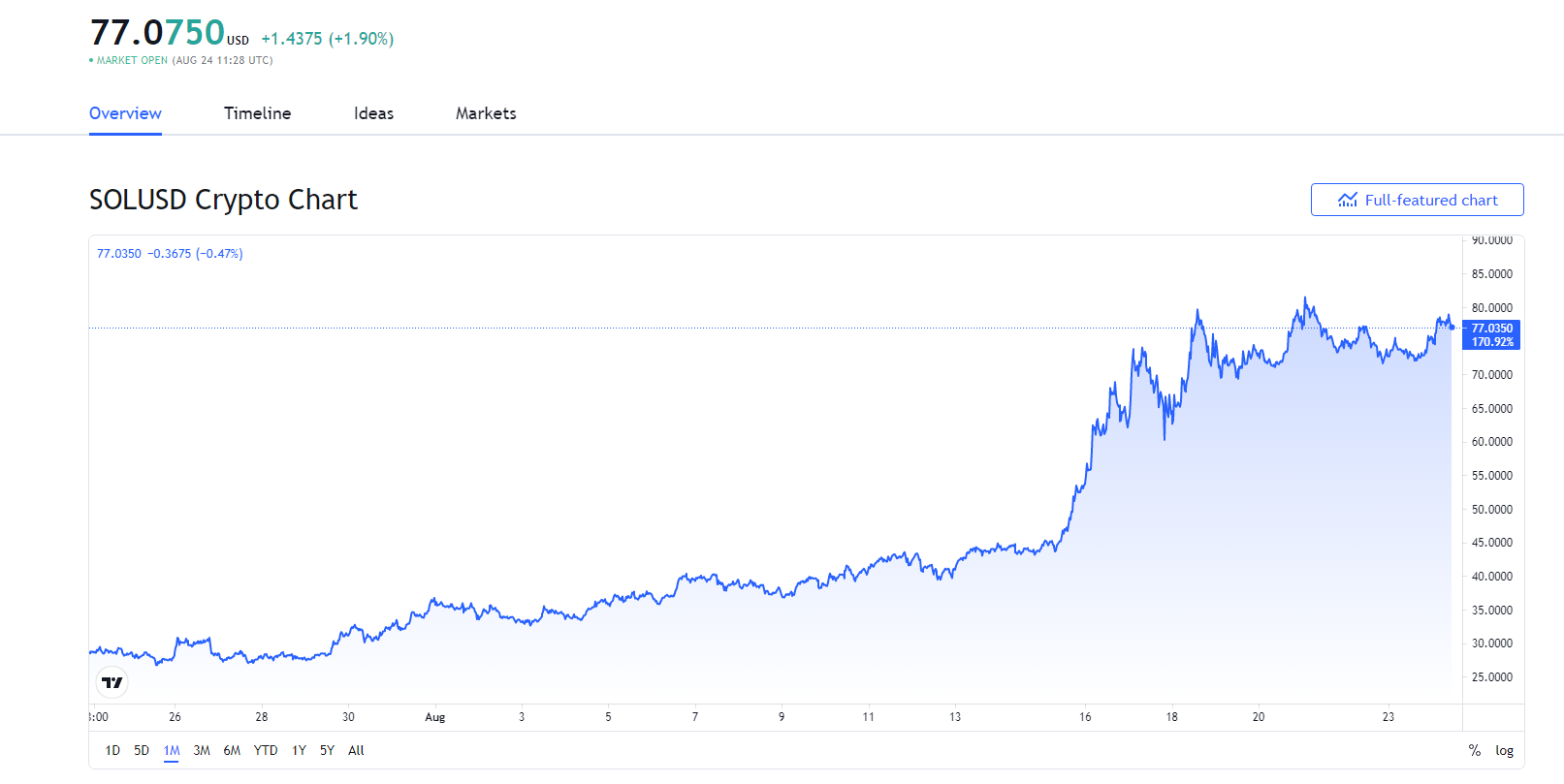

- The price of Solana tokens, SOL, has also reached an all-time high of $81.81, after doubling in value in August.

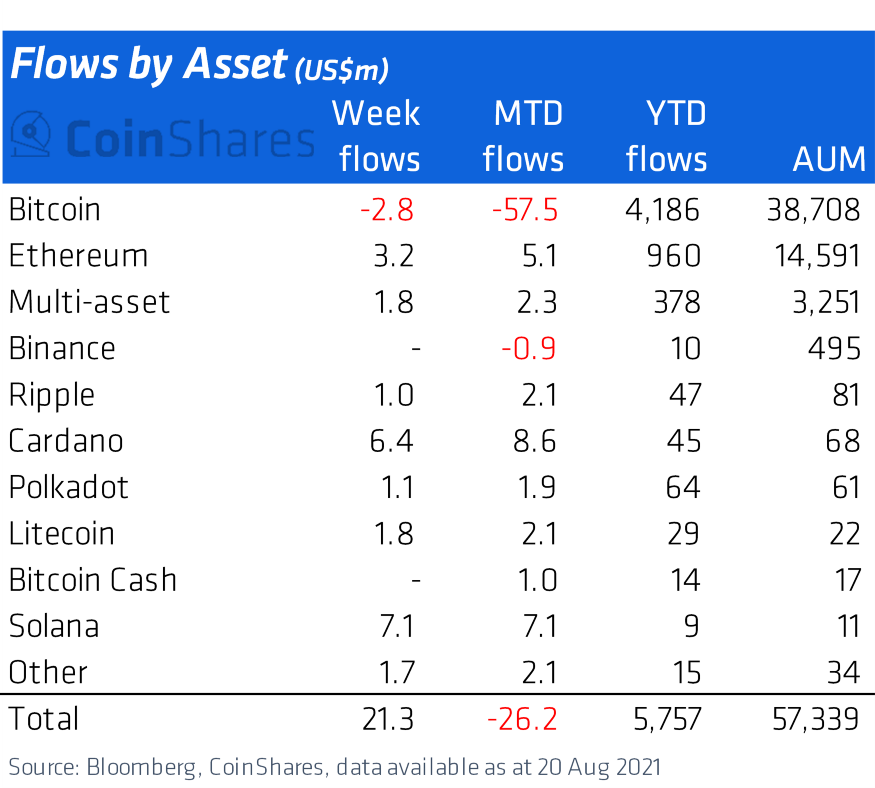

2021, the year of institutional adoption for the crypto industry continues as prophesied. Crypto funds now hold $57.3 billion in total assets under management, which is the highest amount held since mid-May.

While the celebration of the extended involvement of institutions in the crypto industry continues, Altcoins seem to be stealing the spotlight from the founders, Bitcoin and Ethereum.

Waning Bitcoin Funds?

The institutional Bitcoin (BTC) products saw outflows for the seventh consecutive week. While Solana topped the inflows this week, Bitcoin recorded $2.8 million in outflows over the same period.

Sponsored

Solana, which is considered an Ethereum-Killer, killed the competition in terms of institutional investments, bringing in $7.1 million. Solana has been attracting attention due to the capital inflows into several projects that are based on Solana’s blockchain.

Weekly update on Institutional Investments. Source: CoinShares

Equity derivatives trader and volatility vet, Jake Weinig, believes other Altcoins will have their time to shine. At the announcement of the launch of his Iceberg Bitcoin Income Fund, he confirmed the shift in focus to other cryptos. Weinig noted that his crypto fund is “going to be tremendously focused on alternative coins.” He also believes that it is “the next wave.”

Sponsored

Remarkably, Solana was one of the two DeFi protocols linked with the fund early on, the other being the Luna Protocol. Solana, which hosts one of the fastest blockchains currently available, has attracted many projects to its ecosystem.

Members of the Solana community are clearly pleased with the development. BlockTales wrote;

“Institutional investors are loading #Solana $SOL, with 1/3rd of inflows to #crypto products being invested in instruments tracking Solana this week SOL gained 1.4% on the spot markets over the same period, it gained 110% from $35.58 since the start of August to trade for $75”

On The Flipside

- While Solana leads this week’s crypto institutional investments, many believe it won’t last long.

- Famous crypto trader, Pentoshi, believes that Bitcoin will remind investors ‘who the king is.’

- He wrote, “and Bitcoin truly is to go to new ath’s. It will remind everyone who the king is.”

Price Break Out for Solana (SOL)

Following the rise in institutional interest in Solana, the price of SOL tokens peaked alongside it. The tokens, which opened for trade in August at $36.68, are now trading at $77.07, at the time of writing.

SOL fell to its lowest point of $33.19 on August 3rd before surging during an intense bull run. Solana reached its highest point on August 20th ($81.81), which represents a rise of more than 125%.

Thirty day price chart for Solana (SOL). Source TradingView.com

In the last 24 hours, SOL has seen an increase in trading volume of 26%, and an increase in its market cap of 8%.

The Solana community has been flooded with positivity since the breakout, Many of whom are expecting further gains in the coming days; as SOL climbed to a new high, Crypto Geek Indonesia wrote;

“$Sol brakin out as predicted. #Solana”

“#SOLANA The 2nd leg is just getting started for many. Be patient... it's worth the wait.”

Sir Lawis believes the same, but opines brief consolidation is a necessity before Solana can break out even further. He wrote;

“$SOL is consolidate a bit before the next big move, +85% in 10 days deserve a bit of rest sir, be aware of the breakout. But IMO, it is just the beginning of this huge ecosystem #Solana #SolanaSummer #COPE.”

Why You Should Care?

Solana and Cardano lead the institutional investment for the week, showing just how quick Altcoins are catching up in the industry. This also means that Bitcoin and Ethereum are no longer the only appealing cryptocurrencies in the industry.