- Unbanked regions get an advantage for peer-to-peer remittances.

- Circle’s USDC is empowering effortless cross-border payments.

- USDC’s stability eliminates cryptocurrency volatility, making it ideal for financial inclusion in unbanked regions.

Amid the growing interest in cryptocurrencies as an alternative to traditional finance, especially for remittances, doubts linger regarding their utility for widespread adoption. However, Island Pay has put together what it sees as a game-changer with the launch of its digital wallet in Latin America and the Caribbean.

In Latin America and the Caribbean, remittances surged by 27% in 2021 and 11% in 2022, reaching $145 billion last year. Despite the challenges posed by high remittance costs in the region, the use of cryptocurrencies, particularly Circle’s USDC stablecoin in conjunction with Island Pay’s CiNKO wallet, aims to revolutionize digital payments and provide a seamless solution for cross-border transactions.

Unbanked Regions Get Access to the USDC-Powered CiNKO Wallet

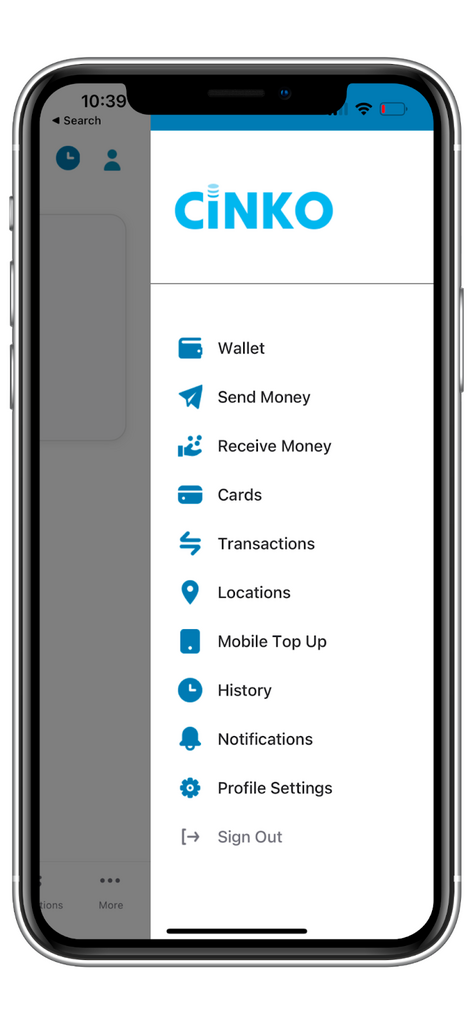

CiNKO will utilize Circle’s USDC stablecoin as its primary currency for seamless and stable cross-border remittances. Residents of more than 30 countries in the region will have access to the CiNKO wallet, enabling users to fund prepaid cards, make peer-to-peer payments, and transact with merchants, all without requiring a bank account.

Sponsored

Latin America grapples with one of the highest inflation rates globally, averaging around 11% year to year. Traditional money transfers can take days, with the World Bank reporting an average cost of 6.2% for sending $200. USDC’s stability eliminates the volatility often associated with cryptocurrencies, making it an ideal alternative for remittances, at least on paper.

CiNKO Wallet’s Global Impact

While the project’s primary focus is on Latin America, Island Pay can extend the technology’s reach to other regions. CiNKO wallet, available for Android and Apple iPhone users, aims to onboard 100,000 users in Central and South America by 2024. According to Circle’s Chief Revenue Officer, Kash Razzaghi, the technology behind CiNKO is estimated to reduce the cost of remittances by 80%.

On the Flipside

- When using CiNKO wallets to receive USDC, recipients incur no direct costs. However, a “gas fee” associated with the blockchain used for the transaction may apply.

- Also, despite a projected growth slowdown of 3.3% this year, remittances are expected to reach an all-time high in the region.

Why This Matters

Island Pay’s CiNKO wallet launch with Circle’s USDC stablecoin in Latin America and the Caribbean is particularly significant due to the region’s high proportion of unbanked populations. By providing an accessible digital payment solution, the CiNKO wallet aims to bridge the gap, allowing users to make transactions, send remittances, and access financial services, even without a traditional bank account. This move towards financial inclusion in unbanked regions holds great potential for transforming how people manage and access their money, driving economic empowerment and growth.

Sponsored

To learn more about Circle’s strategic decision to capitalize on Japan’s new stablecoin legislation, click here:

Circle to Capitalize on Japan’s New Stablecoin Legislation

To stay updated on Indonesia’s launch of the National Crypto Bourse to enhance investor protection and regulatory oversight, click here:

Indonesia Launches National Crypto Bourse to Strengthen Investor Protection and Regulatory Oversight