One in three NFTs ends up as a dead collection with little or no trade activity after it has been minted, says Nansen, the blockchain analytics firm from Singapore.

The firm published a report of their study on trends related to NFT minting today. As their data revealed, a third of newly mined NFT creators set higher floor prices than initial minting costs. Accordingly, one in three newly minted NFTs fails to attract investors’ attention and is never sold, says Nansen.

The firm published a report of their study on trends related to NFT minting today. As their data revealed, the proportion of minted NFTs that are sold on the secondary market has been gradually declining since July 2021.

Sponsored

On average, one in three newly minted NFTs fails to attract investors’ attention and never gets sold, says Nansen. A similar one-third of NFT creators set higher floor prices than initial minting costs.

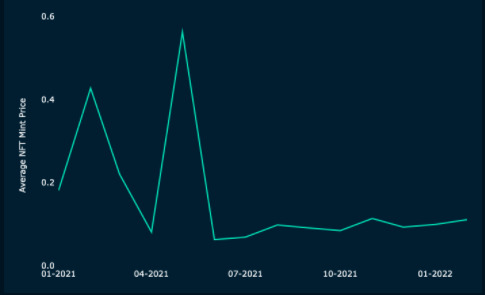

Nansen further discovered that the average NFT minting price has ranged between 0.07 ETH to 0.1 ETH since July 2021. The majority of the miners spent up to 0.5 ETH for their mints.

Analytics explain the drop as a consequence of the increased competition when more and more new NFT miners are entering the market.

Sponsored

The number of NFT miners surged by 2000 times within the past year, from approximately 500 NFT creators at the beginning of 2021 to 1.2 million NFT miners at the end of February 2022.

“Between January 2021 to February 2022, we saw the number of minted collections increase by over 4800%, from 39,802 collections to 1,970,886,” states the report.

As Nansen’s analytics revealed, from January 2021 to February 2022, an average of 44.8% of minted NFTs are resold on the secondary market each month.