- PancakeSwap is overhauling its tokenomics structure.

- Part of the overhaul includes cutting the maximum token supply.

- The PancakeSwap team seeks community feedback on the proposal.

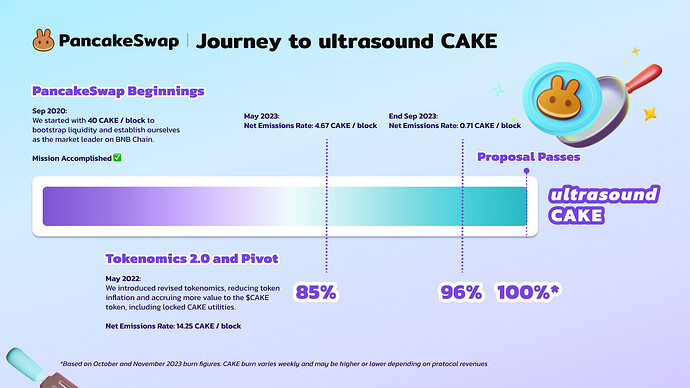

“Tokenomics” refers to studying how a cryptocurrency token can be best utilized. It considers concepts from economics, game theory, computer science, and psychology to ensure a sufficient reward structure for participants while establishing long-term sustainability. To improve its tokenomics, PancakeSwap recently proposed cutting its token supply as part of its “journey to ultrasound CAKE.”

PancakeSwap Proposes Supply Cut

Pancakeswap’s “journey to ultrasound CAKE” began in early 2023, intending to overhaul its tokenomics structure, including cutting the rate of new coins entering circulation and introducing vote-escrowed CAKE (veCAKE,) a secondary token enabling holders to vote for rewards and approving external protocols.

Another element in this overhaul to recapture former glories relates to a proposal to significantly reduce CAKE’s maximum supply from 750 million tokens to 450 million.

Sponsored

“With a current circulating supply of 388M CAKE, the Kitchen believes this new and lower cap will be sufficient to gain market share across all chains and sustain the veCAKE model,” commented the PancakeSwap team.

To sell the concept to the community, the PancakeSwap team stated that a supply reduction better reflects their revised understanding of incentives to achieve maximum growth. This would also move the protocol from its previous “hyperinflationary token model,” capping the change to the ultrasound CAKE model.

The PancakeSwap team called on the CAKE community to submit their feedback for consideration before the proposal goes live.

Community Feedback

A review of the community feedback so far showed that most users supported the proposal, with many comments expressing enthusiasm for the proposal to cut the token supply.

Sponsored

However, one user voiced frustration with his experience of locking his CAKE tokens for a long period, only for the token price to plummet during the lock-in period. Instead, this user shunned the proposal, recommending a cut to the maximum supply to match the existing circulating supply, cut rewards, and stop new CAKE from entering circulation. There was no explanation for paying rewards under a system where no new tokens entered circulation.

“You lost serious investors and need to get them back… do not mean few whales but thousands of small investors trusting this project and the team,” remarked the frustrated user.

On the Flipside

- It appears the decision to cut the token supply has already been made, with the feedback being a mechanism to accommodate valid suggestions.

- CAKE is down 94% from its $43.96 ATH in April 2021.

- The PancakeSwap DEX remains Binance Smart Chain‘s (BSC) leading DeFi protocol with $1.4B locked.

- Total value locked (TVL) in BSC has been declining in both dollars and BNB since 2021.

Why This Matters

PancakeSwap cutting its token supply may not be enough to counter the rising popularity of rival DEXs and other fresh, innovative “killer Dapps” on alternative DeFi chains such as Solana, Cardano, and Base, which are all gaining ground on BSC.

Read about the latest gaming development on the PancakeSwap marketplace here:

BinaryX Launches City Building Game Pancake Mayor on PancakeSwap’s New Marketplace

Find out more on Max Keiser’s take on the pending Bitcoin ETFs here:

Max Keiser Slams Bitcoin ETFs as “Bait and Switch”