A bull market is prime time for both investors and pig butchering scammers.

With the crypto market entering a new bullish cycle, it won’t be surprising to see insidious fraudsters ramp up their operations accordingly.

DailyCoin continues its series of pig butchering scams deconstructions. This time, we explore common tactics and red flags of this financial fraud.

Phases of Pig Butchering Scams

Pig butchering is the term for financial fraud that combines romance and investment scam schemes and follows a sequence of phases designed to manipulate and deceive.

Sponsored

The scheme always begins with a seemingly innocent conversation to build trust and establish a connection. Eventually, fraudsters introduce an alluring investment method, often based on insider knowledge.

When victims become intrigued, scammers collect their funds, encouraging them to invest even more. Once they have amassed a substantial amount, scammers abruptly disappear.

Sponsored

In each of these phases, there are almost always the same repetitive warning signs that victims of pig butchering scams often miss.

An Accidental Contact

A pig butchering scam is an industrialized criminal business where fraudsters search for victims en masse. Typically, they initiate contact via a dating app, social media, or by texting a “wrong number.”

Their excuses could vary from a wrong friend message to a job interview invitation. But the main idea is the same: to engage you in conversation.

“It’s best to stop here. Ignore the messages and don’t respond to them. Otherwise, you’ll be tricked further into “sweet talk” aimed at building a closer connection with you,” a spokesperson of the Lithuanian Criminal Police Bureau has told DailyCoin.

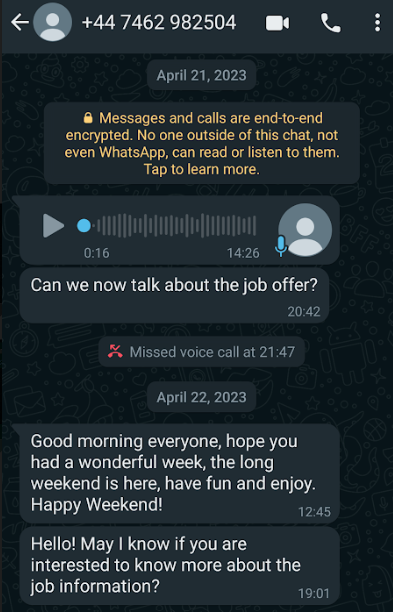

Moving to Private Messaging

If you meet scammers on social media or dating apps, they will soon ask to move communication to WhatsApp or Telegram. They will say it’s more private, or they’re better accustomed to using it. But don’t be fooled.

The true reason is that they fear their social profiles will get blocked before they drain your funds. Social networks often block suspicious or scam-related accounts thus fraudsters are in a hurry to leave them ASAP.

When on Telegram or WhatsApp, texting may last for weeks. Scammers are proactive, sharing snippets of their daily lives, making the victims more invested emotionally.

Keep in Mind:

“Scammers may change their phone numbers during this phase, claiming that they’ve been hacked,” says Marius, a pig butchering scam victim, whose story DailyCoin covered here.

“They avoid meeting you live. For instance, if you matched on Tinder and are both in the same city, scammers will make excuses for not meeting you in person.”

An Alluring Persona

Pig butchering scammers aim to lure you into fake investments and highlight their personal success stories to gain your trust. They often boast about successful investments and showcase a luxurious lifestyle funded by investment gains.

They feed you with pictures or videos of their luxurious setting. Typically, such footage does not include the fraudsters themselves. Why? Because it’s a stock visual intended to be shared with numerous victims.

Scammers may also share screenshots of their investment results. However, these are typically cropped, showing only transaction details and never additional data, like the platform’s logo.

“This is because they run multiple platforms at once with a similar interface,” explains Marius.

Keep in Mind:

Fraudsters use fake or stolen identities. Search the internet for such a person by name or photo. You will find nothing about them or come across a person from a different region whose profile was stolen.

Check the photos using reverse image search, and you may be able to identify their initial source.

Promising Investment Opportunity

Once trust is established, scammers actively shift to talking about investments. They will claim they have become wealthy through trading based on insider knowledge.

Their brother, sister, uncle, or aunt has a connection with the insiders who provide signals on when to buy or sell. They trade on these signals for an agreed profit fee.

Then the main bait is thrown – the scammers invite you to join them. It’s all done automatically, they promise; you don’t need to understand anything.

“The offer sounds too good to be true. Scammers promise risk-free investments, guarantees, double or even triple returns, and so on,” warns the Lithuanian Criminal Police Bureau. “It's important to critically evaluate all promises and remember that investing always involves risk.”

Keep in Mind:

If you request more time to think, scammers may ask you to keep their suggestions a secret. They explain that the fewer people who know about it, the lower the risk of the insider being exposed. The question is, then, why do they share this information with strangers?

Fake Investment Platforms

When the victim is already hooked on investing, scammers suggest opening an account on their chosen investment platform.

The latter typically is one you’ve never heard of, but scammers praise it as tested and trusted and having more advanced trading tools.

“Scammers have answers to all your doubts. So, if you suggest trading through a well-known broker, they will tell you that there are limited opportunities, low leverage, not worth wasting time,” explains a victim of a pig butchering scam.

Fake trading platforms usually mimic the interface of existing genuine ones. They have functioning features and reactive customer support and, in principle, do not differ from legitimate counterparts.

However, the lifespan of fakes is only a few months until scammers lure money in. Later, they are shut down, and new clones are created with different names and designs.

Keep in Mind:

Scammers put effort into making fakes look legit. Their platform’s contacts may include a registration address and the licensing country. However, this is not necessarily true.

Verify the facts. Check publicly available sources, the corporate registers of countries, and confirm if the company is officially registered. Treat it as a significant red flag if you find no official records.

Examine the website’s domain and when it was officially registered. Sometimes, the website’s age does not match the company’s claim of years in business.

Push to Invest More Money

Another alarming signal of the pig butchering scam is the imminent push to increase the account balance soon after the victim makes an initial deposit.

Arguments may vary: to unlock higher leverage, a wider choice of advanced trading products, or insure against risks.

“One of the distinctive features is pressure, and sometimes even the demand, to make investment decisions as fast as possible, leaving no time for deliberation or consultation with a trusted specialist,” states the police.

Once scammers receive substantial funds, they fabricate gains in victims’ accounts. The latter see healthy growth and nice profits. However, the problems start once they attempt to withdraw.

Keep in Mind:

Fake platforms may initially simulate successful withdrawals and then claim that funds are stuck in smart contracts or for another reason. If the victim runs out of money, scammers push them to take out loans, warning that otherwise, the money may disappear. They argue that it’s not profitable for the broker to keep inactive funds.

Keep researching online reviews and comments about the specific investment platform. Since these platforms typically last only a few months, reviews from other victims often appear during that time.

Broker Dissapears Together With Scammers

Finally, the fake trading platform suddenly disappears when the victim is completely drained. Once it’s gone, all related acquaintances become inaccessible by any means as well.

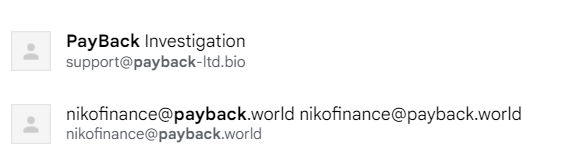

However, the trouble usually doesn’t end here. Scammers often return in a few weeks pretending to be a financial authority or a money recovery service, promising to help recover lost money by requesting an advance fee.

Keep in Mind:

Fraudulent websites often use a domain name referencing authorized and trusted money recovery firms. Double-check the domain name for misspellings and typos.

Remember that legitimate money recovery firms never ask for a fee in advance.

Key Takeaways

So, what do you do if you suspect a scam? First and foremost, slow down. Take a breath, and think it through if someone you don’t know is offering an investment that looks too good to be true.

Consult a friend or family member that you trust. Ask for a second opinion. Conduct research, and seek out reviews before making any investments.

Avoid dealing with unknown brokers or trading platforms, especially if verifying their legitimacy on official registries is impossible.

Strengthen your cyber protection. Check out your digital footprint to identify any exposed personal data that could make you a scammer target.

Check out the true story of a pig butchering scam victim:

Pig Butchering Scam Trails Blend with Russian Intelligence

Learn about fraudulent crypto signal trading schemes: