A nonprofit working towards scaling the Terra blockchain ecosystem and has managed to raise $1 billion through a private token sale.

As a result of the success, the Luna Foundation Guard (LFG) is aiming to establish a Bitcoin reserve for Terra’s UST stablecoin.

The Token Sale Leaders

The token sale was led by Jump Crypto and Three Arrows Capital; however, it also saw participation from GSR, Republic Capital, Tribe Capital, DeFiance Capital, and many others.

Sponsored

The fundraiser represents one of the largest to date within the crypto sphere, right next to NYDIG’s $1 billion funding round, which managed to raise its valuation to above $7 billion in December.

As an algorithmic stablecoin, the UST coin is pegged to a series of financial aspects within the broader Terra protocol.

This leads to movement above or below $1, and LUNA, which is Terra’s reserve, used for staking and as a governance asset, retains an elastic supply as a means of helping to neutralize market pressures.

Sponsored

Last year, Huobi Pool also launched Terra (LUNA) staking, to encourage more investor participation within its ecosystem.

On the Flipside

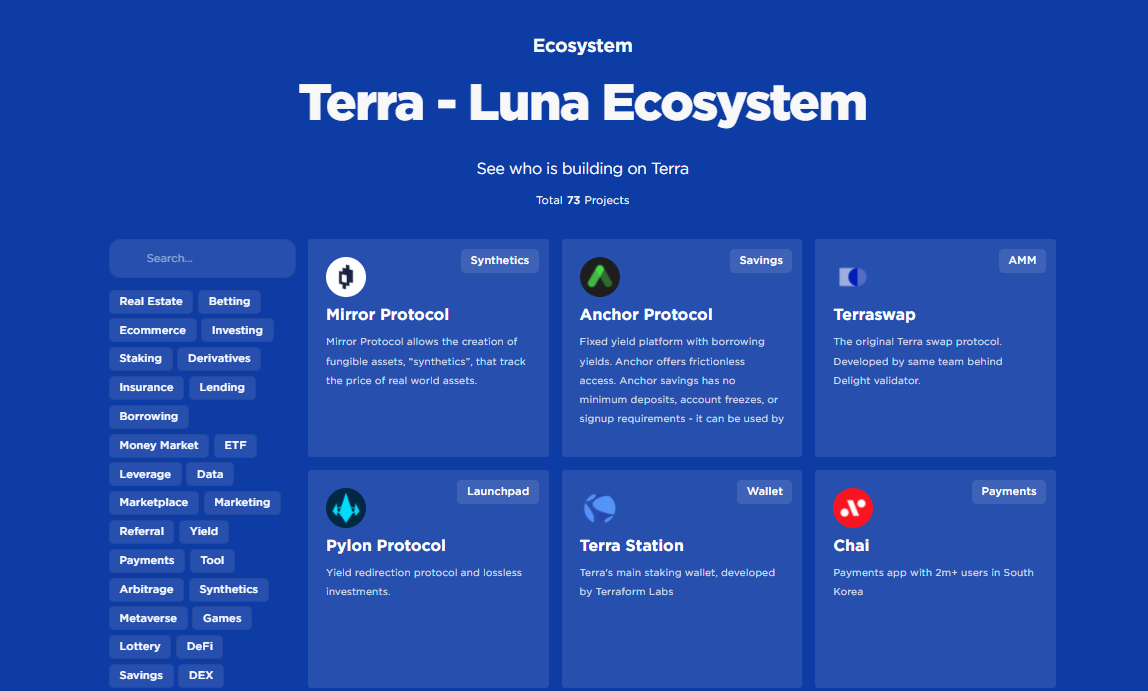

- Terra is a fast-growing blockchain that currently supports 73 projects, and the funding round has genuine potential to enhance the size of its overall ecosystem.

Why You Should Care

The token sale will initially capitalize on its UST Forex Reserve, with investor purchases locked over a four-year vesting period. The overall growth of the Terra ecosystem can contribute to the expansion of its overall value and utility, which may make it an appealing project in the eyes of a a wider range of people.