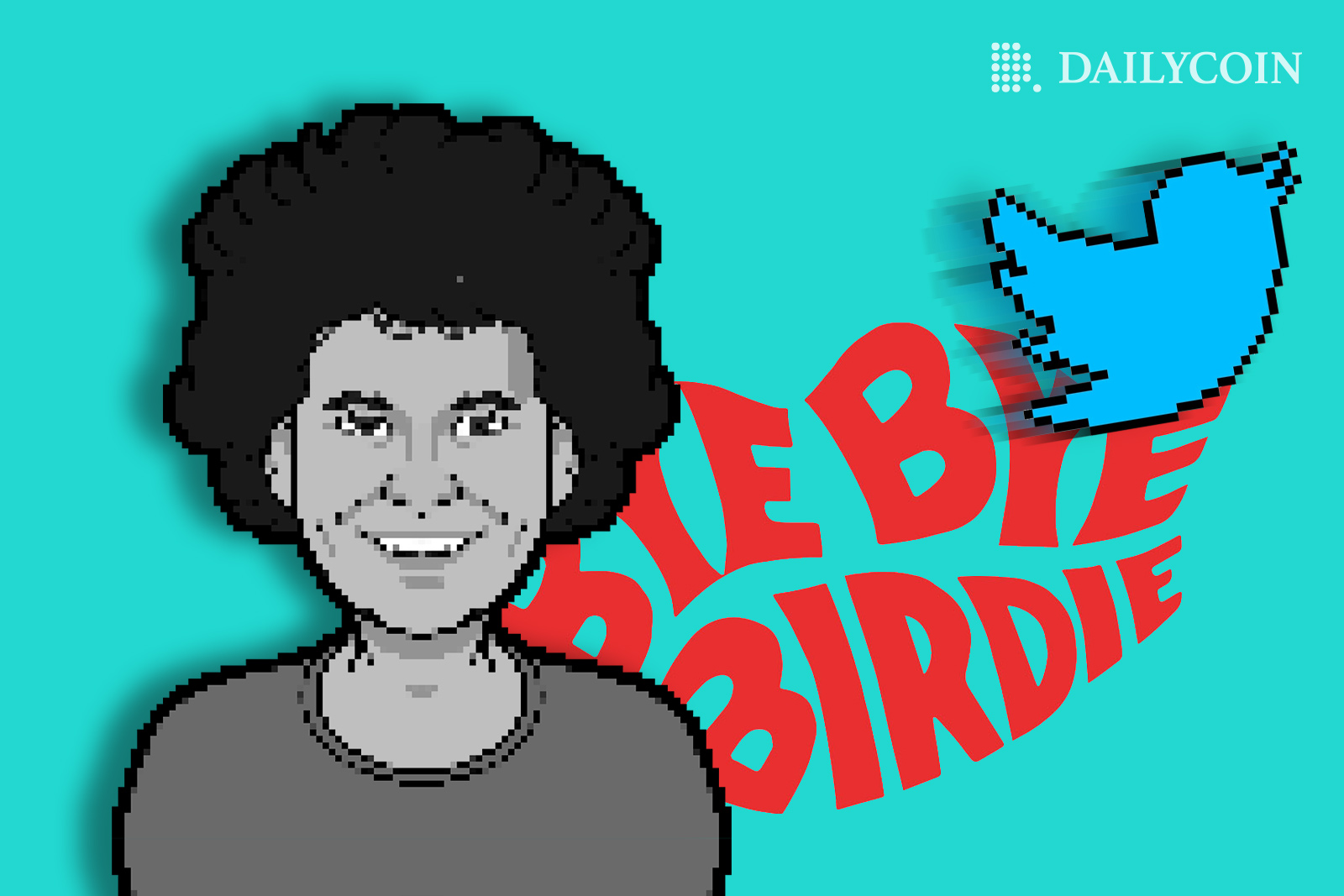

Crypto billionaire and founder of FTX, Sam Bankman-Fried, has revealed that his company was interested in taking part in Elon Musk’s $44 billion acquisition of Twitter, but passed on the investment due to differing visions.

SBF Explains Why FTX Passes On Twitter Investment

In a recent interview, the founder and CEO of FTX, Bankman-Fried explained that they passed on the opportunity to invest in Twitter due to differing views of the platform’s future.

Sponsored

While speaking at the first Forbes Iconoclast Summit on Thursday, November 3rd, Bankman-Fried explained that the vision Elon Musk has for Twitter is not exactly the same as his.

In August, court records showed text messages where SBF indicated an interest in the Twitter investment. However, SBF said it “didn’t feel like it made sense for us to be involved” since their goals didn’t align.

Bankman-Fried Wants A Decentralized Twitter

The FTX boss explained that his vision was to implement Web 3.0 technology into the micro-blogging platform by adding crypto-wallet elements to tokenize the identities of Twitter users.

SBF concluded that Musk did not have enough of a Web 3.0 focus, saying

Sponsored

“He (Musk) was going for something less payment-oriented.”

On October 27, 2022, Elon Musk completed the Twitter deal for $44 billion after months of back-and-forths.

On the Flipside

- Rival cryptocurrency exchange billionaire, Binance, joined Elon Musk in his purchase of Twitter, with a $500 million early investment, also showing interest in Web 3.0-focused Twitter.

Why You Should Care

Although the visions of SBF and Musk didn’t align, the Twitter deal has been much talked about, especially with plans to integrate crypto into the social media platform.

For more info on the Twitter acquisition, read:

Elon Musk’s Takeover of Twitter and His Relationship with Cryptocurrencies

Read about why Binance invested in the deal below:

CZ Reveals Monetization and Free Speech Drove Binance’s Investment, Plans ‘To Bring Twitter Into Web 3.0’