Ten cryptocurrency tokens now approved for trading and eight for custody by one of the US financial watchdogs.

The New York State Department of Financial Services (NYDFS) issued an updated greenlist of tokens in the beginning of August, with 8 digital coins approved for listing and 10 cryptocurrencies approved for custody service.

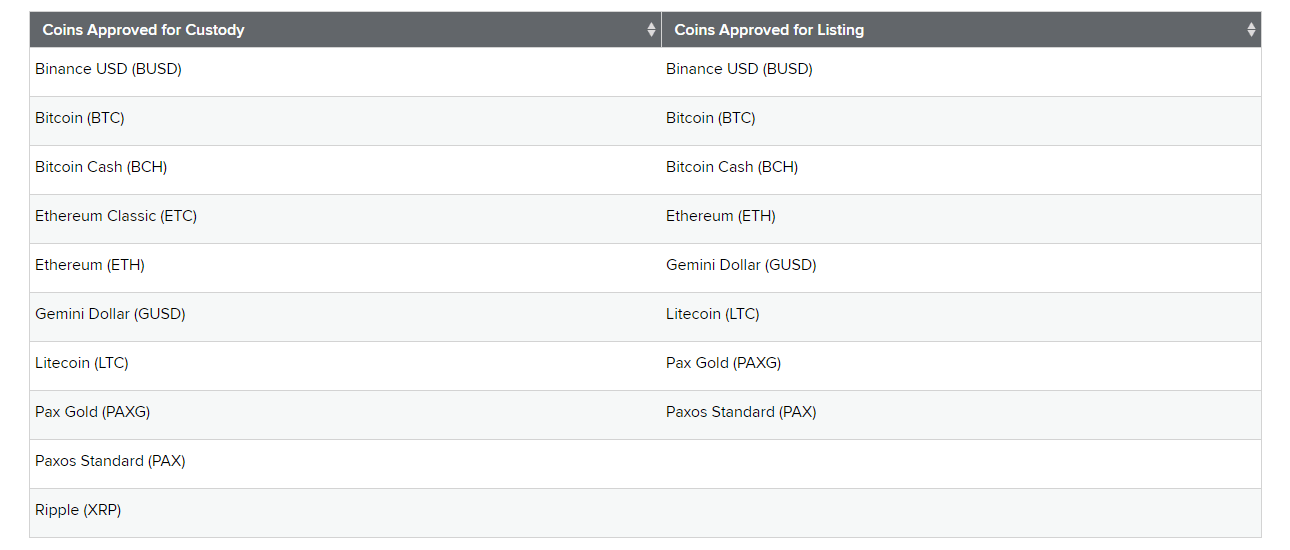

According to the official statement of NYDFS, the greenlist of coins approved for custody include Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), Ripple (XRP), Binance USD (BUSD), Gemini dollar (GUSD), Paxos Standard (PAX) and Pax Gold (PAXG).

Sponsored

Meanwhile, the virtual currencies allowed for listing include BitCoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), Binance USD (BUSD), Gemini dollar (GUSD), Paxos Standard (PAX) and Pax Gold (PAXG). Ripple (XRP) and Ethereum Classic (ETC) were both excluded from the second list.

The announcement further reads that any NYDFS-licensed company is allowed to use the listed virtual currencies for its own purposes, however only after informing the watchdog first:

Any entity licensed by DFS to conduct virtual currency business activity in New York may use coins on the Greenlist for their approved purpose(s). Note that if a licensed entity decides to use a coin on the Greenlist, it must inform DFS prior to beginning its use.

The NYDFS approval means that New York banks and other licensed financial institutions are now allowed to list or store any of the mentioned digital currencies without further approval from regulators, except the first one from NYDFS.

The financial authority started regulating the cryptocurrency industry back in 2015. Since then the NYDFS became the issuer of BitLicense, the main license for cryptocurrency-related businesses operating in the state of New York.

Sponsored

The list of NYDFS approved cryptocurrencies comes after the coin listing requirements proposed at the end of 2019. The guidelines included the option for companies operating with virtual currencies to adopt the specific coin listing policy, that allows license holders to self-certify the listing of a new coin.

A few weeks ago the cryptocurrency sphere in the United States witnessed the historic moment as the OCC, an independent financial institution watchdog, announced the permission for national banks to serve as both physical and digital asset custodians. The majority of the USA states adopted the laws and regulations related to cryptocurrencies earlier this year.