- Over the last week, crypto outflows hit $32 million for the first time since December 2022.

- The outflow, caused by the crackdown on crypto companies in the United States, saw Bitcoin bear the burnt, with outflows of almost $25 million.

- Despite the outflows of crypto products, the prices of digital assets have been on the rise, with Bitcoin gaining 10% in the same week.

Last week, the United States regulators’ crackdown on the crypto industry resulted in digital asset investment products recording net outflows totaling $32 million as institutional investors exercised caution.

Fleeting Negative Sentiments?

Crypto products recorded $32 million in net flows last week, snapping a six-week run of inflow. The outflows also mark the largest withdrawal from crypto funds since late December 2022.

Sponsored

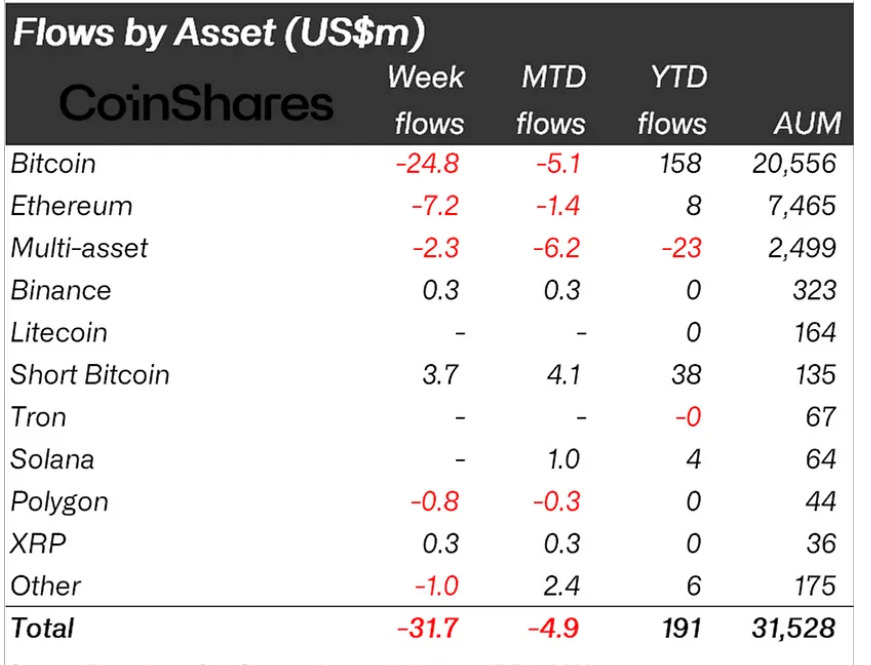

According to data from Coinshares, mid-way through last week, the outflows were much higher at $62 million amidst negative sentiments. However, sentiments improved, and Friday brought inflows of $30 million to cut the damage.

Bitcoin (BTC) recorded the highest outflows of $24.8 million amidst the negative sentiment last week. The major reason for the outflows from crypto products was the regulators’ crackdown on crypto companies in the U.S.

Investors React and Respond

Last week, the New York Financial Regulator ordered Paxos to stop minting new Binance USD (BUSD) stablecoins on the back of a potential SEC enforcement action against the stablecoin issuer.

Although the SEC is yet to take any action against Paxos, the week before, the regulator expressed its desire to crack down on crypto staking providers, which it refers to as unregistered securities.

Sponsored

Crypto exchange Kraken was forced to pay a $30 million settlement fee and close its staking program for breaching U.S. securities law.

The Crypto Market is Not Letting Up

The negative sentiments amongst investors of exchange-traded products (ETP) failed to affect the broader market, with the market soaring amidst the crackdown on regulators on crypto companies.

During the week of the outflows, the price of Bitcoin (BTC) rallied by 10% as it pushed toward the $25k mark. Similarly, the broader market is on an uptrend, as the global crypto market cap holds above $1 trillion.

The rising crypto market prices have sent the total assets under management (AuM) above $30 billion, their highest level since August 2022.

On the Flipside

- While crypto recorded outflows, blockchain equities saw inflows of $9.6m. The six consecutive weeks of inflows highlight a more constructive sentiment amongst investors for blockchain.

Why You Should Care

The report shows how institutional investors react to regulators and how these actions can affect the entire cryptocurrency market.

The crackdown on Paxos is covered in:

SEC to Sue Paxos Over BUSD, Ordered to Stop Issuance

Read more on the SEC action against Kraken below:

Kraken Pays $30 Million Fine and Shuts Down Staking Service in SEC Settlement, the Crypto Mom Reacts