- Ripple has stated that South Korean regulators and policymakers need to consider a more targeted approach.

- Ripple has emphasized the significance of regulatory clarity for digital assets in South Korea.

- Ripple’s whitepaper from March 14th, 2022, has suggested policy recommendations to achieve regulatory changes.

Digital assets have gained significant attention and investment in recent years, and governments worldwide are grappling with how to regulate this rapidly growing market. South Korea is no exception and has introduced regulations for Virtual Asset Service Providers (VASPs) to address consumer protection and risk management.

The broad scope of implementation has posed challenges for firms providing digital asset solutions that are not VASPs, leading to a cautious approach by onshore firms.

Addressing these issues, Ripple’s most recent press release, dated March 14th, 2023, emphasized the importance of regulatory clarity and a clear taxonomy for digital assets in South Korea.

The blockchain-based digital asset company believes that the information they have provided is essential for ensuring consumer protection and managing risks in the rapidly growing market.

Ripple on South Korea’s New Guidelines

Ripple has stated that South Korean regulators and policymakers would need to review the licensing requirements and consider a more targeted approach to regulation that does not stifle innovation.

Sponsored

The blockchain firm argues that a one-size-fits-all approach by South Korea will not be appropriate for all digital assets and that more nuanced regulations will be necessary.

To further tackle the challenges facing the digital assets sector in South Korea, Ripple recommends undertaking efforts to educate consumers about the risks associated with investing in digital assets and provide more robust consumer protection measures.

Sponsored

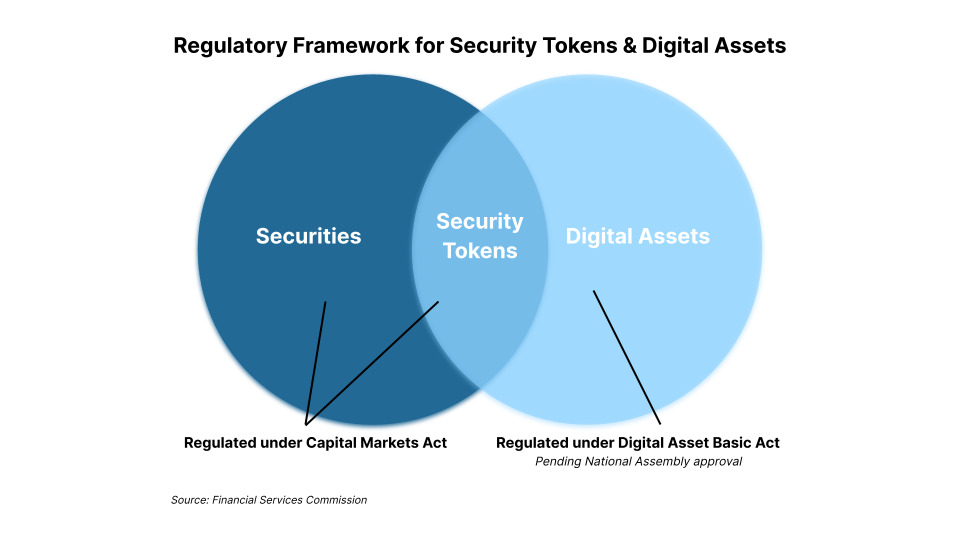

This complements recent publication guidelines by South Korea’s Financial Services Commission (FSC) for defining digital assets as security tokens (STOs). The outline represents a significant step towards regulatory clarity for the country’s digital assets sector.

The guidelines outline the characteristics that digital assets must have to be considered STOs, including providing a stake in the operation of a business, bearing rights to dividends or residual property, and attributing profits generated from the business to investors.

Ripple Highlights Importance of Digital Asset Taxonomy

Ripple’s press release refers to a previous whitepaper written on March 14th, 2022, which emphasized the importance of regulatory changes to encourage innovation in South Korea’s digital asset market. The whitepaper also suggested policy recommendations to achieve this goal.

An essential part of the policy framework was adopting a clear digital asset taxonomy that aligns with global best practices. They stated that this would help distinguish between payment tokens, utility tokens, and security tokens, ensuring that each type of digital asset is subject to the appropriate regulations.

On the Flipside

- While the FSC’s guidelines defining digital assets as STOs are a step towards regulatory clarity, there are still questions about how this will be implemented and whether it will be sufficient to address the challenges faced by the market.

- The South Korean government has recently announced plans to revise the current digital asset regulations to address some of the challenges faced by the industry.

Why You Should Care

Regulatory clarity is crucial to ensuring consumer protection and risk management. Ripple’s emphasis on this issue and the recent publication of guidelines by South Korea’s FSC is an important step towards providing clear definitions for digital assets in the South Korean market, which would help distinguish between different types of digital assets and subject them to appropriate regulations.

For more information on South Korea’s regulation of cryptocurrencies, check out the article:

South Korea Unveils Guideline for Regulating Cryptocurrencies as Securities

To learn more about the impact of Silicon Valley Bank’s collapse on the cryptocurrency market, read:

Crypto Rallies Amidst Traditional Banking Crisis