- Lido DAO wants to sell or stake the 20,304 ETH (worth around $30 million) it currently holds in the treasury.

- If the DAO decides to sell the ETH, the funds would be used to secure additional runway in current market conditions.

- Lido DAO might end up selling part of the ETH and staking what’s left.

Lido DAO (LDO), the governing body behind the largest Ethereum staking provider, is trying to decide what to do with its treasury ether ahead of the Shanghai upgrade, which will enable ETH staking withdrawals.

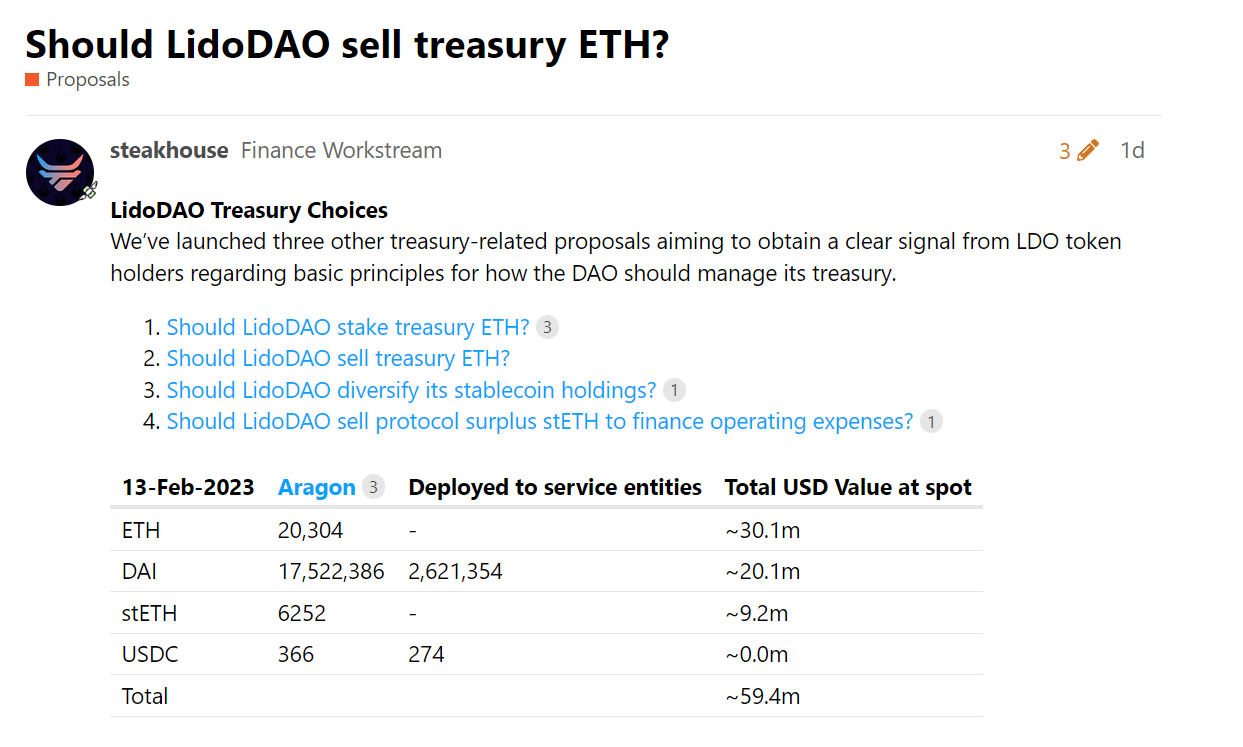

On February 14, Steakhouse Financial, the Lido DAO branch responsible for managing the treasury, made three proposals concerning the 20,304 ETH and surplus stETH the DAO holds.

Sponsored

One of the proposals outlined a plan to sell all or part of the treasury denominated in ETH. The 20,304 Lido DAO currently holds is worth around $30 million.

Lido DAO proposal. Source: Lido DAO.

One of the arguments for selling the ETH for a stablecoin is that the funds would be used to secure additional runway in current market conditions. Lido DAO, which also holds $20.1 million in DAI, currently has a monthly run rate of $1.3-$1.5 million. The DAO is also trying to decide whether it should sell the excess stETH to add to its operating budget.

Another option for the ETH in the Lido DAO treasury is to stake it. The proposals also said it’s possible to sell some of the ETH and stake what’s left.

Sponsored

Lido DAO is not the only DAO that’s been thinking of selling its treasury ETH recently. Ethereum Name Service (ENS) DAO voted in favor of a proposal to sell 10,000 ETH ($13 million) a week ago. The DAO wanted to decrease the treasury’s exposure to ETH, which had made up almost 100% of the treasury.

On the Flipside

- The voting on the proposals has not started yet.

Why You Should Care

Lido is the largest Ethereum staking service provider in the market. Users might find it interesting to see how Lido DAO manages its treasury and adjusts to the current environment in crypto.

You Might Also Like:

ENS DAO Passes Proposal to Sell 10,000 ETH in Single Transaction