Digital bulls rage on cryptocurrency markets. The world’s largest crypto Bitcoin breaks new all-time highs in a week. Altcoins with the leading Ethereum thrive to their own highs.

With all this boiling context in mind and the greed on its max, crypto space meets the Hamlet question: investing or trading? Which generates a better ROI (Return on Investment)? And even more, how much better?

Sponsored

Let’s do an experiment. Let’s take the same asset, trend, and timeline and calculate which way generates better profit.

Experiment rules

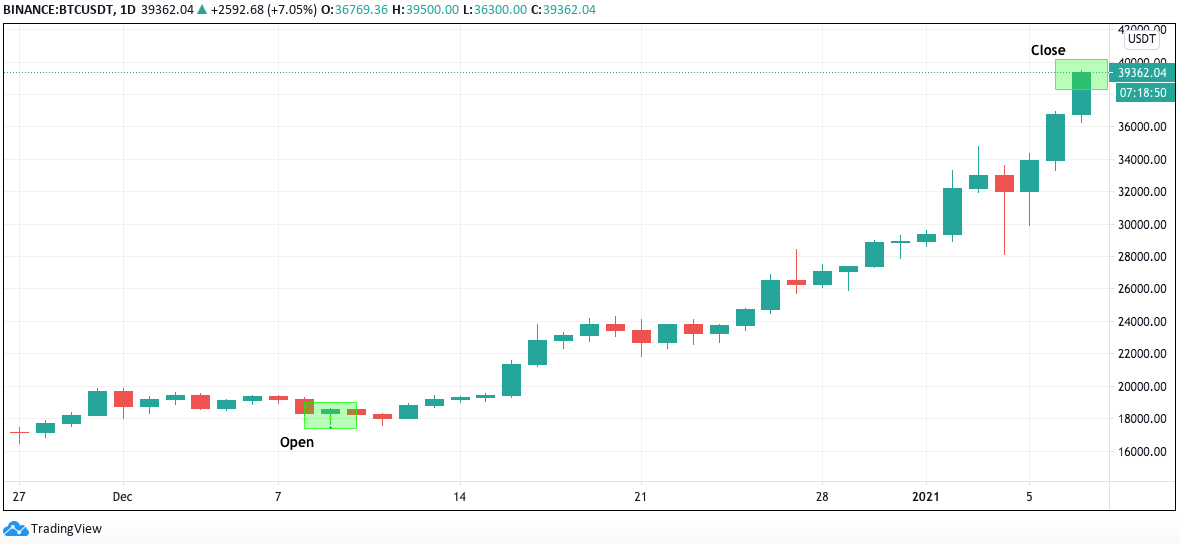

Before the start, let’s agree on the details. The experiment will monitor the price movements of Bitcoin. To be specific, the popular BTC/USDT trading pair.

We will open equal positions of $1,000 for both investing and trading options on Binance cryptocurrency exchange. Both positions will be set for the same timeframe of 1 month:

- Open position: BTC price – $17,950.07 (9 December, 2020)

- Close position: BTC price – $38,901.788 (January, 2021)

Accordingly, we will include ] trading fee into the final account to see the most accurate ROI difference between investing and trading options.

Experiment 1: Investing

Investing means purchasing a financial asset with the hope that it will increase in value. It is also more about accumulating capital gradually over time than about the quick short-term gains.

Investing is definitely less active than trading. Basically, it includes two actions: purchasing and selling. You buy and hodl hodl hodl through the ups and downs of the market.

How did we do it?

This is exactly what we did. On 9 December 2020, we fulfilled a 1,000 USDT buy order on Binance exchange. We bought 0,05571009 BTC for the price of $17,950.07 at the time.

Bitcoin was in the middle of an uptrend at the time. It kept growing wildly since the day we bought it, experiencing over a 100% increase in 30 days. We held it tight during a few minor drops and did not sell as it set a new record high on December 17 and January 4, 2021.

On January 8 it sat at $38,901.78 when we closed the position. This is a 116% increase since the day we bought it. Our initial investment is $20,951.71 higher in a single month.

ROI calculation

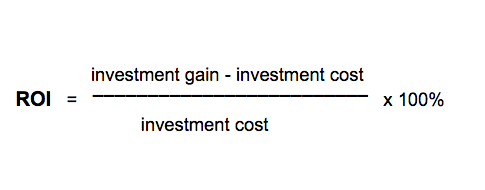

Return on Investment (ROI) is a financial ratio we use to calculate the benefit received from our investment. Simply speaking, it is a measure of success. The higher the ratio, the greater the benefit. To calculate ROI we will follow the universal formula:

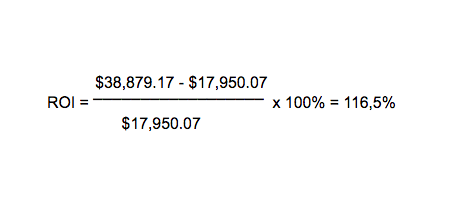

In our case investment gain is the amount at which we sold Bitcoin ($38,901.78). However, we paid transaction fees for opening and closing positions. Exchanges charge trading fees on spot markets depending on trading volume in the last 30 days.

Fees

Our trading volume is below 50 BTC, which is charged by a 0.10% fee for both maker and taker orders.

This means the BTC buy order fee is approximately $1 (1000 USDT/100 x 0.10% = 1 USDT). The BTC sell order fee sits around 2,16 USDT or $2,16 (0,05571009 BTC/100 x 0.10% x $38,901.78).

We also include 0,0005 BTC ( $19,45) withdrawal fee to transfer coins to our BTC wallet. This makes the total fees of $22,61 to and also lowers the investment gain: $38,901.78 – $22,61 = $38,879.17

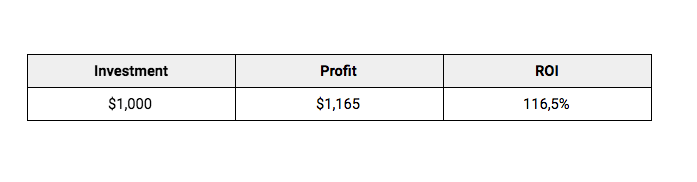

ROI

To calculate the percentage of ROI we have to subtract the initial investment cost ($17,950.07) from the final investment gain ($38,879.17), and divide the amount received by the initial cost. Then multiply the units by 100%. This is how it looks like:

To calculate the percentage of ROI we have to subtract the initial investment cost ($17,950.07) from the final investment gain ($38,879.17) and divide the amount received by the initial cost. Then multiply the units by 100%. This is how it looks like:

Experiment 2: Trading

Trading is a different approach to raising your capital. Contrary to the kind of “laid-back” investing, it means very active decision making, focusing on short term price movements and quick gains.

Day trading and swing trading are ones of the most popular forms of trading. Day traders open and close positions multiple times within the same day, they never hold overnight. Meanwhile, swing traders follow the trend that can continue for days or even weeks.

Trading is certainly a much riskier business, especially when leverages are used. This means traders borrow funds to increase their positions and profit from relatively small price fluctuations. Short selling is one of these trading options of amplified risk level.

How did we do it?

This experiment relies on a one-month time frame, which we chose as a compromise best suited to depict investment and trading ROIs. The 30 days period is yet too lengthy for day trading, thus we eliminate it from the calculation and only focus on swing trades.

Our goal is to compare possible profit, so we will not include losses into account. Neither we will not do short selling. We will enter the positions based on the clear support and resistance levels.

As in experiment 1, we opened the first position on 9 December 2020 on Binance. Spent 1,000 USDT to buy 0,05571009 BTC for a price of $17,950.07.

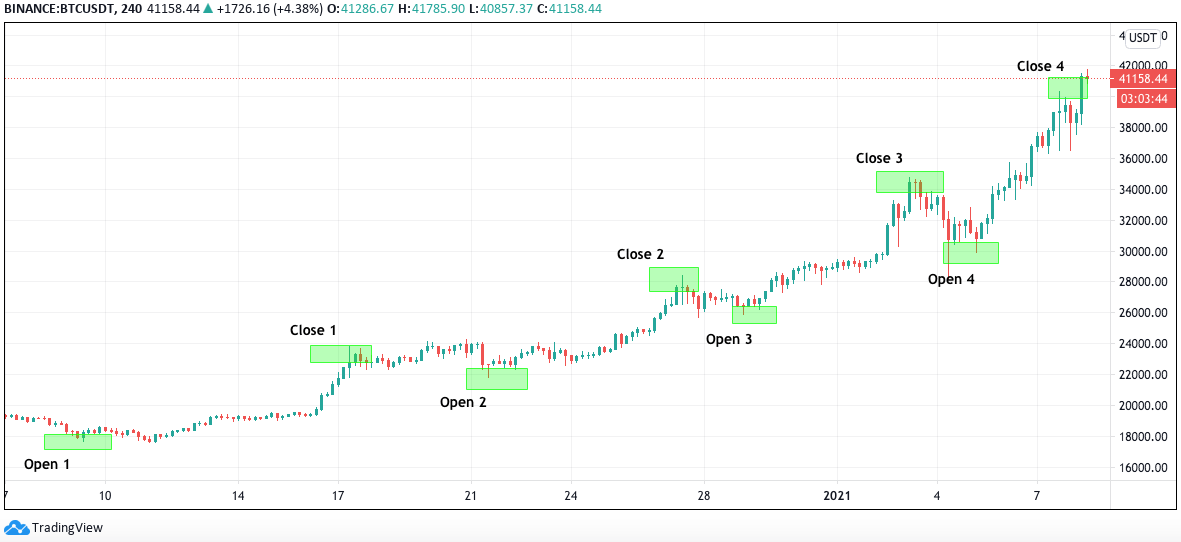

Then made 8 open and close orders in total within 30 days. Exactly like in the first experiment, the final order was executed on January 8, with the Bitcoin price of $38,901.78. Here is how all the trades looked like:

Trade 1

- Opened at $17,950.07 (December 9)

- Amount: 0,05571009 BTC

- Closed at $22,848.60 (December 17)

- Gain: 27%

Trade 2

- Opened at $22,230.73 (December 21)

- Amount: 0,05721809 BTC

- Closed at $27,707.64 (December 27)

- Gain: 24%

Trade 3

- Opened at $26,411.90 (December 29)

- Amount: 0,06001083 BTC

- Closed at $34,380.59 (January 3)

- Gain: 30%

Trade 4

- Opened at $30,882.21 (January 5)

- Amount: 0,06680221 BTC

- Closed at $38,901.78 (January 8)

- Gain: 26%

The last position closed with the 2,598.7 USDT (or $2,598.7) in the account, which we consider as our investment gain before fees.

ROI calculation

Fees

To know the final profit, we calculate all trading and withdrawal costs and exclude them from our investment gain. The trading volume of 30 days is below 50 BTC, thus the platform charges a 0.10% fee.

Trade 1

- BTC buy order (1,000 USDT) fee: $1

- BTC sell order (0,05571009 BTC) – charged $1,27

Trade 2

- BTC buy order (1,272 USDT) fee: $1,3

- BTC sell order (0,05721809 BTC) fee: $1,58

Trade 3

- BTC buy order (1,585 USDT) fee: $1,58

- BTC sell order (0,06001083) fee: $2,1

Trade 4

- BTC buy order (2,063 USDT) fee: $2

- BTC sell order (0,06680221 BTC) fee: $2,6

The total amount of trading fees is $13,43. The withdrawal fee is 0,0005 BTC, thus – $19,45 assuming Bitcoins were transferred to BTC wallet right after the last order. We exclude both fees from the amount to get a final investment gain: $2,598.7 – $13,43 – $19,45 = $2,565.82.

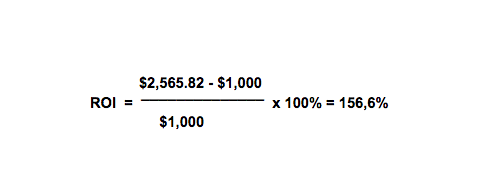

ROI

To calculate the return on investment we use the same formula as in the previous experiment. We subtract the initial investment cost from the final investment gain and divide it by the initial cost before multiplying by 100%.

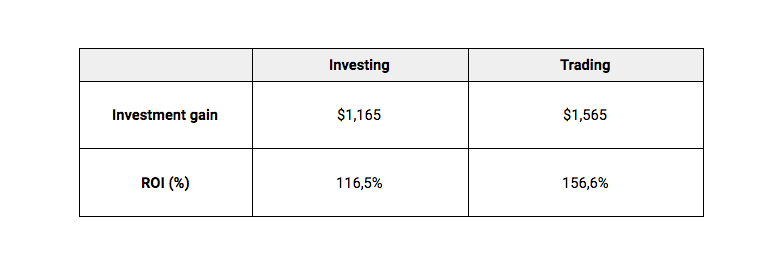

The return on investment in trading Bitcoin is 156,5%, which converts to $1,565 profit made in a month.

This makes trading ROI almost 40% higher compared to the investments. The experiment revealed that traders can earn up to $400 more during the same time frame that the investors.

In conclusion

Investing and trading are different methods of attaining profits. While one seeks long-term capital gains, the other focuses on much shorter periods of time and faster gains.

Traders tend to make gains on prior gains and thus build the capital faster and quicker compared to long-term investors. However, their levels of risk are also much higher and require skill and experience before attaining success.

Cryptocurrency investments are still speculative and involve the risk of loss. This experiment should not be taken as financial advice.