- XRP is currently navigating within the confines of a long-term symmetrical triangle pattern in the market.

- XRP is trading within a short-term descending parallel channel.

- The current market trend suggests that XRP may be in the midst of an A-B-C corrective structure.

The XRP Price and Its Future Outlook

Symmetrical Triangle Formation

Since June 2022, XRP has traded within a symmetrical triangle pattern, a chart pattern in technical analysis where a series of lower and higher lows characterize the price action.

Sponsored

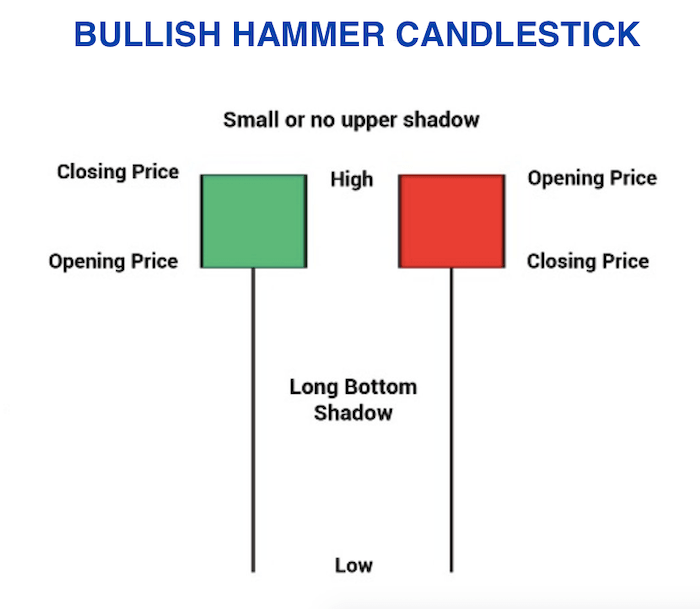

This triangle pattern has both resistance and support lines being repeatedly validated. These supports and resistances are lines at which heavy trading volume has occurred. On January 2, 2023, a bullish hammer candlestick was formed, a single-price candle with a small body, long lower shadow, and little or no upper shadow signaling an upward movement.

Bullish Hammer Candlestick Explanation. Source: Learn Stock Market

Despite an increase above the $0.380 area, the price failed to break out from the triangle and was consistently rejected for nearly one month. The XRP price has now decreased below the $0.380 area again, causing the daily relative strength index (RSI), a momentum oscillator used to measure the speed and change of price movements, to drop below 50, a bearish sign.

Sponsored

A potential breakout or breakdown from the triangle pattern could determine the future price trend direction. A breakout could take the XRP token toward $0.505, while a breakdown could bring it to its 2021 lows at $0.300.

XRP/USDT Daily Chart. Source: TradingView

The 4-Hour Time Frame

The XRP price could be nearing the end of an A-B-C corrective structure, in which waves A and C had a 1:1 ratio. For this count to remain valid, the XRP price must soon reverse the trend.

A decisive breakdown from the channel and the 0.618 Fibonacci retracement support level would invalidate the bullish XRP price forecast and potentially bring the price down to $0.300.

The 0.618 Fibonacci retracement level is a technical analysis tool used to identify potential support and resistance levels. It is calculated by finding the 61.8% retracement level between a significant high and a low.

XRP/USDT Four-Hour Chart. Source: TradingView

Based on the current analysis, it is likely that the XRP price will soon reverse its bearish decrease and attempt to break out from the triangle. However, if the price closes below $0.360, this hypothesis would be invalidated, and the price could drop to $0.300.

On the Flipside

- While chart analysis can provide insight into potential price movements, it’s crucial to remember that unexpected events can impact the market and alter the current outlook.

- Market sentiment, which can contradict technical indicators, can also result in unexpected price movements.

- While technical analysis can help predict future price movements, multiple interpretations of the same chart could result in varying predictions.

Why You Should Care

As XRP is closely watched for its price movements and potential to play a role in the crypto and blockchain industry, understanding the current market conditions and key indicators can greatly impact its future development.

Find out more on recent changes at Ripple:

Ripple Shakes Up Leadership Ahead of XRP Lawsuit Outcome – What to Expect in Advance – DailyCoin

For more information on the SEC and Ripple Lawsuit:

Ripple vs. SEC Saga Approaches an End as Crypto Firm Files Final Submission – DailyCoin